PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928982

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1928982

Used Trucks Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2026 - 2035

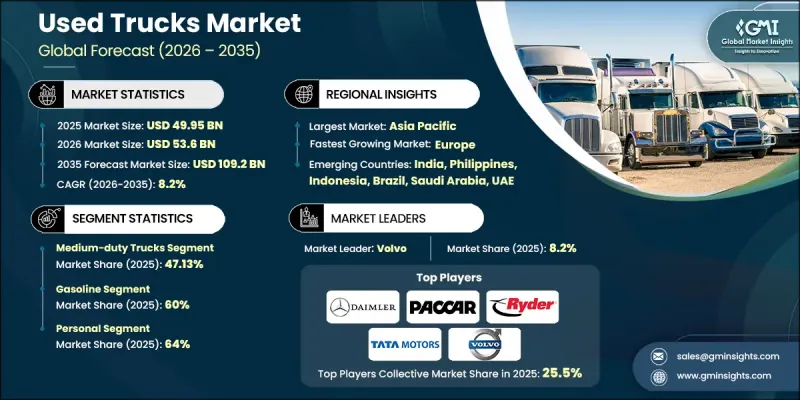

The Global Used Trucks Market was valued at USD 49.95 billion in 2025 and is estimated to grow at a CAGR of 8.2% to reach USD 109.2 billion by 2035.

Increasing vehicle prices, long OEM delivery times, and a focus on capital preservation are driving fleet operators toward the secondary market to maintain operational continuity and protect profit margins. Once viewed as residual assets, used trucks are now integral to fleet optimization strategies across logistics, construction, municipal services, mining, agriculture, and utilities. Fleet managers are prioritizing vehicles with verified service histories, compliance with emission standards, and the ability to accommodate digital retrofits. The adoption of telematics, predictive maintenance, ADAS retrofits, and powertrain monitoring enhances vehicle longevity, reduces total cost of ownership, and enables data-driven decisions for fuel efficiency, driver performance, and asset redeployment. This lifecycle-oriented approach, rather than first-ownership economics, is reshaping demand dynamics, making used trucks a strategic choice for cost-conscious fleet operators seeking operational flexibility and efficiency in urban and regional transportation networks.

| Market Scope | |

|---|---|

| Start Year | 2025 |

| Forecast Year | 2026-2035 |

| Start Value | $49.95 Billion |

| Forecast Value | $109.2 Billion |

| CAGR | 8.2% |

The medium-duty segment held 47.13% share in 2025 and is projected to grow at a CAGR of 8.1% through 2035. Medium-duty trucks, with GVWR ranging from 10,001-26,000 lbs, offer versatility, fuel efficiency, and lower acquisition costs, making them ideal for urban logistics, last-mile deliveries, construction support, and municipal applications. These trucks are particularly favored by small and medium-sized fleet operators due to their balance of payload capacity and operational cost-effectiveness.

The gasoline trucks segment accounted for 60% share in 2025 and is expected to grow at a CAGR of 8.3% from 2026 to 2035. Their widespread availability, lower purchase price, and ease of maintenance make them highly appealing to fleet operators, small businesses, and local delivery services. Broad service networks and abundant spare parts further enhance the attractiveness of gasoline trucks, particularly in emerging markets.

China Used Trucks Market held 65.5% share, generating USD 22.96 billion in 2025. The growth is supported by rapid expansion in e-commerce, logistics, regional transportation, and infrastructure projects. Rising new truck prices have further increased the appeal of pre-owned vehicles among small- and medium-sized operators, fueling demand for medium- and heavy-duty used trucks.

Major players in the Global Used Trucks Market include Enterprise Truck Rental, PACCAR, Daimler, Penske Used Trucks, Ryder System, Schneider National, Ritchie Bros. Auctioneers, TATA Motors, Werner Enterprises, and Volvo Trucks. Companies in the Global Used Trucks Market strengthen their presence through strategic fleet acquisition, digital integration, and after-sales services. Emphasis on telematics, predictive maintenance, and vehicle certification ensures reliability and builds customer trust. Expanding geographic reach and diversifying inventory across duty classes meet regional demand. Partnerships with logistics, construction, and municipal operators enhance market penetration. Companies also focus on value-added services such as financing, warranty programs, and fleet management solutions to improve customer retention and increase total cost-of-ownership transparency.

Table of Contents

Chapter 1 Methodology

- 1.1 Research approach

- 1.2 Quality commitments

- 1.2.1 GMI AI policy & data integrity commitment

- 1.3 Research trail & confidence scoring

- 1.3.1 Research trail components

- 1.3.2 Scoring components

- 1.4 Data collection

- 1.4.1 Partial list of primary sources

- 1.5 Data mining sources

- 1.5.1 Paid sources

- 1.6 Base estimates and calculations

- 1.6.1 Base year calculation

- 1.7 Forecast model

- 1.8 Research transparency addendum

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2022 - 2035

- 2.2 Key market trends

- 2.2.1 Regional

- 2.2.2 Type

- 2.2.3 Fuel

- 2.2.4 Sales Channel

- 2.2.5 Size

- 2.2.6 Age

- 2.2.7 Drive

- 2.2.8 Application

- 2.3 TAM Analysis, 2026-2035

- 2.4 CXO perspectives: Strategic imperatives

- 2.4.1 Executive decision points

- 2.4.2 Critical success factors

- 2.5 Future outlook and strategic recommendations

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.2 Profit margin analysis

- 3.1.3 Cost structure

- 3.1.4 Value addition at each stage

- 3.1.5 Factor affecting the value chain

- 3.1.6 Disruptions

- 3.2 Industry impact forces

- 3.2.1 Growth drivers

- 3.2.1.1 Increasing demand for electric & hybrid heavy-duty trucks across the globe

- 3.2.1.2 Growing freight transportation activities across North America

- 3.2.1.3 The rising number of small and medium-sized businesses

- 3.2.1.4 Rising investments in infrastructure development activities in Asia Pacific

- 3.2.2 Industry pitfalls and challenges

- 3.2.2.1 Economic downturns and low economic growth

- 3.2.2.2 Regulatory compliance and government regulations

- 3.2.3 Market opportunities

- 3.2.3.1 Expansion of certified pre-owned (CPO) and OEM-backed used truck programs

- 3.2.3.2 Growing demand for cost-effective fleet solutions among SME and owner-operators

- 3.2.3.3 Rising cross-border trade of used trucks from developed to emerging markets

- 3.2.3.4 Increasing adoption of digital remarketing, online auctions, and data-driven pricing

- 3.2.1 Growth drivers

- 3.3 Growth potential analysis

- 3.4 Regulatory landscape

- 3.4.1 North America

- 3.4.1.1 NEVI / IIJA, Advanced Clean Trucks (ACT) Regulation.

- 3.4.2 Europe

- 3.4.2.1 Germany: Electric Mobility Act (EmoG)

- 3.4.2.2 UK: Clean Vehicle Retrofit Accreditation Scheme (CVRAS), Ultra-Low Emission Zone (ULEZ)

- 3.4.2.3 France: Mobility Orientation Law (LOM Act)

- 3.4.2.4 Italy: National Integrated Plan for Energy and Climate (PNIEC)

- 3.4.3 Asia Pacific

- 3.4.3.1 China: New Energy Vehicle (NEV) Mandate

- 3.4.3.2 India: FAME II Scheme

- 3.4.3.3 Japan: Strategic Roadmap for EV/FCV Deployment

- 3.4.3.4 Australia: State-Level Zero-Emission Vehicle Mandates

- 3.4.4 Latin America

- 3.4.4.1 Brazil: National Electric Mobility Policy (PNME)

- 3.4.4.2 Mexico: Urban Zero-Emission Fleet Programs

- 3.4.4.3 Argentina: Provincial EV Incentive Regulations (Buenos Aires)

- 3.4.5 MEA

- 3.4.5.1 UAE: EV Charging Infrastructure Regulation (ADDM/DEWA)

- 3.4.5.2 Saudi Arabia: EV Deployment Regulatory Framework (SASO)

- 3.4.5.3 South Africa: Green Transport Strategy

- 3.4.1 North America

- 3.5 Porter';s analysis

- 3.6 PESTEL analysis

- 3.7 Technology and Innovation landscape

- 3.7.1 Current technological trends

- 3.7.2 Emerging technologies

- 3.8 Patent analysis

- 3.9 Pricing Analysis

- 3.9.1 By region

- 3.9.2 By fuel

- 3.10 Production statistics

- 3.10.1 Production hubs

- 3.10.2 Consumption hubs

- 3.10.3 Export and import

- 3.11 Cost breakdown analysis

- 3.12 Sustainability and environmental impact analysis

- 3.12.1 Sustainable practices

- 3.12.2 Waste reduction strategies

- 3.12.3 Energy efficiency in production

- 3.12.4 Eco-friendly initiatives

- 3.12.5 Carbon footprint considerations

- 3.13 Future outlook & opportunities

- 3.14 Fleet procurement & buying behavior analysis

- 3.14.1 Purchase decision criteria for Used trucks

- 3.14.2 OEM selection and brand preference factors

- 3.14.3 Impact of fuel, payload, and uptime on buying decisions

- 3.15 Residual value & used truck market dynamics

- 3.16 Financing, leasing & Truck-as-a-Service (TaaS) economics

- 3.17 Aftermarket, service & parts economics

- 3.18 Powertrain transition & fuel migration pathways

Chapter 4 Competitive Landscape, 2025

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.2.1 North America

- 4.2.2 Europe

- 4.2.3 Asia Pacific

- 4.2.4 Latin America

- 4.2.5 MEA

- 4.3 Competitive analysis of major market players

- 4.4 Competitive positioning matrix

- 4.5 Strategic outlook matrix

- 4.6 Key developments

- 4.6.1 Mergers & acquisitions

- 4.6.2 Partnerships & collaborations

- 4.6.3 New Product Launches

- 4.6.4 Expansion Plans and funding

Chapter 5 Market Estimates & Forecast, By Fuel, 2022 - 2035 ($Bn, Units)

- 5.1 Key trends

- 5.2 Gasoline

- 5.3 Diesel

- 5.4 Electric

- 5.5 Hybrid

Chapter 6 Market Estimates & Forecast, By Type, 2022 - 2035 ($Bn, Units)

- 6.1 Key trends

- 6.2 Light-duty truck

- 6.3 Medium-duty truck

- 6.4 Heavy-duty truck

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2022 - 2035 ($Bn, Units)

- 7.1 Key trends

- 7.2 Franchised Dealer

- 7.3 Independent Dealer

- 7.4 Peer-to-peer

Chapter 8 Market Estimates & Forecast, By Size, 2022 - 2035 ($Bn, Units)

- 8.1 Key trends

- 8.2 Full-size

- 8.3 Mid-size

- 8.4 Compact

Chapter 9 Market Estimates & Forecast, By Age, 2022 - 2035 ($Bn, Units)

- 9.1 Key trends

- 9.2 Up to 3 years

- 9.3 5-10 years

- 9.4 Above 10 years

Chapter 10 Market Estimates & Forecast, By Drive, 2022 - 2035 ($Bn, Units)

- 10.1 Key trends

- 10.2 Two-wheel drive

- 10.3 Four-wheel drive

Chapter 11 Market Estimates & Forecast, By Application, 2022 - 2035 ($Bn, Units)

- 11.1 Key trends

- 11.2 Personal

- 11.3 Commercial

- 11.3.1 Construction and heavy equipment

- 11.3.2 Agriculture and farming

- 11.3.3 Landscaping and outdoor services

- 11.3.4 Utility and municipal use

Chapter 12 Market Estimates & Forecast, By Region, 2022 - 2035 ($Bn, Units)

- 12.1 Key trends

- 12.2 North America

- 12.2.1 US

- 12.2.2 Canada

- 12.3 Europe

- 12.3.1 Germany

- 12.3.2 UK

- 12.3.3 France

- 12.3.4 Italy

- 12.3.5 Spain

- 12.3.6 Russia

- 12.3.7 Nordics

- 12.4 Asia Pacific

- 12.4.1 China

- 12.4.2 India

- 12.4.3 Japan

- 12.4.4 Australia

- 12.4.5 South Korea

- 12.4.6 Philippines

- 12.4.7 Indonesia

- 12.5 Latin America

- 12.5.1 Brazil

- 12.5.2 Mexico

- 12.5.3 Argentina

- 12.6 MEA

- 12.6.1 South Africa

- 12.6.2 Saudi Arabia

- 12.6.3 UAE

Chapter 13 Company Profiles

- 13.1 Global Players

- 13.1.1 Copart

- 13.1.2 Daimler

- 13.1.3 Hino Motors

- 13.1.4 Isuzu Motors

- 13.1.5 Navistar International

- 13.1.6 PACCAR

- 13.1.7 Penske Used Trucks

- 13.1.8 Ritchie Bros. Auctioneers

- 13.1.9 Ryder System

- 13.1.10 TATA Motors

- 13.1.11 Volvo Trucks

- 13.2 Regional Players

- 13.2.1 Arrow Truck Sales

- 13.2.2 Enterprise Truck Rental

- 13.2.3 International Used Trucks

- 13.2.4 Knight-Swift Transportation

- 13.2.5 Mascus

- 13.2.6 Schneider National

- 13.2.7 TruckPaper

- 13.2.8 Werner Enterprises

- 13.3 Emerging Players

- 13.3.1 J.D. Power

- 13.3.2 Carvana

- 13.3.3 Manheim