PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911472

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911472

Malaysia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

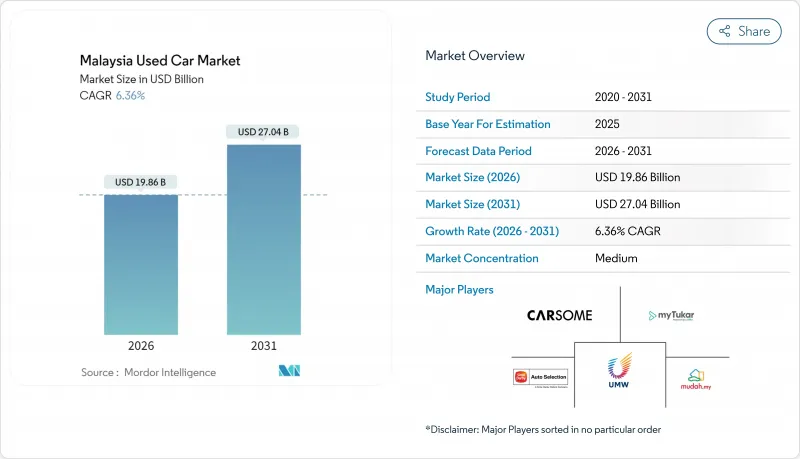

The Malaysia Used Car Market was valued at USD 18.67 billion in 2025 and estimated to grow from USD 19.86 billion in 2026 to reach USD 27.04 billion by 2031, at a CAGR of 6.36% during the forecast period (2026-2031).

Robust household spending, strategic sales-tax exemptions and the National Automotive Policy's gradual import liberalization underpin demand further enlarged the future supply of pre-owned vehicles. SUV demand is accelerating as buyers look for elevated driving positions suited to mixed traffic and seasonal flooding, while battery-electric models gain traction on the back of expanding charging infrastructure.

Malaysia Used Car Market Trends and Insights

Escalating New-Car Prices

New-vehicle sticker prices climbed during 2024 and are expected to rise another 8-20% once excise duty reforms are activated in 2026, pushing many middle-income families toward the USD 5,000-9,999 used segment that already commands 38.74% share. Persistent inflation and a weak ringgit inflate import costs, keeping the price gap wide. The differential supports steady inventory turnover for local brands such as Perodua and Proton that provide ample supply and affordable parts.

Digital Retail Platform Expansion

CARSOME processes more than 100,000 vehicles a year through its AI-driven 175-point inspection regime, delivering roughly USD 1 billion in revenue and setting new quality benchmarks. Partnerships with Google Cloud allow real-time pricing and customer-experience optimization, while traditional lots now add virtual showrooms to defend market share. The online channel's 6.73% CAGR shows that Malaysian shoppers increasingly begin their journey with a mobile search even though many still insist on a last-mile physical inspection.

Counterfeit / Illegally Imported Vehicles

The end of the Open Approved Permit model and fresh Vehicle Entry Permit fines of RM300 for Singapore-registered cars entering Malaysia underscore tighter border controls. The crackdown lifts compliance costs in the short run but ultimately shields legitimate dealers, encouraging customers to gravitate toward organised lots with verifiable documentation.

Other drivers and restraints analyzed in the detailed report include:

- Diverse Selection Among Models

- Integrated Financing & Insurance

- Fragmented Inspection Standards

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Sedans maintained the largest 37.68% slice of the Malaysia used car market in 2025, though SUVs are forecast to post a 7.03% CAGR, outpacing every other body style. The SUV uptrend stems from elevated driving positions, better flood clearance and fresh supply from Proton X70 lease returns. CARSOME reports that SUV transactions command higher average selling prices, boosting per-unit profitability even while unit volumes are still catching sedans.

The Malaysia used car market size for SUVs is projected to grow exponentially by 2031, while hatchbacks retain strong entry-level resonance because of low running costs. Multi-Purpose Vehicles continue serving large families and ride-hailing operators that value flexible seating. Dealers stocking diversified SUV trims position themselves ahead of the demand curve as infrastructure projects lengthen urban commutes.

Unorganised yards still control 62.54% of the Malaysia used car market share, but organised operators are growing faster at 6.47% CAGR due to warranty coverage and digital service layers. Consumers are willing to pay modest premiums for certified inspections that reduce risk and provide after-sales peace of mind.

The Malaysia used car market size attributable to organised vendors as CARSOME expands to increase its inspection centres and Carro introduces instant online valuations. Sime Darby's purchase of UMW Holdings integrates Toyota and Perodua pre-owned programs under a single banner, signalling deeper consolidation ahead.

Petrol cars commanded 75.92% of 2025 transactions, yet battery-electric units are charting the fastest 7.15% trajectory on incentives and charging rollouts. Diesel remains the province of logistics fleets, whereas hybrids deliver a transitional option for drivers worried about range.

Malaysia used car market size for xEVs is projected to triple between 2026 and 2031 as charging points climb to 10,000 and tax holidays stay intact through 2025. Dealers are beginning to train technicians in high-voltage servicing to capture the residual-value opportunity once the first wave of mass-market EVs enters secondary circulation.

The Malaysia Used Car Market Report is Segmented by Vehicle Type (Hatchbacks and More), Vendor Type (Organized and Unorganized), Fuel Type (Petrol, Diesel, and More), Vehicle Age (0 - 2 Years, 3 - 5 Years, and More), Price Segment (Less Than USD 5 000, and More), Sales Channel (Online and Offline), and Ownership (First-Owner Resale and Multi-Owner). Market Size & Growth Forecasts (Value (USD) and Volume (Units)).

List of Companies Covered in this Report:

- CARSOME Sdn Bhd

- myTukar Sdn Bhd

- Sime Darby Auto Selection

- UMW Toyota Motor Sdn Bhd (TOPMARK)

- Mercedes-Benz Malaysia (CPO)

- Mudah.my Sdn Bhd

- Carlist.my

- Caricarz Sdn Bhd

- BMW Malaysia (Premium Selection)

- Perodua Pre-Owned Vehicles

- Proton Certified Pre-Owned

- Bermaz Auto Pre-Owned

- TC Euro Cars (Renault)

- GoCar Subs / GoEV Marketplace

- EasyCars

- MUV Marketplace

- Big Three Auto

- Motor Trader Malaysia

- eBid Motors

- Carsome Certified Lab

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Escalating new-car prices

- 4.2.2 Digital retail platform expansion

- 4.2.3 Diverse selection among models

- 4.2.4 Integrated financing & insurance

- 4.2.5 OEM-backed CPO programs

- 4.2.6 Telematics-enabled transparency

- 4.3 Market Restraints

- 4.3.1 Counterfeit / illegally imported vehicles

- 4.3.2 EV residual-value uncertainty

- 4.3.3 Fragmented inspection standards

- 4.3.4 Limited aftermarket warranty

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers/Consumers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sport-Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.1.5 Others (convertibles, coupes, crossovers, sports cars)

- 5.2 By Vendor Type

- 5.2.1 Organised

- 5.2.2 Unorganised

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid (HEV & PHEV)

- 5.3.4 Battery-Electric (BEV)

- 5.3.5 LPG / CNG / Others

- 5.4 By Vehicle Age

- 5.4.1 0 - 2 Years

- 5.4.2 3 - 5 Years

- 5.4.3 6 - 8 Years

- 5.4.4 9 - 12 Years

- 5.4.5 More than 12 Years

- 5.5 By Price Segment

- 5.5.1 Less than USD 5 000

- 5.5.2 USD 5 000 - USD 9 999

- 5.5.3 USD 10 000 - USD 14 999

- 5.5.4 USD 15 000 - USD 19 999

- 5.5.5 USD 20 000 - USD 29 999

- 5.5.6 More than or equal to USD 30 000

- 5.6 By Sales Channel

- 5.6.1 Online

- 5.6.1.1 Digital Classified Portals

- 5.6.1.2 Pure-play e-Retailers

- 5.6.1.3 OEM-Certified Online Stores

- 5.6.2 Offline

- 5.6.2.1 OEM-Franchised Dealers

- 5.6.2.2 Multi-brand Independent Dealers

- 5.6.2.3 Physical Auction Houses

- 5.6.1 Online

- 5.7 By Ownership

- 5.7.1 First-owner Resale

- 5.7.2 Multi-owner

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 CARSOME Sdn Bhd

- 6.4.2 myTukar Sdn Bhd

- 6.4.3 Sime Darby Auto Selection

- 6.4.4 UMW Toyota Motor Sdn Bhd (TOPMARK)

- 6.4.5 Mercedes-Benz Malaysia (CPO)

- 6.4.6 Mudah.my Sdn Bhd

- 6.4.7 Carlist.my

- 6.4.8 Caricarz Sdn Bhd

- 6.4.9 BMW Malaysia (Premium Selection)

- 6.4.10 Perodua Pre-Owned Vehicles

- 6.4.11 Proton Certified Pre-Owned

- 6.4.12 Bermaz Auto Pre-Owned

- 6.4.13 TC Euro Cars (Renault)

- 6.4.14 GoCar Subs / GoEV Marketplace

- 6.4.15 EasyCars

- 6.4.16 MUV Marketplace

- 6.4.17 Big Three Auto

- 6.4.18 Motor Trader Malaysia

- 6.4.19 eBid Motors

- 6.4.20 Carsome Certified Lab

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment