PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911471

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911471

Philippines Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

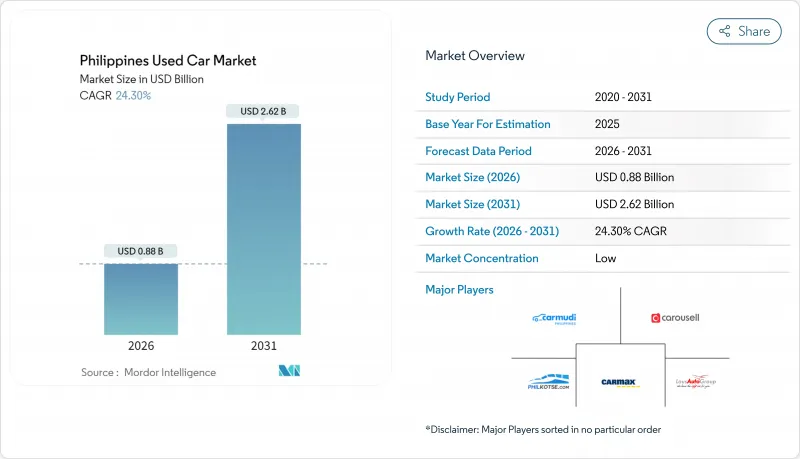

The Philippines Used Car Market is expected to grow from USD 0.71 billion in 2025 to USD 0.88 billion in 2026 and is forecast to reach USD 2.62 billion by 2031 at 24.30% CAGR over 2026-2031.

This impressive growth underscores the market's resilience in economic challenges. As new car prices climb and the middle class seeks mobility, more Filipinos turn to pre-owned vehicles. Digital platforms are playing a pivotal role, boosting market expansion, enhancing transparency, and streamlining transactions. These online channels are anticipated to grow robustly from 2025 to 2030. Regulatory changes, like the LTO's temporary halt on ownership transfer penalties, are smoothing out the resale process. Furthermore, a surge in auto loan penetration, coupled with collaborations between banks and digital auto marketplaces, is set to amplify transaction volumes in the coming years.

Philippines Used Car Market Trends and Insights

Digitalization of Used-Car Transactions via Online Classifieds and E-commerce

The digital transformation of the Philippines used car market is fundamentally altering transaction dynamics, with 85% of leads now originating from online sources, particularly social media platforms like Facebook. This shift has compressed the traditional buying cycle from weeks to days as consumers leverage digital tools to compare options, check vehicle histories, and secure financing before visiting dealerships. Digital platforms are not merely listing services but increasingly offer end-to-end transaction capabilities, including online payment processing, digital documentation, and virtual inspections.The transition is most pronounced in Metro Manila, where internet penetration exceeds 72%, but is rapidly extending to provincial cities as smartphone adoption increases

Middle-Class Expansion in Metro Manila Boosting Affordable Mobility Demand

The expanding middle class in Metro Manila is creating unprecedented demand for affordable mobility solutions, with the used car market serving as the primary entry point for first-time vehicle owners. This demographic shift is characterized by young professionals aged 25-35 who prioritize value retention and practical features over new-car prestige. The economic pragmatism driving this trend is evident in the preference for vehicles in the PHP 500k-1 million range, which offers the optimal balance between quality and affordability for middle-income households earning PHP 50,000-100,000 monthly. The impact extends beyond simple ownership to influence vehicle selection criteria, with fuel efficiency and maintenance costs becoming primary considerations over brand prestige.

Limited Vehicle-History Transparency Undermining Buyer Trust

The persistent challenge of limited vehicle history transparency continues to undermine consumer confidence in the Philippines used car market, particularly in the dominant unorganized segment where documentation practices remain inconsistent. This information asymmetry creates significant friction in the purchasing process, with buyers forced to rely on superficial inspections or third-party mechanics rather than comprehensive vehicle history reports that are standard in more developed markets. The trust deficit is most acute in provincial areas where access to vehicle verification services is limited, creating geographic disparities in market efficiency and pricing.

Other drivers and restraints analyzed in the detailed report include:

- OEM Trade-in and Financing Programs Shortening Ownership Cycles

- OFW Remittance-Driven Purchases in Provincial Growth Centers

- Competition from Ride-hailing and Micro-mobility in Urban Hubs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Unorganized dealers controlled 71.65% of 2025 sales thanks to lower overheads and relationship-based negotiations, particularly outside major cities. They appeal to bargain hunters but struggle with limited documentation, which fuels buyer hesitation. Unorganized dealers maintain their foothold through hyperlocal market knowledge and relationship-based selling, particularly in provincial areas where personal connections often outweigh formal guarantees. Their business model typically involves lower overhead costs and minimal documentation, allowing for competitive pricing but creating transparency challenges that increasingly sophisticated consumers find problematic.

Organized players, led by Carmudi and Automart.PH is scaling at 25.05% CAGR by bundling inspection certificates, financing pre-approval, and seven-day return windows that reduce purchase anxiety. Their digital storefronts reach a national audience, while physical hubs in Metro Manila, Cebu, and Davao anchor test drives and after-sales service. As consumer expectations for verifiable histories grow, the Philippines' used car market gradually shifts toward these transparent marketplaces.

Sedans captured 36.10% of transactions in 2025 and remain the entry point for commuters seeking low running costs. Yet SUVs and MPVs are charting a 24.72% CAGR, buoyed by families looking for higher ground clearance against floods and potholes. The category is dominated by compact Japanese models like the Toyota Vios and Honda City, which benefit from established reliability reputations and abundant parts availability that reduce ownership costs. Hatchbacks serve as entry-level options for budget-conscious consumers, while vans cater to commercial users and large families requiring maximum passenger capacity. Pickup trucks maintain steady demand in provincial areas where utility and durability on unpaved roads are primary considerations.

Mid-sized contenders such as the Toyota Fortuner and Mitsubishi Montero Sport headline this surge, offering modern driver-assistance suites and seven-seat capacity. Hatchbacks and vans maintain steady niche roles, while pickups cater to provincial buyers balancing cargo needs and rugged roads. The Philippines used car market size for SUVs is forecast to close much of the volume gap with sedans by 2030.

Philippines Used Car Market Report is Segmented by Vendor Type (Organized and Unorganized), Vehicle Type (Hatchbacks, Sedans, and More), Fuel Type (Petrol, Diesel, and More), Sales Channel (Online and Offline), Vehicle Age (0 To 3 Years, 4 To 6 Years, and More), Price Band (Less Than PHP 500K, PHP 500K To 1 Million, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Carmudi

- Carousell

- Carmax

- LausGroup

- Toyota Motor Philippines

- Automart.PH

- Philkotse.com

- ZigWheels

- Tsikot.com

- Car Empire

- OLX Philippines

- AutoDeal.com.ph

- Hyundai HARI CPO

- Volkswagen PH

- Ford Philippines

- PGA Cars Premium Used

- Mitsubishi Diamond CPO

- Nissan Intelligent Choice PH

- Suzuki Certified Used Cars

- Isuzu PH Used Truck Centers

- Grab AutoExchange

- BPI Repossessed Cars Marketplace

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Digitalization of Used-Car Transactions via Online Classifieds and E-commerce

- 4.2.2 Middle-Class Expansion in Metro Manila Boosting Affordable Mobility Demand

- 4.2.3 Aggressive OEM Trade-in and Financing Programs Shortening Ownership Cycles

- 4.2.4 OFW Remittance-Driven Purchases in Provincial Growth Centers

- 4.2.5 Relaxed Import Quotas in Subic and Freeport Zones Spurring Supply

- 4.2.6 Rising Fuel Costs Driving Shift to More Efficient Used Vehicles

- 4.3 Market Restraints

- 4.3.1 Limited Vehicle-History Transparency Undermining Buyer Trust

- 4.3.2 Flood-Damage Risk Post-Typhoon Season Depressing Residual Values

- 4.3.3 Competition from Ride-hailing and Micro-mobility in Urban Hubs

- 4.3.4 High Interest Rates Constraining Consumer Financing Access

- 4.4 Technological Outlook

- 4.5 Porter's Five Forces

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vendor Type

- 5.1.1 Organized

- 5.1.2 Unorganized

- 5.2 By Vehicle Type

- 5.2.1 Hatchbacks

- 5.2.2 Sedans

- 5.2.3 SUVs and MPVs

- 5.2.4 Pickup Trucks

- 5.2.5 Vans

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid and Electric

- 5.3.4 Others (CNG, LPG)

- 5.4 By Sales Channel

- 5.4.1 Online

- 5.4.2 Offline

- 5.5 By Vehicle Age

- 5.5.1 0 to 3 Years

- 5.5.2 4 to 6 Years

- 5.5.3 7 to 10 Years

- 5.5.4 More than 10 Years

- 5.6 By Price Band (PHP)

- 5.6.1 Less than 500 k

- 5.6.2 500k to 1 million

- 5.6.3 More than 1 million

- 5.7 By Geography

- 5.7.1 Luzon

- 5.7.2 Visayas

- 5.7.3 Mindanao

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Carmudi

- 6.4.2 Carousell

- 6.4.3 Carmax

- 6.4.4 LausGroup

- 6.4.5 Toyota Motor Philippines

- 6.4.6 Automart.PH

- 6.4.7 Philkotse.com

- 6.4.8 ZigWheels

- 6.4.9 Tsikot.com

- 6.4.10 Car Empire

- 6.4.11 OLX Philippines

- 6.4.12 AutoDeal.com.ph

- 6.4.13 Hyundai HARI CPO

- 6.4.14 Volkswagen PH

- 6.4.15 Ford Philippines

- 6.4.16 PGA Cars Premium Used

- 6.4.17 Mitsubishi Diamond CPO

- 6.4.18 Nissan Intelligent Choice PH

- 6.4.19 Suzuki Certified Used Cars

- 6.4.20 Isuzu PH Used Truck Centers

- 6.4.21 Grab AutoExchange

- 6.4.22 BPI Repossessed Cars Marketplace

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment