PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911455

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911455

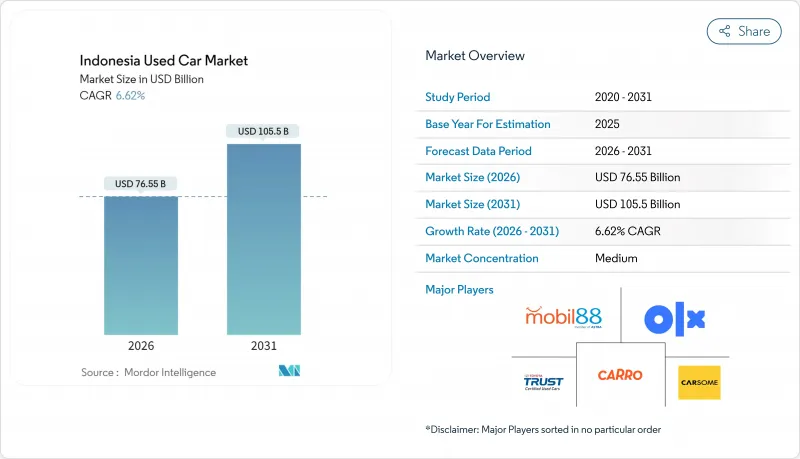

Indonesia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Indonesia used car market is expected to grow from USD 71.80 billion in 2025 to USD 76.55 billion in 2026 and is forecast to reach USD 105.5 billion by 2031 at 6.62% CAGR over 2026-2031.

Demand resilience reflects a structural tilt toward pre-owned vehicles as tighter credit conditions and waning purchasing power push households to stretch budgets without postponing mobility goals. Used-car financing outpaced new-car loans for the first time in 2024, signalling a lasting recalibration of consumer behavior. Online classifieds now dominate discovery journeys, and emerging AI-grading tools narrow price dispersion by giving buyers objective condition scores. Financing pivots by major banks boost accessibility and margins, while ride-hailing fleet renewals inject a steady stream of high-quality cars into dealer inventories.

Indonesia Used Car Market Trends and Insights

Growing Online Classified and E-retail Activity

Digital portals empower consumers to compare prices, mileage, and photos, streamlining their transactions before reaching out to sellers. Platform operators integrate inspection, financing, and documentation, reducing search friction in secondary cities where dealer density is low. SEVA's 17,500-unit throughput and IDR 8.2 trillion gross transaction value in 2024 validated the model, encouraging capital inflows and unicorn creation . Traditional conglomerates have reacted: Astra's OLX acquisition aligned captive financing, inspection centers, and logistics into a single stack. Regulatory support from OJK for in-platform digital lending completes a frictionless experience, propelling the Indonesian used car market toward deeper online penetration.

Banks' Pivot to Used-car Specific Loan Products

Major banks such as BCA expanded vehicle loan books to IDR 65.3 trillion (USD 4.1 billion) in 2024, with used cars forming an increasing share as lenders chase higher yields . Proprietary scorecards have evolved to incorporate a range of crucial factors, including mileage bands, detailed inspection grades, and projected resale values, moving beyond the traditional focus on borrower income. This innovative approach allows for instant pre-approval within online marketplaces, significantly reducing approval times to just a few hours. As a result, this streamlined process not only enhances conversion rates but also invigorates liquidity in the Indonesian used car market, creating dynamic opportunities for both buyers and sellers.

Odometer and Accident-history Fraud Remains Pervasive

Provincial STNK and BPKB systems operate in silos, letting bad actors reset mileage or hide flood damage when vehicles cross borders. First-time buyers and online shoppers bear the brunt, paying inflated prices for compromised cars. Trust deficits raise financing risk premiums, dampening the Indonesia used car market velocity until AI inspection and centralized data become mainstream.

Other drivers and restraints analyzed in the detailed report include:

- Expanding Organized Dealer Networks Outside Java

- Ride-hailing Fleet Renewal Cycles (Grab and Gojek)

- Fragmented Provincial Registration Databases

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs owned 37.62% of the Indonesia used car market share in 2025, buoyed by high ground clearance and perceived safety in congested streets. MPVs, climbing at 7.05% CAGR, appeal to multi-generational households that prize sliding doors and flexible seating. Sedans cater to commuters seeking fuel efficiency, and hatchbacks target first-time owners navigating tight parking norms. The Indonesia used car market size for SUVs is projected to keep pace with robust supply from fleet replacements, yet MPVs fetch quicker days-to-sale in suburban Java as school-run demand rises. Chinese OEMs have entered both segments with competitive hybrid trims, pushing Japanese incumbents to refresh line-ups more frequently.

New-energy SUVs feed aspirational buyers in Jakarta and Surabaya, while compact MPVs dominate outer-island lanes where road quality varies. Digital platforms algorithmically recommend SUVs to ride-hailing prospects and MPVs to growing families, increasing match efficiency. Certified programs overweight SUVs and MPVs because warranty upsells monetize better than sedans.

Petrol models still command 63.10% of the Indonesia used car market size in 2025, yet hybrids and electric models exhibit a 12.34% CAGR, propelled by VAT cuts and zero luxury tax. The diesel share erodes amid rising subsidy talk and emissions scrutiny. The Indonesia used car market size for electric models remains small, but fast-charger rollouts and government roadmaps catalyze future secondary sales. Residual values of hybrids have outperformed petrol peers in Jakarta auctions by 6-8% since 2024, hinting at shifting buyer calculus.

Battery degradation uncertainty curbs wider uptake. Dealers hesitate to stock older BEVs without OEM testing. Banks apply shorter tenures and higher collateral haircuts for BEVs pending battery warranties. Petrol cars, however, keep liquidity advantages in rural exchanges where charging remains scarce.

Units priced USD 11,000-21,999 held 39.05% of the Indonesia used car market revenue in 2025 and expanded at 7.33% CAGR, aligning with median household affordability and bank lending brackets. Entry models under USD 5,500 attract cash buyers in tier-3 cities, while premium brackets above USD 22,000 serve affluent urbanites eyeing luxury badges. The Indonesia used car market share of mid-range vehicles benefits from abundant trade-ins and certified programs bundling one-year warranties.

Online calculators showcasing installment scenarios boost mid-range visibility: a USD 15,000 Avanza with a 20% down payment and a 48-month tenor remains the most-searched combination on leading portals. Growth in premium slices rides on expatriate turnovers and corporate fleet disposals, but remains niche relative to value-centric core segments.

The Indonesia Used Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, and More), Fuel Type (Petrol, Diesel, and More), Price Segment (Below USD 5, 500, USD 5, 500-10, 999, and More), Sales Channel (Online Digital Classified Portals, Pure-Play E-Retailers, and More), Vendor Type (Organized and Unorganized), Vehicle Age, Financing Providers, and Province. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mobil88 (PT Serasi Auto Raya (SERA))

- Toyota Astra Motor (Toyota Trust)

- PT Tunas Ridean Tbk.

- PT Inchcape Indomobil Distribution Indonesia (IIDI) (Mercedes Certified)

- BMW Premium Selection (BME Eurokars)

- OLX Indonesia

- Carro Indonesia (Trusty Cars Ltd )

- Carsome Indonesia

- Broom.id

- Carmudi Indonesia

- Moladin

- Mobil123

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Online Classified and E-retail Activity

- 4.2.2 Banks' Pivot to Used-car Specific Loan Products

- 4.2.3 Expanding Organized Dealer Networks Outside Java

- 4.2.4 Ride-hailing Fleet Renewal Cycles (Grab and Gojek)

- 4.2.5 OEM Buy-back Schemes Boosting Residual Values

- 4.2.6 AI-led Condition Grading Platforms Reducing Price Dispersion

- 4.3 Market Restraints

- 4.3.1 Odometer and Accident-history Fraud Remains Pervasive

- 4.3.2 Fragmented Provincial Registration Databases

- 4.3.3 High Inter-island Logistics Cost Discourages Non-Java Trade

- 4.3.4 Limited Certified-battery Health Checks for Used EVs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 SUVs

- 5.1.4 MPVs

- 5.2 By Fuel Type

- 5.2.1 Petrol

- 5.2.2 Diesel

- 5.2.3 Hybrid and Electric

- 5.2.4 Others (LPG, CNG, etc.)

- 5.3 By Price Segment

- 5.3.1 Below USD 5,500

- 5.3.2 USD 5,500 - 10,999

- 5.3.3 USD 11,000 - 21,999

- 5.3.4 >= USD 22,000

- 5.4 By Sales Channel

- 5.4.1 Online Digital Classified Portals

- 5.4.2 Pure-play e-Retailers

- 5.4.3 Dealer/OEM Online Platforms

- 5.4.4 Physical Franchise Dealerships

- 5.4.5 Independent Used-Car Lots

- 5.4.6 Auction Houses (Physical and Online Hybrid)

- 5.4.7 Peer-to-Peer (Private) Sales

- 5.5 By Vendor Type

- 5.5.1 Organized

- 5.5.2 Unorganized

- 5.6 By Vehicle Age

- 5.6.1 0 - 2 Years

- 5.6.2 3 - 5 Years

- 5.6.3 6 - 8 Years

- 5.6.4 Above 8 Years

- 5.7 By Financing Providers

- 5.7.1 Original Equipment Manufacturers (OEMs)

- 5.7.2 Banks

- 5.7.3 Non-Banking Financial Companies

- 5.8 By Province

- 5.8.1 West Java

- 5.8.2 East Java

- 5.8.3 Central Java

- 5.8.4 North Sumatra

- 5.8.5 Banten

- 5.8.6 Jakarta

- 5.8.7 Other Provinces

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Mobil88 (PT Serasi Auto Raya (SERA))

- 6.4.2 Toyota Astra Motor (Toyota Trust)

- 6.4.3 PT Tunas Ridean Tbk.

- 6.4.4 PT Inchcape Indomobil Distribution Indonesia (IIDI) (Mercedes Certified)

- 6.4.5 BMW Premium Selection (BME Eurokars)

- 6.4.6 OLX Indonesia

- 6.4.7 Carro Indonesia (Trusty Cars Ltd )

- 6.4.8 Carsome Indonesia

- 6.4.9 Broom.id

- 6.4.10 Carmudi Indonesia

- 6.4.11 Moladin

- 6.4.12 Mobil123

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment