PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906197

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906197

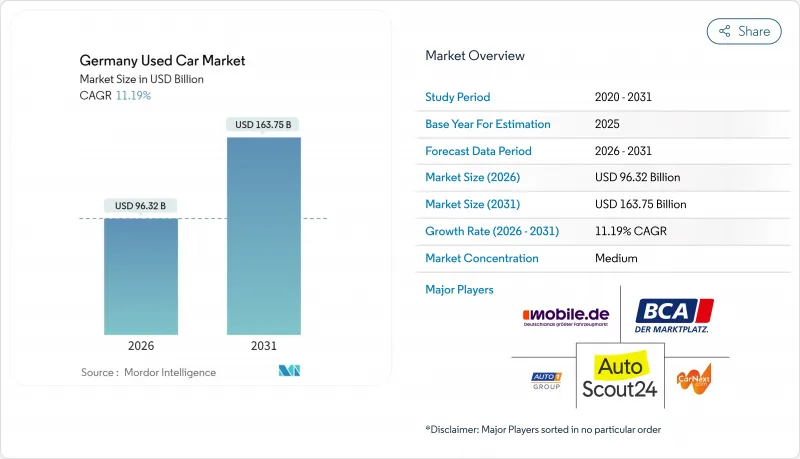

Germany Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The German used car market was valued at USD 86.63 billion in 2025 and estimated to grow from USD 96.32 billion in 2026 to reach USD 163.75 billion by 2031, at a CAGR of 11.19% during the forecast period (2026-2031).

Robust demand stems from tight new-car supply, an aging national vehicle fleet, and the rapid uptake of online transaction platforms that reduce friction in vehicle sourcing and sales. Policy drivers such as the European Union Battery Regulation, broader low-emission-zone roll-outs, and OEM-backed certified-pre-owned (CPO) programs are reshaping consumer confidence and shortening replacement cycles. Electric-vehicle (EV) resale activity is accelerating as battery-health transparency improves, while petrol models continue to dominate volumes. Regionally, the southern manufacturing hubs of Baden-Wurttemberg and Bayern benefit from better vehicle maintenance records, supporting premium residual values. Competitive intensity remains fragmented, leaving room for consolidation as larger digital players leverage scale and data analytics to outpace smaller dealers.

Germany Used Car Market Trends and Insights

Rising Average Vehicle Age Boosts Replacement Demand

Germany's passenger-car fleet now averages 10.1 years. Vehicles older than 12 years hold a 34.17% share, creating predictable replacement pressure as owners seek newer safety and infotainment features. Organized dealers capitalize by packaging finance and warranty offerings that mitigate reliability concerns. Southern states, where disposable incomes are higher, keep fleets younger, leaving eastern regions to generate stronger replacement flows. Subscription providers further accelerate turnover by releasing nearly-new stock after each short-term contract cycle.

Tight Supply of New Cars Elevates Used-Car Prices

Domestic vehicle production fell to a decades-low level in 2024, causing extended lead times and steering buyers toward certified pre-owned alternatives. Premium segments face 8-12-week factory delays, a window that organized dealers exploit by moving stock from surplus regions to high-demand metros. Resilient used-car prices are especially evident in electric and hybrid models, which serve as substitutes for out-of-stock new vehicles.

Diesel Demand Falls Amid Urban Low-Emission Zones

Euro 4 and Euro 5 restrictions render older diesel units less attractive in major cities. Stuttgart alone restricts roughly 190,000 diesel cars, depressing valuations within its urban core. Surplus stock is increasingly exported to Eastern Europe, creating logistical opportunities for traders but eroding domestic availability.

Other drivers and restraints analyzed in the detailed report include:

- Proliferation of Online Transaction Platforms

- EU Battery Regulation Accelerates BEV Remarketing

- High Interest Rates Restrict Financing Affordability

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hatchbacks currently lead volume at 23.84% share due to their maneuverability in dense urban areas. SUVs are projected to record a 14.63% CAGR, well ahead of any other body style. Sedans face a gradual decline as crossovers satisfy the same comfort demands with greater practicality. Multi-purpose vehicles hold niche family appeal, while convertibles and sports cars sustain collector interest rather than mass-market traction.

Affluent southern states exhibit the highest SUV penetration, supported by disposable income levels and suburban driving patterns. Conversely, compact segments remain dominant in northern coastal regions where narrow streets and tighter parking favor smaller footprints. The differential offers dealers geographical arbitrage opportunities.

Organized players commanded 62.55% of the German used car market size in 2025 and are growing at 12.29% CAGR. Consumers increasingly seek warranty coverage, financing, and reliable after-sales service, advantages that structured dealerships deliver. Unorganized sellers still attract bargain hunters but lose ground as transaction complexity rises.

Metropolitan centers witness faster consolidation; rising real-estate costs push independent lots to partner with larger networks or exit. Digital platforms amplify reach, allowing organized vendors to source nationally while offering localized service, accelerating their market capture.

Petrol models retained 60.92% share in 2025. However, BEVs will expand at a striking 21.93% CAGR, aided by clear battery-health standards and expanding fast-charging grids. Diesel faces structural decline owing to low-emission-zone policies, though it remains valuable in logistics-heavy rural districts. Hybrid vehicles serve a transitional segment, providing range confidence while meeting emerging emissions expectations.

Southern states, benefitting from OEM incentives and dense charger networks, are early adopters of used BEVs. Eastern regions lag yet present upside potential as infrastructure gaps close.

The Germany Used Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, and More), Vendor Type (Organized and Unorganized), Fuel Type (Petrol and More), Vehicle Age (0 To 2 Years and More), Price Segment (Below USD 5, 000 and More), Sales Channel (Online and Offline), and Ownership (First-Owner Resale and Multi-Owner). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- AUTO1 Group SE (wirkaufendeinauto.de, AutoHero)

- mobile.de GmbH

- AutoScout24 GmbH

- CarNext.com

- BCA Autoauktionen GmbH

- heycar GmbH

- Driverama Germany GmbH

- Cinch Cars Ltd.

- Cazoo Ltd.

- pkw.de Autoborse GmbH

- OOYYO Corporation

- 12Gebrauchtwagen.de

- FairCar GmbH

- Autobid.de (AlphAuction GmbH)

- Gebrauchtwagen.de AG

- Carsale24 GmbH

- Cargurus Germany GmbH

- Autoscout24 Dealer Financing

- Emil Frey Gruppe (Used-Car Superstores)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising average vehicle age boosts replacement demand

- 4.2.2 Tight supply of new cars elevates used-car prices

- 4.2.3 Proliferation of online transaction platforms

- 4.2.4 EU Battery Regulation accelerates BEV remarketing

- 4.2.5 Subscription models spur demand for nearly-new cars

- 4.2.6 OEM certified-pre-owned (CPO) programs gain traction

- 4.3 Market Restraints

- 4.3.1 Diesel demand falls amid urban Low-Emission Zones

- 4.3.2 High interest rates restrict financing affordability

- 4.3.3 Digital registration backlogs slow title transfers

- 4.3.4 Exports siphon affordable stock from domestic market

- 4.4 Value/Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 Sport-Utility Vehicles (SUVs)

- 5.1.4 Multi-Purpose Vehicles (MPVs)

- 5.1.5 Others (convertibles, coupes, crossovers, sports cars)

- 5.2 By Vendor Type

- 5.2.1 Organised

- 5.2.2 Unorganized

- 5.3 By Fuel Type

- 5.3.1 Petrol

- 5.3.2 Diesel

- 5.3.3 Hybrid Vehicles (HEV and PHEV)

- 5.3.4 Battery-Electric Vehicles (BEV)

- 5.3.5 Others (LPG, CNG, etc.)

- 5.4 By Vehicle Age

- 5.4.1 0 to 2 Years

- 5.4.2 3 to 5 Years

- 5.4.3 6 to 8 Years

- 5.4.4 9 to 12 Years

- 5.4.5 Above 12 Years

- 5.5 By Price Segment

- 5.5.1 Below USD 5,000

- 5.5.2 USD 5,000 to USD 9,999

- 5.5.3 USD 10,000 to USD 14,999

- 5.5.4 USD 15,000 to USD 19,999

- 5.5.5 USD 20,000 to USD 29,999

- 5.5.6 USD 30,000 and Above

- 5.6 By Sales Channel

- 5.6.1 Online

- 5.6.2 Offline

- 5.7 By Ownership

- 5.7.1 First-owner Resale

- 5.7.2 Multi-owner

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 AUTO1 Group SE (wirkaufendeinauto.de, AutoHero)

- 6.4.2 mobile.de GmbH

- 6.4.3 AutoScout24 GmbH

- 6.4.4 CarNext.com

- 6.4.5 BCA Autoauktionen GmbH

- 6.4.6 heycar GmbH

- 6.4.7 Driverama Germany GmbH

- 6.4.8 Cinch Cars Ltd.

- 6.4.9 Cazoo Ltd.

- 6.4.10 pkw.de Autoborse GmbH

- 6.4.11 OOYYO Corporation

- 6.4.12 12Gebrauchtwagen.de

- 6.4.13 FairCar GmbH

- 6.4.14 Autobid.de (AlphAuction GmbH)

- 6.4.15 Gebrauchtwagen.de AG

- 6.4.16 Carsale24 GmbH

- 6.4.17 Cargurus Germany GmbH

- 6.4.18 Autoscout24 Dealer Financing

- 6.4.19 Emil Frey Gruppe (Used-Car Superstores)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment