PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849819

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849819

Germany Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

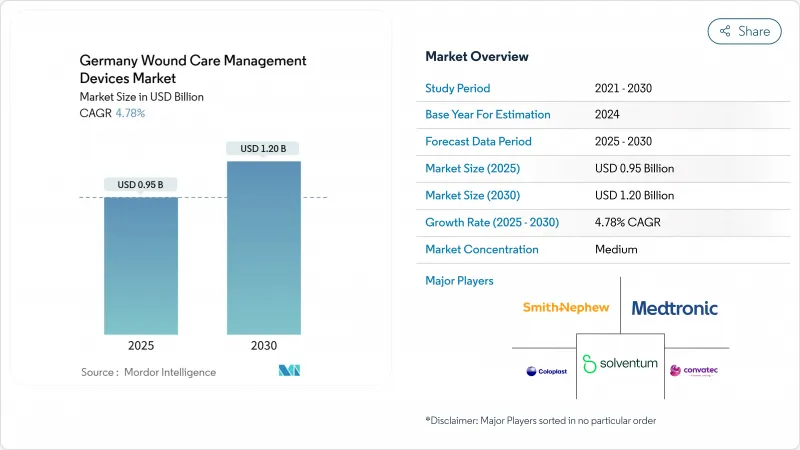

The Germany wound care management devices market is valued at USD 0.95 billion in 2025 and is projected to reach USD 1.20 billion by 2030, reflecting a CAGR of 4.78%.

Demand is propelled by an ageing population, the high clinical burden of diabetes, and a reimbursement framework that rewards clinically validated innovation. Hospitals are still the prime buyers of advanced dressings and negative-pressure systems, yet digital therapeutics and extended-wear products have begun to shift care toward homes and community settings. The EU Medical Device Regulation (MDR) now shapes competitive strategy by favouring companies that already possess extensive quality-management infrastructure. Meanwhile, the Digital Healthcare Act allows physicians to prescribe reimbursable digital health applications (DiGAs), a policy that is gradually pulling sensor-enabled bandages and tele-monitoring platforms into routine practice. Taken together, these forces signal that the Germany wound care management devices market will keep expanding even as institutional budgets tighten and skilled nursing capacity shrinks.

Germany Wound Care Management Devices Market Trends and Insights

Rising chronic wounds & geriatric population

Germany already counts 17.3 million citizens aged 65 years or older, and the proportion living with severe disability continues to climb. Prevalence surveys place chronic wounds among nursing-home residents at 7.8%, with pressure ulcers representing half of these lesions. As hospital consolidation reduces inpatient beds, more care shifts toward the community, elevating the need for dressings that simplify self-application without compromising clinical outcomes. Patients with diabetes show a higher chronic-wound prevalence than non-diabetics, which pushes demand for premium multilayer dressings and sensor-equipped negative-pressure systems able to sustain therapy between less frequent nursing visits.

Diabetes prevalence fuelling diabetic-foot ulcers

Roughly 7.2% of German adults carry a formal diabetes diagnosis, and surveillance studies estimate that another 2% remain undiagnosed. Clinical registries record 250,000 new diabetic-foot ulcers each year and 13,000 major amputations despite multidisciplinary care pathways . Evidence that specialised centres can cut amputation risk by 80% has accelerated procurement of advanced monitoring technologies and antimicrobial dressings capable of detecting sub-clinical infection markers.

Shortage of specialised wound-care nurses

Federal projections show a possible deficit of 690,000 nurses by 2049 Fewer professionals mean less frequent dressing changes and greater reliance on products that maintain efficacy for a week or more without specialist intervention.

Other drivers and restraints analyzed in the detailed report include:

- Continuous product innovation including silicone super-absorbers and NPWTi-d

- Hospital-digitalisation grants accelerating advanced wound-tech uptake

- Stringent EU-MDR post-market compliance burden

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound-care products generated 65.39% of Germany wound care management devices market revenue in 2024, reflecting a preference for multifunctional foams, hydrofibers, and silicone super-absorbers that address exudate control and skin integrity simultaneously. Negative-pressure systems, now equipped with automated pressure monitors, are gaining institutional traction as payers accept their cost-saving profile for complex surgical wounds. Smart hydrogels infused with antibiofilm peptides are moving from research labs toward commercial pipelines, promising additional gains in healing speed. Traditional gauze still serves primary-care settings but faces encroachment from low-cost composite dressings. Disposable NPWT kits target outpatient settings where pump rental logistics once constrained adoption. Together, these innovations ensure that the Germany wound care management devices market maintains a technology-led growth curve.

Wound-closure devices exhibit the fastest CAGR at 5.23% through 2030 as hospitals resume deferred surgeries and adopt bioresorbable staples and tissue adhesives. Bioengineered skin substitutes increasingly bridge extensive tissue defects, shortening hospital stays and enabling earlier discharge to home-care programmes. Smart bandages capable of real-time biomarker sensing, such as the iCares prototype, foreshadow an era in which closure products double as diagnostic platforms. These trends align closely with statutory insurance goals of complication prevention, indicating sustained procurement momentum despite overall budgetary constraints in the Germany wound care management devices industry.

Chronic lesions commanded 60.37% of Germany wound care management devices market size in 2024. Diabetic-foot ulcers alone account for 250,000 new cases every year, spurring hospital investment in multidisciplinary limb-saving teams. Pressure-ulcer prevalence remains highest in long-term-care institutions, reinforcing demand for dressings that can distribute shear forces while absorbing high exudate volumes. Venous leg ulcers also drive utilisation of compression-compatible materials with antimicrobial silver or polyhexanide. Clinical guidelines now recommend point-of-care fluorescence imaging to detect bacterial load, creating a pull-through effect for compatible dressings and topical solutions.

Acute wounds are expanding at a 5.49% CAGR, buoyed by rising orthopaedic and oncologic surgery volumes as pandemic backlogs clear. Extended-wear NPWT dressings now remain in situ for seven days, limiting theatre-to-ward hand-offs and freeing nursing resources. Skin-grafting adjuncts containing growth-factor matrices shorten recovery after burns and trauma, and absorbable sutures coated with antimicrobials lessen the risk of surgical-site infections. These developments collectively raise the performance expectations for all acute-care devices sold into the Germany wound care management devices market.

The Germany Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure [Sutures, Surgical Staplers, and More]), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Hartmann Group

- Solventum

- B. Braun

- Smiths Group

- Molnlycke Health Care

- Cardinal Health

- ConvaTec Group plc

- Coloplast

- Medtronic

- Integra LifeSciences Holdings Corp.

- curea medical GmbH

- Lohmann & Rauscher GmbH

- Advanced Medical Solutions Group

- Hartmann Group

- Johnson & Johnson

- Stryker

- Medela

- QRSKIN GmbH

- Essity Medical

- Urgo Medical SAS

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising chronic wounds & geriatric population

- 4.2.2 Diabetes prevalence fuelling diabetic-foot ulcers

- 4.2.3 Continuous product innovation including silicone super-absorbers and NPWTi-d, among others

- 4.2.4 Hospital-digitalisation grants accelerating advanced wound tech uptake

- 4.2.5 Reimbursement for wound-care apps & tele-monitoring

- 4.2.6 Strong German cost-effectiveness evidence for NPWT boosting payer adoption

- 4.3 Market Restraints

- 4.3.1 High device costs & reimbursement gaps

- 4.3.2 Stringent EU-MDR post-market compliance burden

- 4.3.3 Fragmented outpatient-care financing limits home-care device penetration

- 4.3.4 Shortage of specialised wound-care nurses

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products & Services, Recent Developments)

- 6.3.1 PAUL HARTMANN AG

- 6.3.2 Solventum

- 6.3.3 B. Braun SE

- 6.3.4 Smith & Nephew plc

- 6.3.5 Molnlycke Health Care AB

- 6.3.6 Cardinal Health Inc.

- 6.3.7 ConvaTec Group plc

- 6.3.8 Coloplast A/S

- 6.3.9 Medtronic plc

- 6.3.10 Integra LifeSciences Holdings Corp.

- 6.3.11 curea medical GmbH

- 6.3.12 Lohmann & Rauscher GmbH

- 6.3.13 Advanced Medical Solutions Group plc

- 6.3.14 Hartmann Group

- 6.3.15 Johnson & Johnson (Ethicon)

- 6.3.16 Stryker Corp.

- 6.3.17 Medela AG

- 6.3.18 QRSKIN GmbH

- 6.3.19 Essity Medical

- 6.3.20 Urgo Medical SAS

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment