PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907261

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907261

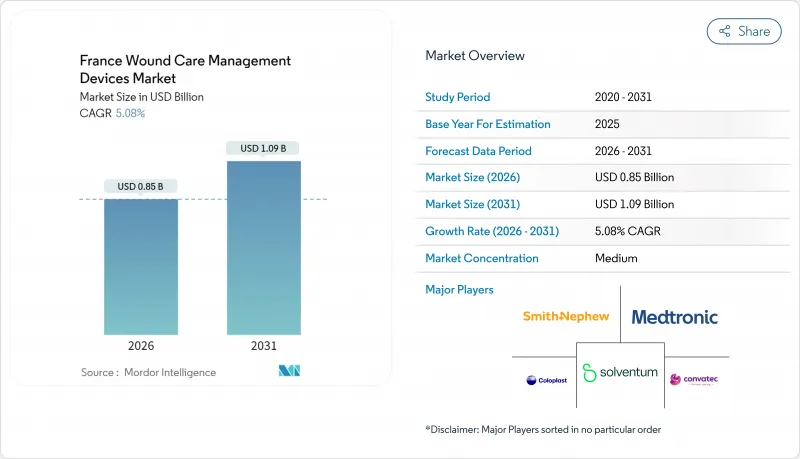

France Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The France wound care management devices market was valued at USD 0.81 billion in 2025 and estimated to grow from USD 0.85 billion in 2026 to reach USD 1.09 billion by 2031, at a CAGR of 5.08% during the forecast period (2026-2031).

Expansion continues despite a EUR 2.4 billion public-hospital deficit that weighed on national health accounts in 2023. Growth rests on the country's Hospitalisation a Domicile framework, which reimburses negative-pressure wound therapy (NPWT) delivered at home and embeds telehealth into standard care pathways. Rising chronic-disease prevalence, notably 4 million residents with type 2 diabetes, intensifies demand for advanced dressings that shorten healing times. Surgical volumes are also lifting unit sales of wound closure devices as same-day discharge procedures reach 37.7% of national surgery output. Meanwhile, artificial-intelligence platforms now support over 600,000 wound evaluations per month, signalling swift digital adoption in clinical settings .

France Wound Care Management Devices Market Trends and Insights

Increasing cases of chronic wounds and diabetic ulcers

France reports more than 4 million type 2 diabetes patients, exposing a large cohort to foot-ulcer risk that ranges between 19% and 34% across their lifetime. Average monthly treatment costs reach EUR 697 for outpatient care and EUR 1,556 for hospital management, creating strong incentives to adopt bioactive dressings that prevent complications. Clinical urgency drives hospitals to deploy AI-enabled imaging platforms that guide early intervention; Swift Medical's tool alone processes more than 600,000 assessments every month. Glucose-responsive smart bandages and single-use NPWT systems therefore move quickly from pilot testing to routine practice, positioning the France wound care management devices market for sustained volume growth.

Rising geriatric population

Older adults will form 30% of the country's population by 2050, lifting prevalence of comorbidities that slow tissue repair. Peripheral arterial disease now affects 11.2% of French type 2 diabetes patients, adding complexity to ulcer management . Policy makers respond with dependency-prevention programs and funding for home-based care, which dovetail with HaD reimbursement for advanced NPWT. Tele-follow-up through the CICAT network improved 75% of chronic wounds while cutting hospitalisations by 72%, validating remote intervention models. Device makers therefore focus on ergonomics and connectivity to meet the needs of ageing users in non-clinical settings.

High cost of advanced wound care products

Public hospitals posted a EUR 2.4 billion deficit in 2023, prompting procurement managers to scrutinise premium products despite their clinical merit. AI-enabled dressings and bioelectrical wraps carry price tags that strain budgets, especially in rural units where 27% of intensive-care beds already face intermittent closure due to staff gaps. Vendor strategies therefore pivot to value-based contracts and low-silver or magnesium-hydroxide antimicrobial substitutes that protect margins while easing upfront cost barriers.

Other drivers and restraints analyzed in the detailed report include:

- Increase in surgical procedures

- Technological advances in advanced dressings and NPWT

- Stringent reimbursement ceilings

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound care products represented 63.98% of 2025 revenue, reflecting their indispensable role across French acute and chronic indications. This dominance lets the France wound care management devices market scale smart dressings that incorporate pH sensors, microfluidic channels and antimicrobial nanoparticles without displacing tried-and-true gauze formats. Smith+Nephew and Paul Hartmann expand silicone super-absorbent portfolios, while domestic mid-caps introduce single-use NPWT kits that marry ease of application with HaD reimbursement. In contrast, wound closure devices post a brisk 5.74% CAGR to 2031, fuelled by ambulatory surgery and robotic stitching platforms that demand bio-resorbable staples and skin adhesives. Although topical agents and biologics hold smaller shares, research into probiotic-laced gels such as ILP100-Topical suggests further diversification ahead. Remote-diagnostic platforms now link dressing selection to machine-learning wound scoring, raising both unit value and stickiness among hospital buyers.

The France wound care management devices market size attached to wound care products is projected to climb steadily as new bioactive formulations secure faster regulatory clearance pathways. Competitive moats widen where firms integrate cloud-linked scanners into product bundles, giving clinicians point-of-care guidance and giving companies richer data loops that underpin next-generation launches. Margins remain robust because frequent dressing changes lock in repeat sales, while NPWT consumables extend lifecycle revenue around a durable pump. As a result, leading suppliers target dual growth tracks: up-market smart materials for tertiary hospitals and cost-sensitive gauze innovations for sparsely staffed rural care settings.

Chronic wounds accounted for 58.83% of revenue in 2025, underscoring the burden diabetic foot ulcers and pressure sores place on French payers. This segment relies on customised therapies such as electroceutical wraps and oxygen-diffusion dressings that regenerate tissue in hypoxic limbs. The France wound care management devices market share linked to chronic wounds is defended by clinical protocols that mandate sophisticated products after first-line measures fail. Device selection is often influenced by AI imaging scores that stratify exudate level and microbial load, steering prescribers toward advanced foams or antimicrobial alginate layers. New reimbursement bundles for HaD NPWT further anchor sales by supporting at-home management for ulcers that once required prolonged inpatient stays.

Acute wounds, though smaller, display a 5.67% CAGR through 2031 as day-case surgery volumes climb. Here, film dressings and cyanoacrylate glues dominate but rapidly give ground to absorbent hydro-fiber matrices designed for robotic and laparoscopic incision profiles. Burns and trauma cases introduce demand for hydrogel dressings with integrated temperature sensors that alert clinicians to infection risk. The France wound care management devices market size for acute wounds also benefits from military procurement contracts that test innovations in austere settings before civilian rollout. Collectively, these dynamics produce a balanced demand outlook in which chronic complexity sustains baseline volumes while acute expansion adds incremental growth.

The France Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure [Sutures, Surgical Staplers, and More]), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Hartmann Group

- Urgo Medical (Laboratoires Urgo)

- Molnlycke Health Care

- B. Braun

- Coloplast

- Cardinal Health

- ConvaTec Group plc

- Medtronic

- Integra LifeSciences

- Lohmann & Rauscher

- Johnson & Johnson

- Baxter

- BSN medical (Essity)

- Laboratoires Genevrier

- Hollister

- Systagenix Wound Management

- Medline Industries

- Derma Sciences (Integra)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing cases of chronic wounds & diabetic ulcers

- 4.2.2 Rising geriatric population

- 4.2.3 Increase in surgical procedures

- 4.2.4 Technological advances in advanced dressings & NPWT

- 4.2.5 Expansion of Hospitalisation Domicile (HaD) reimbursed NPWT

- 4.2.6 Tele-wound-care platforms endorsed by ARS

- 4.3 Market Restraints

- 4.3.1 High cost of advanced wound care products

- 4.3.2 Stringent reimbursement ceilings

- 4.3.3 Shortage of specialised wound-care nurses in rural France

- 4.3.4 Eco-design / single-use-plastic rules raising compliance costs

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.1.1 Dressings

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith & Nephew plc

- 6.3.3 Paul Hartmann AG

- 6.3.4 Urgo Medical (Laboratoires Urgo)

- 6.3.5 Molnlycke Health Care AB

- 6.3.6 B. Braun SE

- 6.3.7 Coloplast A/S

- 6.3.8 Cardinal Health Inc.

- 6.3.9 ConvaTec Group plc

- 6.3.10 Medtronic plc

- 6.3.11 Integra LifeSciences

- 6.3.12 Lohmann & Rauscher

- 6.3.13 Johnson & Johnson

- 6.3.14 Baxter International Inc.

- 6.3.15 BSN medical (Essity)

- 6.3.16 Laboratoires Genevrier

- 6.3.17 Hollister Incorporated

- 6.3.18 Systagenix Wound Management

- 6.3.19 Medline Industries

- 6.3.20 Derma Sciences (Integra)

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment