PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849883

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1849883

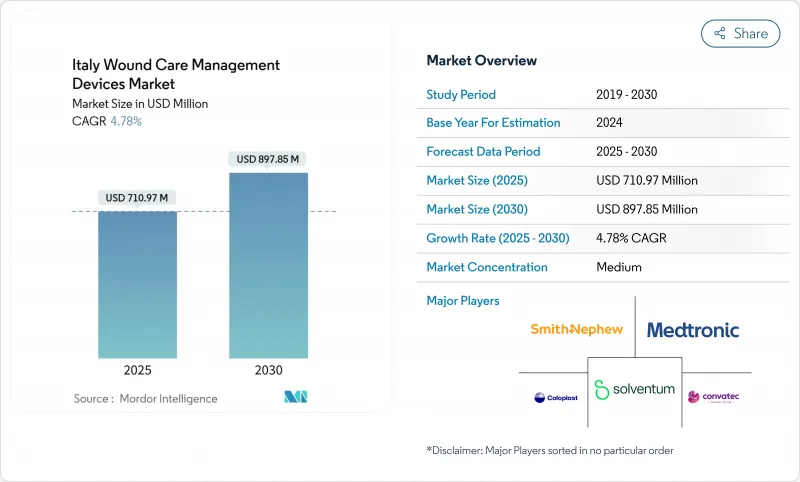

Italy Wound Care Management Devices - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

The Italy wound care management devices market stands at USD 710.97 million in 2025 and is projected to reach USD 897.85 million by 2030, advancing at a 4.78% CAGR.

A larger elderly population, rising diabetes incidence, and continuous digital upgrades within the national health service sustain volume growth and encourage faster adoption of advanced dressings, negative pressure wound therapy (NPWT), and bioactive materials. Hospitals remain the backbone of demand, yet home-healthcare momentum is intensifying as payers look to curb inpatient costs and patients favor convenient recovery options. Procurement reforms that standardize tenders and reward value-based purchasing stimulate competition among global brands and regional specialists . Meanwhile, regulatory deadlines under the EU Medical Device Regulation push manufacturers toward safer, data-rich products that match Italy's shift to outcome-driven care.

Italy Wound Care Management Devices Market Trends and Insights

Surging Prevalence of Diabetes-Linked Chronic Ulcers

Italy's 6% diabetes prevalence feeds continuous demand for sophisticated dressings and off-the-shelf NPWT that curb hospitalization costs averaging EUR 4,888 per diabetic foot ulcer case. Ageing amplifies this pressure because ulcer risk rises sharply after 65 years. Hospitals increasingly employ predictive analytics-machine-learning algorithms with 80% accuracy-to prioritize high-risk patients and guide early intervention. Suppliers offering integrated device portfolios, remote monitoring, and evidence-based protocols gain traction with regional health authorities seeking budget predictability .

Growing Adoption of NPWT in Italian Public Hospitals

Clinical-economic studies show NPWT shortens stays by 2.5 days and lowers readmissions, prompting procurement teams in Lombardy and Emilia-Romagna to accelerate single-use system tenders. After Europe-wide clinical standardization, nurses across Italy report smoother protocol rollouts and fewer dressing-related infections. Portable, battery-powered units designed for transfer to primary care settings now form a fast-growing sub-line that aligns with home-care expansion .

Unfavorable Reimbursement for Next-Gen Skin Substitutes

AIFA's cost-effectiveness lenses slow listing for premium cellular matrices, partly because 23% of health outlays already fall on patients. Where dossiers lack extensive Italian data, regional commissions hesitate to grant coverage, forcing clinicians to rely on conventional dressings. Companies that pair long-term outcome studies with budget impact models are improving acceptance, but widespread coverage remains a multi-year prospect.

Other drivers and restraints analyzed in the detailed report include:

- Shift to Outpatient & Home-Based Advanced Wound Dressings

- EU MDR-Driven Innovation in Bioactive Collagen-HA Dressings

- Regional Procurement Delays in Southern Italy

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Wound care products held a commanding 65.11% share of the Italy wound care management devices market in 2024 as clinicians relied on advanced dressings, foams, hydrofibers, and NPWT canisters for day-to-day ulcer management. The recurring replacement cycle secures predictable revenue, and demand is reinforced by 2 million chronic wound cases that require constant exudate management. Traditional gauze usage is falling because antimicrobial dressings achieve faster epithelialization and fewer infection-related readmissions. Portable NPWT units strengthen outpatient adoption, while single-use kits lower nurse workload and cross-contamination risk.

Wound closure products expand at a 5.45% CAGR to 2030, outpacing the broader Italy wound care management devices market. Increased elective surgeries and minimally invasive procedures in major university centers stimulate uptake of absorbable staplers, tissue adhesives, and novel sealants. Surgeons in Lombardy report reduced operating time when using bioresorbable adhesives, aligning with hospital pay-for-performance metrics that reward shorter stays. Start-ups focusing on synthetic polymer glues that set in under 60 seconds attract venture funding, adding competitive pressure.

Chronic wounds contributed 58.76% to the Italy wound care management devices market size in 2024, reflecting the persistence of diabetic foot, pressure, and venous ulcers. Diabetic ulcers alone generate treatment outlays of EUR 4,888 per patient and push hospitals to adopt algorithms that predict non-healing trajectories and trigger early NPWT initiation. Protein-enriched platelet-rich plasma injections achieving 52% area reduction exemplify therapies that could shift cost burdens from inpatient beds to outpatient infusion rooms.

Acute wounds grow faster, registering a 5.53% CAGR as trauma centers upgrade burn units and adopt closed-incision NPWT. Economic analyses from Italian surgery wards show EUR 166,944 savings per 100 patients when NPWT prevents surgical site infections. Burn care research institutes in Emilia-Romagna also test xenogenic dermal matrices that promise shorter grafting intervals and less hypertrophic scarring.

The Italy Wound Care Management Devices Market is Segmented by Product (Wound Care [Dressings, Wound-Care Devices, and More] and Wound Closure), Wound Type (Chronic Wounds and Acute Wounds), End User (Hospitals & Specialty Wound Clinics and More), and Mode of Purchase (Institutional Procurement and Retail / OTC Channel). The Market and Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Solventum

- Smiths Group

- Molnlycke Health Care

- Coloplast

- ConvaTec Plc

- B. Braun

- Medtronic

- Hartmann Group

- Integra LifeSciences

- Essity (BSN medical)

- Lohmann & Rauscher

- Urgo Medical

- Fidia Farmaceutici SpA

- Medela

- DeRoyal Industries

- Cardinal Health

- Baxter

- Kerecis

- Vivostat

- Kinetic Concepts

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging prevalence of diabetes-linked chronic ulcers

- 4.2.2 Growing adoption of Negative-Pressure Wound Therapy (NPWT) in Italian public hospitals

- 4.2.3 Shift to outpatient & home-based advanced wound dressings

- 4.2.4 National tender reforms accelerating uptake of single-use NPWT

- 4.2.5 EU MDR-driven innovation in bioactive collagen-HA dressings

- 4.2.6 Hospital Pay-for-performance rules rewarding faster wound closure

- 4.3 Market Restraints

- 4.3.1 Unfavourable reimbursement for next-gen skin substitutes

- 4.3.2 Regional procurement delays in Southern Italy

- 4.3.3 High clinician training gap for smart wound monitoring devices

- 4.3.4 Supply-chain dependency on imported foam & alginate raw materials

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porters Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Product

- 5.1.1 Wound Care

- 5.1.1.1 Dressings

- 5.1.1.1.1 Traditional Gauze & Tape Dressings

- 5.1.1.1.2 Advanced Dressings

- 5.1.1.2 Wound-Care Devices

- 5.1.1.2.1 Negative Pressure Wound Therapy (NPWT)

- 5.1.1.2.2 Oxygen & Hyperbaric Systems

- 5.1.1.2.3 Electrical Stimulation Devices

- 5.1.1.2.4 Other Wound Care Devices

- 5.1.1.3 Topical Agents

- 5.1.1.4 Other Wound Care Products

- 5.1.2 Wound Closure

- 5.1.2.1 Sutures

- 5.1.2.2 Surgical Staplers

- 5.1.2.3 Tissue Adhesives, Strips, Sealants & Glues

- 5.1.1 Wound Care

- 5.2 By Wound Type

- 5.2.1 Chronic Wounds

- 5.2.1.1 Diabetic Foot Ulcer

- 5.2.1.2 Pressure Ulcer

- 5.2.1.3 Venous Leg Ulcer

- 5.2.1.4 Other Chronic Wounds

- 5.2.2 Acute Wounds

- 5.2.2.1 Surgical/Traumatic Wounds

- 5.2.2.2 Burns

- 5.2.2.3 Other Acute Wounds

- 5.2.1 Chronic Wounds

- 5.3 By End User

- 5.3.1 Hospitals & Specialty Wound Clinics

- 5.3.2 Long-term Care Facilities

- 5.3.3 Home-Healthcare Settings

- 5.4 By Mode of Purchase

- 5.4.1 Institutional Procurement

- 5.4.2 Retail / OTC Channel

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Market Share Analysis

- 6.3 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products & Services, and Recent Developments)

- 6.3.1 Solventum

- 6.3.2 Smith+Nephew

- 6.3.3 Molnlycke Health Care AB

- 6.3.4 Coloplast Group

- 6.3.5 ConvaTec Plc

- 6.3.6 B. Braun SE

- 6.3.7 Medtronic plc

- 6.3.8 Paul Hartmann AG

- 6.3.9 Integra LifeSciences

- 6.3.10 Essity (BSN medical)

- 6.3.11 Lohmann & Rauscher

- 6.3.12 Urgo Medical

- 6.3.13 Fidia Farmaceutici SpA

- 6.3.14 Medela AG

- 6.3.15 DeRoyal Industries

- 6.3.16 Cardinal Health

- 6.3.17 Baxter International

- 6.3.18 Kerecis

- 6.3.19 Vivostat A/S

- 6.3.20 Kinetic Concepts

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment