PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906987

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1906987

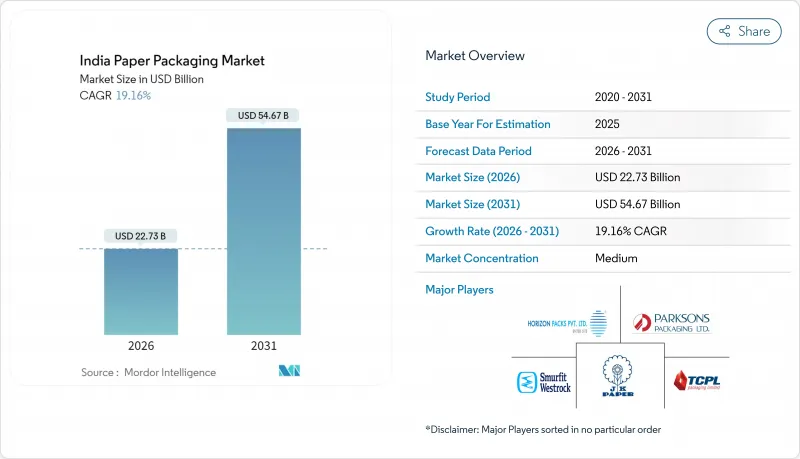

India Paper Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India paper packaging market size in 2026 is estimated at USD 22.73 billion, growing from 2025 value of USD 19.07 billion with 2031 projections showing USD 54.67 billion, growing at 19.16% CAGR over 2026-2031.

Expansive e-commerce operations, plastic-use restrictions, and rising fast-moving consumer goods (FMCG) volumes combine to lift demand for lightweight, recyclable substrates across primary and secondary formats. Regulatory bans on selected single-use plastics in all 28 states accelerate substitution, while brand owners invest in premium barrier-coated paperboard to meet sustainability pledges and consumer expectations. Digital printing adoption, already at 18% penetration in label lines, supports agile production, late-stage customization, and counterfeit deterrence. Amid growth, raw-material exposure to kraft-paper price swings and cost-competitive zero-duty ASEAN imports pressure margins, prompting domestic mills to scale, backward-integrate, and secure recovered-fiber feedstock. Overall, India paper packaging market participants deploy capital toward coating, molded-fiber, and smart-label technologies that strengthen product stewardship credentials and capture higher-value applications along the supply chain.

India Paper Packaging Market Trends and Insights

Accelerating E-commerce Fulfillment Demand

India processed 5.2 billion online shipments in 2024 compared with 3.8 billion a year earlier, boosting corrugated-box volumes and encouraging adoption of lightweight high-strength grades. Large platforms added automated packing lines that standardize dimensions and reduce empty space. Quick-commerce operators favor compact corrugated formats designed for micro-fulfillment centers. Digital payment penetration reached 87% in urban areas, allowing removal of cash-on-delivery inserts and lowering material usage. Subscription-commerce models provide predictable demand, enabling converters to dedicate lines and secure raw-material contracts, thereby stabilizing throughput.

FMCG and Packaged-Food Volume Expansion

The packaged-food sector grew 8.2% in 2024, supported by organized retail penetration of 12% nationally and 35% in metros. Nestle India allocated INR 2,600 crore (USD 29.28 crore ) for capacity upgrades, underscoring confidence in sustained consumption growth. Rural-income support schemes stimulated demand for branded goods sold in small pack sizes that favor coated paperboard. Growth in the organized dairy channel at 12% annually requires insulated corrugated containers for cold-chain logistics. These shifts reinforce multiyear contracting between food majors and packaging suppliers, anchoring baseline order volumes for the India paper packaging market.

Kraft-paper input-price volatility

Spot kraft prices fluctuated 15-20% in 2024 due to ocean-freight spikes and energy-cost swings, eroding SME corrugator margins that lack hedging capacity. Mills with captive pulping muted exposure, underscoring integration's value. Price uncertainty delays capacity upgrades as payback models become fluid, and it hampers long-term contracts with brand owners expecting stable cost curves.

Other drivers and restraints analyzed in the detailed report include:

- Government Ban on Select Single-Use Plastics

- Rapid Adoption of Digital and On-Demand Printing

- Zero-duty ASEAN imports squeezing margins

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated board maintained 53.65% India paper packaging market share in 2025, driven by e-commerce durability requirements and industrial stacking needs. Yet coated paperboard registers a 20.95% CAGR to 2031, propelled by premium FMCG and pharmaceutical applications that demand moisture and grease barriers. India paper packaging market size for paperboard is projected to reach USD 18.47 billion by 2031, up from USD 5.9 billion in 2025. Coated variants also leverage government procurement favoring recyclable substrates, particularly in public food-distribution channels. Investments such as ITC's INR 800 crore (USD 9.011 crore) barrier-coating line reflect this structural tailwind.

Advanced multiwall kraft innovations cut weight in cement sacks without sacrificing burst strength, winning share from woven polypropylene. Recovered-fiber content rises alongside FSC certification uptake, helping brands achieve Scope-3 carbon reductions. Material diversification cushions mills against kraft price cycles and broadens the India paper packaging market addressable for specialized grades.

Flexible structures secured 53.74% India paper packaging market share during 2025 thanks to pouches, sachets, and wraps optimized for snack, confectionery, and personal-care items. The sub-category posts a 21.55% CAGR as barrier coatings allow plastic-free laminates. Digital web presses tune graphics to micro-market preferences, reinforcing volume gains. Meanwhile, rigid folding cartons and corrugated cases expand as omnichannel brands harmonize shelf-ready and ship-in-own-container designs.

Rigid formats benefit from micro-flute and litho-lam innovations that reduce fiber by 8-10% yet elevate print fidelity, deepening penetration in cosmetics and electronics. Cartonboard lines tailored for pharmaceutical serialization add tamper evidence crucial to regulatory compliance, accelerating rigid adoption.

The India Paper Packaging Market Report is Segmented by Material Type (Kraft Paper, Paperboard, Corrugated Board, and More), Product Type (Flexible Paper Packaging, Rigid Paper Packaging), Packaging Format (Primary Packaging, Secondary Packaging, Tertiary/Transit Packaging), End-Use Industry (Food, Beverage, Healthcare and Pharmaceuticals, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Smurfit WestRock

- ITC Ltd. - Paperboards and Specialty Papers Div.

- JK Paper Ltd.

- Parksons Packaging Ltd.

- TCPL Packaging Ltd.

- Horizon Packs Pvt. Ltd.

- Oji Holdings Corp. (Oji India Packaging Pvt. Ltd.)

- Astron Paper and Board Mill Ltd.

- Kapco Packaging Ltd.

- Chaitanya Packaging Pvt. Ltd.

- Trident Paper Box Industries Pvt. Ltd.

- TGI Packaging Pvt. Ltd.

- Packman Packaging Pvt. Ltd.

- Emami Paper Mills Ltd.

- Andhra Paper Ltd.

- Pakka Ltd.

- P.R. Packagings Ltd.

- Total Pack Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Accelerating e-commerce fulfilment demand

- 4.2.2 FMCG and packaged-food volume expansion

- 4.2.3 Government ban on select single-use plastics

- 4.2.4 Brand-owner switch to premium, lightweight board

- 4.2.5 Rapid adoption of digital and on-demand printing

- 4.2.6 Supply-chain traceability and smart-label adoption

- 4.3 Market Restraints

- 4.3.1 Kraft-paper input-price volatility

- 4.3.2 Zero-duty ASEAN imports squeezing margins

- 4.3.3 Structural shortage of recovered fibre in India

- 4.3.4 Excess domestic corrugator capacity and fragmentation

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products

- 4.7.5 Intensity of Competitive Rivalry

- 4.8 Impact of Macroeconomic Factors on the Market

- 4.9 Pricing Analysis - Corrugated and Folding Carton

- 4.10 India Paper Industry Statistics

- 4.10.1 Current Capacity of Paper and Paperboard

- 4.10.2 Production, Sales and Utilisation Rates

- 4.10.3 Writing and Printing Paper Breakdown

- 4.10.4 Paperboard and Packaging Paper Breakdown

- 4.10.5 Specialty and MG Paper Overview

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Material Type

- 5.1.1 Kraft Paper

- 5.1.2 Paperboard

- 5.1.3 Corrugated Board

- 5.1.4 Other Material Types

- 5.2 By Product Type

- 5.2.1 Flexible Paper Packaging

- 5.2.1.1 Pouches and Bags

- 5.2.1.2 Wraps and Films

- 5.2.1.3 Other Flexible Paper Packaging

- 5.2.2 Rigid Paper Packaging

- 5.2.2.1 Folding Carton

- 5.2.2.2 Corrugated Boxes

- 5.2.2.3 Other Rigid Paper Packaging

- 5.2.1 Flexible Paper Packaging

- 5.3 By Packaging Format

- 5.3.1 Primary Packaging

- 5.3.2 Secondary Packaging

- 5.3.3 Tertiary / Transit Packaging

- 5.4 By End-Use Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare and Pharmaceuticals

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Industrial and Electronic

- 5.4.6 Other End-Use Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Smurfit WestRock

- 6.4.2 ITC Ltd. - Paperboards and Specialty Papers Div.

- 6.4.3 JK Paper Ltd.

- 6.4.4 Parksons Packaging Ltd.

- 6.4.5 TCPL Packaging Ltd.

- 6.4.6 Horizon Packs Pvt. Ltd.

- 6.4.7 Oji Holdings Corp. (Oji India Packaging Pvt. Ltd.)

- 6.4.8 Astron Paper and Board Mill Ltd.

- 6.4.9 Kapco Packaging Ltd.

- 6.4.10 Chaitanya Packaging Pvt. Ltd.

- 6.4.11 Trident Paper Box Industries Pvt. Ltd.

- 6.4.12 TGI Packaging Pvt. Ltd.

- 6.4.13 Packman Packaging Pvt. Ltd.

- 6.4.14 Emami Paper Mills Ltd.

- 6.4.15 Andhra Paper Ltd.

- 6.4.16 Pakka Ltd.

- 6.4.17 P.R. Packagings Ltd.

- 6.4.18 Total Pack Ltd.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment