PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910931

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1910931

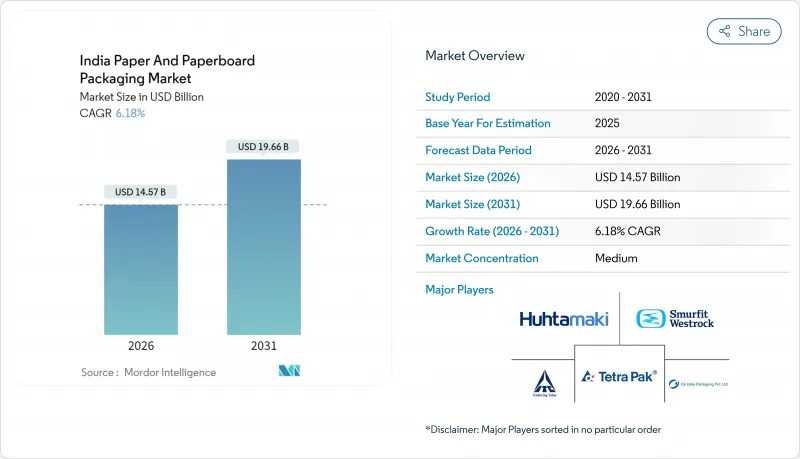

India Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

India paper and paperboard packaging market size in 2026 is estimated at USD 14.57 billion, growing from 2025 value of USD 13.72 billion with 2031 projections showing USD 19.66 billion, growing at 6.18% CAGR over 2026-2031.

Demand momentum reflects the nationwide shift away from single-use plastics, the rapid scale-up of e-commerce logistics, and brand commitments to circular-economy packaging.Corrugated boxes dominate because online retail requires impact-resistant yet lightweight transit formats, while liquid cartons are benefiting from premium beverage growth and aseptic filling investments. Food and beverage brands accelerate the adoption of recyclable mono-material packs, and quick-commerce hubs in Tier-1 and Tier-2 cities enlarge the addressable base for small-format secondary packs. On the supply side, recycled fiber capacity, agro-residue pulp lines, and high-speed flexo presses are expanding, yet margin pressure persists due to energy inflation and volatile imported waste-paper prices.

India Paper And Paperboard Packaging Market Trends and Insights

Rising E-commerce Corrugated Demand

Order-volume surges and heavier quick-commerce shipments now permitted up to 35 kg are pushing converters to engineer corrugated designs that balance strength and grammage for last-mile efficiency. Flipkart's commitment to eliminating plastic cushioning has already converted millions of parcels to paper-based formats. FMCG suppliers such as Adani Wilmar have introduced larger stock-keeping units tailored for online channels, fueling incremental box tonnage. Regional hub networks in Bengaluru and Delhi enable faster replenishment but also multiply touch-points, widening demand for high-print graphics that preserve brand equity. As a result, corrugators are installing inline flexo folders and digital print modules to shorten make-ready times and cut waste. The India paper and paperboard packaging market, therefore, derives a structural uplift from the intersection of e-commerce penetration and material-neutral sustainability mandates.

Food Brand Shift to Recyclable Mono-Material Packs

Recyclability is now a purchase driver as urban consumers scrutinize pack labels for end-of-life credentials. Large food processors are reformulating laminates toward single-substrate paperboard combined with aqueous or biopolymer coatings that deliver grease and moisture barriers without multi-layer plastics. Huhtamaki's partnership with the Confederation of Indian Industry created open-source design guides that clarify how mono-material formats ease mechanical recycling workflows. As brand owners chase Extended Producer Responsibility targets that ramp up in 2026, vendors able to guarantee fiber purity and traceability gain preference.Because coating chemistries can be applied in-line at scale, converters capture both margin and speed advantages, reinforcing the long-run tailwind on the India paper and paperboard packaging market.

Price Volatility of Imported Waste Paper

India relies on seaborne recovered fiber for roughly 30% of recycled-board furnish; freight disruptions and bidding wars push spot prices, squeezing mill margins. The Indian Paper Manufacturers Association has petitioned for duties on multi-layer board imports from China and Chile, citing price undercutting. JK Paper's FY 2024 profit drop of 58% exemplifies how cost spikes flow through earnings. Although new North American pulp lines tempered global prices in mid-2025, currency swings and Red Sea routing risks keep volatility elevated, dampening the near-term growth tempo of the India paper and paperboard packaging market.

Other drivers and restraints analyzed in the detailed report include:

- Government Ban on Single-Use Plastics

- Emergence of Quick-Commerce Regional Hubs

- Chronic Containerboard Energy-Cost Inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated stock generated 48.23% of 2025 revenue, buoyed by e-commerce fulfillment centers that prize cushioning and pallet efficiency. Liquid cartons, though smaller, are slated for a 7.28% CAGR on the back of premium dairy, juice, and aseptic meal solutions. The India paper and paperboard packaging market size for corrugated grades is projected to increase by an additional USD 2.29 billion between 2026 and 2031, driven by investments in inline print-and-die-cut technology that lowers changeover costs. Liquid-carton leaders such as UFlex plan to lift output to 12 billion packs annually, helped by Tetra Pak's landmark rollout of 5% ISCC PLUS certified recycled-polymer layers. In parallel, folding cartons maintain a stable FMCG base, upgraded by water-based barrier coats that meet mono-material guidelines. Specialty paperboards and molded fiber trade on niche protection requirements and ecological branding, commanding premium spreads that cushion input volatility.

From a competitive stance, large groups like ITC control the full chain from agro-forestry to finished board, enabling raw-material hedging and shorter product-development cycles. Corrugators respond by co-locating print cells near digital marketplaces to deliver same-day box replenishment, an operational edge as the India paper and paperboard packaging market pivots toward hyperlocal delivery.

Food and beverage brands captured 39.35% revenue in 2025 due to stringent hygiene codes and an expanding cold chain, while personal care and cosmetics outperformed with an 7.72% CAGR forecast. Within food-service, quick-serve restaurants adopt grease-resistant clamshells built from recycled fiber plus PLA dispersion, aligning with the single-use-plastic ban. The India paper and paperboard packaging market size for personal-care items is slated to advance by USD 568 million through 2031 as premium labels trade plastic jars for rigid paperboard tubes and offset-printed sleeves.

On the healthcare front, blister backing and medical-grade cartons enjoy secure demand as domestic pharma output climbs. Electronics brands seek static-safe fiber trays but weigh cost against functional parity with foam, damping runaway growth. Industrial and automotive parts rely on multi-wall corrugated crates that dovetail with the Make in India sourcing expansion, ensuring a broad, balanced revenue footprint across end-use bands.

The India Paper and Paperboard Packaging Market Report is Segmented by Product Type (Folding Cartons, Corrugated Packaging, Liquid Cartons, and More), End-User Vertical (Food and Beverage, Healthcare and Pharma, Automotive, and More), Packaging Format (Primary Retail Packs, Secondary Transit Packs, and More), Material Grade (Virgin Fiber, Recycled Fiber, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- TCPL Packaging Limited

- Parksons Packaging Limited

- Smurfit WestRock plc

- KCL Limited

- Borkar Packaging Private Limited

- Canpac Trends Private Limited

- Trident Paper Box Industries

- Tetra-Pak India Private Limited

- UFlex Ltd

- Oji India Packaging Private Limited

- ITC Limited - Paperboards and Specialty Papers Division

- JK Paper Limited

- Horizon Packs Private Limited

- Astron Packaging Limited

- A N Y Graphics Private Limited

- Meghna Packaging Private Limited

- GPA Global India

- Huhtamaki India Limited

- Mayur Uniquoters Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising e-commerce corrugated demand

- 4.2.2 Food brand shift to recyclable mono-material packs

- 4.2.3 Government ban on single-use plastics

- 4.2.4 Emergence of quick-commerce regional hubs

- 4.2.5 Automated high-speed flexo printing investments

- 4.2.6 Agro-residue pulp capacity additions

- 4.3 Market Restraints

- 4.3.1 Price volatility of imported waste paper

- 4.3.2 Chronic containerboard energy-cost inflation

- 4.3.3 Delayed GST refunds for SME converters

- 4.3.4 Digital substitution in billing and publishing

- 4.4 Industry Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Industry Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Folding Cartons

- 5.1.2 Corrugated Packaging

- 5.1.3 Liquid Cartons

- 5.1.4 Other Product Types

- 5.2 By End-User Vertical

- 5.2.1 Food and Beverage

- 5.2.2 Healthcare and Pharma

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Automotive

- 5.3 By Packaging Format

- 5.3.1 Primary Retail Packs

- 5.3.2 Secondary Transit Packs

- 5.3.3 Shelf-ready / Display Packs

- 5.3.4 Protective Inserts and Cushioning

- 5.4 By Material Grade

- 5.4.1 Virgin Fiber

- 5.4.2 Recycled Fiber

- 5.4.3 Hybrid/Mixed Fiber

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 TCPL Packaging Limited

- 6.4.2 Parksons Packaging Limited

- 6.4.3 Smurfit WestRock plc

- 6.4.4 KCL Limited

- 6.4.5 Borkar Packaging Private Limited

- 6.4.6 Canpac Trends Private Limited

- 6.4.7 Trident Paper Box Industries

- 6.4.8 Tetra-Pak India Private Limited

- 6.4.9 UFlex Ltd

- 6.4.10 Oji India Packaging Private Limited

- 6.4.11 ITC Limited - Paperboards and Specialty Papers Division

- 6.4.12 JK Paper Limited

- 6.4.13 Horizon Packs Private Limited

- 6.4.14 Astron Packaging Limited

- 6.4.15 A N Y Graphics Private Limited

- 6.4.16 Meghna Packaging Private Limited

- 6.4.17 GPA Global India

- 6.4.18 Huhtamaki India Limited

- 6.4.19 Mayur Uniquoters Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment