PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911452

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1911452

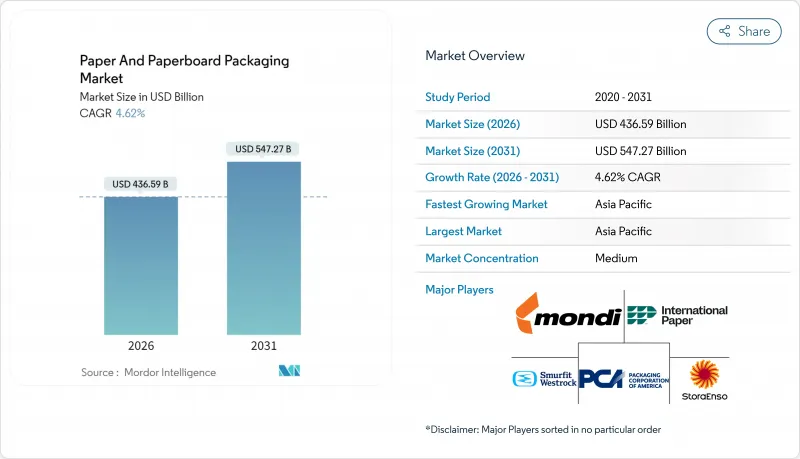

Paper And Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Paper and paperboard packaging market size in 2026 is estimated at USD 436.59 billion, growing from 2025 value of USD 417.31 billion with 2031 projections showing USD 547.27 billion, growing at 4.62% CAGR over 2026-2031.

Demand builds on three structural tailwinds: tougher recycling mandates in the European Union, e-commerce's need for protective shipping formats, and rapid capacity additions in the Asia Pacific. Corrugated cases remain the anchor format because of strength-to-weight advantages and compatibility with automated packing lines, while liquid cartons gain traction in beverages and dairy. Regulatory deadlines that push recycling rates to 70% by 2030 in Europe and the United States' roadmap to phase out problematic plastics by 2040 reinforce substitution momentum. Consolidation typified by the Smurfit Kappa-WestRock merger brings scale that helps players manage volatile old-corrugated-container (OCC) and virgin-pulp input prices. At the same time, fiber-blend innovation enables lighter boards that cut freight emissions and support brand sustainability goals.

Global Paper And Paperboard Packaging Market Trends and Insights

E-commerce-led SKU explosion

Online marketplaces list thousands of product variants that must reach consumers undamaged, pushing converters toward shorter print runs and made-to-fit corrugated designs. Packaging Corporation of America posted a 9.2% jump in corrugated shipments in 2024 as merchants upgraded secondary packs to minimize void fill and cut dimensional-weight surcharges. Shelf-ready formats that reveal brand graphics without extra unpacking are expanding at 5.81% CAGR, and digital printing speeds let converters batch small orders economically. International Paper's USD 18.6 billion net sales in 2024 underline the volume upside when mills can pivot capacity between linerboard and specialty flute grades. Recycling mandates favor paper solutions over plastic mailers, ensuring the paper packaging market continues capturing parcel growth

Plastic-use bans and taxes

Governments target single-use plastics with outright bans or levies that take immediate effect. New South Wales began restricting plastic-lined coffee cups and cutlery in January 2025. In Europe, product-safety labeling rules also steer brands toward mono-material boards that carry clear recycling logos. Billerud's Performance Brown Barrier sack paper now replaces polyethylene coatings in industrial bags, securing premium pricing for verified bio-based content. With the U.S. Environmental Protection Agency mapping a plastic-waste exit by 2040, brand owners lock in multi-year supply contracts that underpin additional kraft-liner capacity.

Volatile OCC and virgin pulp prices

Pulp and recovered-paper indices rose 7.2% in 2024, squeezing converters that lack hedging programs. Stora Enso cited wood-fiber inflation as a headwind despite EUR 9 billion (USD 9.7 billion) of sales. Small mills dependent on spot OCC struggle to pass surcharges through quarterly contracts, narrowing margins against plastic substitutes with steadier resin costs.

Other drivers and restraints analyzed in the detailed report include:

- Quick-service food expansion in tier-2 cities

- Rise of industrial composting standards

- Deforestation-driven NGO pressure

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Corrugated boards represented 42.85% of the paper packaging market in 2025, benefiting from rigorous e-commerce handling standards and recyclability requirements. The segment's operating leverage shows in International Paper's steady industrial-packaging margins amid sluggish macro demand. Liquid cartons, though just a fraction of volume, expand at a 5.54% CAGR as dairy and beverage brands swap multi-layer plastic pouches for renewable cartons certified under the PEFC chain-of-custody. Folding cartons maintain relevance in cosmetics and pharmaceuticals, where high-definition offset graphics add shelf appeal. Innovation focuses on water-based barriers that resist oil and moisture yet allow fiber recovery at mill pulpers.

Lightweighting remains the dominant cost-containment tactic. Leading corrugators deploy high-starch dual-wall flutes that achieve the required edge-crush strength with less fiber. Billerud's SEK 1.4 billion (USD 0.13 billion) grade-conversion program aims to produce food-grade cartonboard with 10% lower basis weight. EU recycling mandates push suppliers toward mono-material designs, ensuring long-term dominance for corrugated and carton grades within the paper packaging market.

Food and beverage accounted for 41.10% of 2025 revenue, underscoring strict hygiene norms and consumers' wish for recyclable takeaway formats. Graphic Packaging's latest 10-K cites above-market growth in paperboard trays for frozen meals. Personal-care brands lift the segment CAGR to 6.30% by substituting laminates with embossed kraft sleeves that convey natural positioning. Pharmaceutical packs benefit from tamper-evident tear strips and barcoded inserts that seamlessly integrate with serialization regulations.

Brand owners also prioritize renewable energy in supplier selection, linking scope-3 emissions to purchasing decisions. Mondi reports 87% of sales now meet reusable or recyclable criteria. This preference underpins the paper packaging market size outlook, leaving little room for plastics in high-visibility consumer applications.

The Paper and Paperboard Packaging Market Report is Segmented by Product Type (Folding Cartons, Corrugated Packaging, Liquid Cartons, and More), End-User Vertical (Food and Beverage, Healthcare and Pharma, and More), Packaging Format (Primary Retail Packs, Secondary Transit Packs, and More), Material Grade (Virgin Fiber, Recycled Fiber, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia Pacific held the largest 46.80% slice of the paper packaging market in 2025, powered by China's record 129.65 million-ton paper production run and a 4.95% regional CAGR through 2031. Cost-effective labor, integrated pulp supply, and explosive e-commerce volumes sustain investment pipelines; Nine Dragons alone is adding two million tons of bleached boxboard capacity to serve quick-service restaurant chains. Japan and South Korea complement the region with recycling systems that push collection rates above 80%, enabling high-recycled-content linerboards for export markets.

North America combines abundant forest resources with advanced converting lines that favor high-graphic corrugated and molded-pulp cushioning. Packaging Corporation of America booked USD 8.4 billion in sales in 2024, testimony to stable domestic demand. Europe follows a stricter regulatory route: the Packaging and Packaging Waste Regulation raises mandatory recycling to 70% by 2030, spurring lightweight board innovation. Stora Enso's new Finnish board line exemplifies capital re-allocation toward premium coated grades that can satisfy circular-economy scorecards.

Latin America and the Middle East/Africa represent emerging corridors where urbanization raises packaged-goods consumption. Klabin's forest-integrated model generates competitive delivered costs into Mercosur neighbors, and Brazil explores bilateral green-fuel trade that could lower the carbon intensity of export linerboard. Infrastructure gaps and currency volatility temper immediate growth, yet brand owners eye these regions for long-run volume upside, adding geographic spread to the paper packaging market.

- International Paper Company

- Smurfit Westrock plc

- Mondi plc

- DS Smith plc

- Packaging Corporation of America

- Stora Enso Oyj

- Nippon Paper Industries Co., Ltd.

- Oji Holdings Corporation

- Billerud AB

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Ltd.

- Svenska Cellulosa AB (SCA)

- Rengo Co., Ltd.

- Lee & Man Paper Manufacturing Ltd.

- Mayr-Melnhof Karton AG

- Pratt Industries Inc.

- Klabin S.A.

- Georgia-Pacific LLC

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce-led SKU explosion

- 4.2.2 Plastic use bans and taxes

- 4.2.3 Quick-service food expansion in tier-2 cities

- 4.2.4 Rise of industrial composting standards

- 4.2.5 Direct-to-consumer pharma fulfilment

- 4.2.6 Sustainability driven Packaging Shift

- 4.3 Market Restraints

- 4.3.1 Volatile OCC and virgin pulp prices

- 4.3.2 Deforestation-driven NGO pressure

- 4.3.3 In-house corrugation by mega-etailers

- 4.3.4 Carbon-border adjustment costs

- 4.4 Industry Value Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Trade Scenario (HS Codes - 4819)

- 4.8.1 Import-Export Data for the Major Countries, Volume, 2021-2024

- 4.8.2 Import-Export Data for the Major Countries, Value, 2021-2024

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Product Type

- 5.1.1 Folding Cartons

- 5.1.2 Corrugated Packaging

- 5.1.3 Liquid Cartons

- 5.1.4 Other Product Types

- 5.2 By End-User Vertical

- 5.2.1 Food and Beverage

- 5.2.2 Healthcare and Pharma

- 5.2.3 Personal Care and Cosmetics

- 5.2.4 Electrical and Electronics

- 5.2.5 Industrial and Automotive

- 5.3 By Packaging Format

- 5.3.1 Primary Retail Packs

- 5.3.2 Secondary Transit Packs

- 5.3.3 Shelf-ready / Display Packs

- 5.3.4 Protective Inserts and Cushioning

- 5.4 By Material Grade

- 5.4.1 Virgin Fiber

- 5.4.2 Recycled Fiber

- 5.4.3 Hybrid/Mixed Fiber

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 Asia Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 South Korea

- 5.5.4.5 Australia

- 5.5.4.6 Malaysia

- 5.5.4.7 Rest of Asia Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit Westrock plc

- 6.4.3 Mondi plc

- 6.4.4 DS Smith plc

- 6.4.5 Packaging Corporation of America

- 6.4.6 Stora Enso Oyj

- 6.4.7 Nippon Paper Industries Co., Ltd.

- 6.4.8 Oji Holdings Corporation

- 6.4.9 Billerud AB

- 6.4.10 Sonoco Products Company

- 6.4.11 Nine Dragons Paper (Holdings) Ltd.

- 6.4.12 Svenska Cellulosa AB (SCA)

- 6.4.13 Rengo Co., Ltd.

- 6.4.14 Lee & Man Paper Manufacturing Ltd.

- 6.4.15 Mayr-Melnhof Karton AG

- 6.4.16 Pratt Industries Inc.

- 6.4.17 Klabin S.A.

- 6.4.18 Georgia-Pacific LLC

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment