PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907289

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1907289

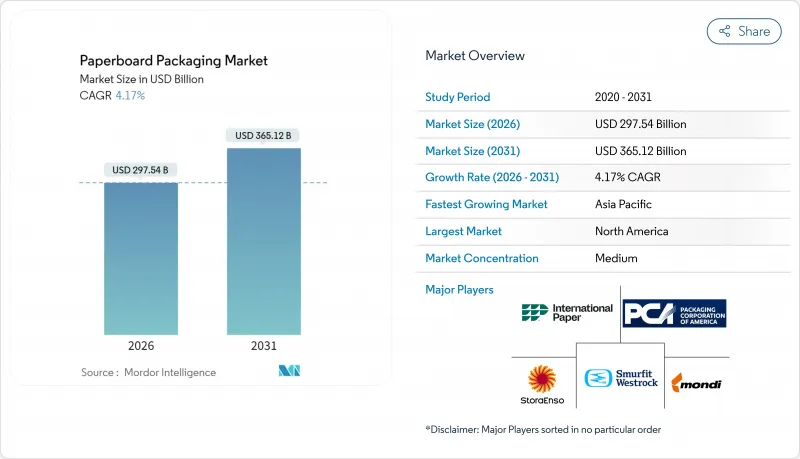

Paperboard Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Paperboard Packaging market is expected to grow from USD 285.63 billion in 2025 to USD 297.54 billion in 2026 and is forecast to reach USD 365.12 billion by 2031 at 4.17% CAGR over 2026-2031.

Rising e-commerce volumes, regulatory momentum favoring fiber over plastic, and continuous improvements in lightweighting and digital converting technologies collectively propel expansion. Recycled fiber's strong cost-to-performance profile complements retailer commitments to circular supply chains, sustaining demand despite raw-material cost swings. Corrugated formats remain the backbone of fulfillment networks, while folding cartons gain ground in premium consumer categories. Market participants counter mounting energy and recovered-paper price volatility by investing in vertical integration and pulp capacity in low-cost forestry regions.

Global Paperboard Packaging Market Trends and Insights

E-commerce Surge Boosting Corrugated-Shipping Demand

Online retail penetration requires stronger, dimension-optimized shipping containers that withstand multiple touchpoints. Box producers captured surging orders by pairing high-performance flute profiles with real-time design tools that tailor packaging to SKU geometry. Packaging Corporation of America's USD 70-per-ton price increase in early 2025 illustrated a tight demand-supply balance. Direct-to-consumer models further reinforce the need for branding space on outer packs, incentivizing converters to integrate high-graphics digital print modules. Smart-label technologies supporting location and shock monitoring now ship on corrugated liners, creating value beyond protection.

Plastic-Substitution Regulations Favor Fiber Packaging

The European Union's Packaging and Packaging Waste Regulation mandates 90% recyclability by 2030, accelerating the shift from multilayer plastics toward recyclable fiber formats. North American states replicate extended-producer-responsibility frameworks, while several Asia-Pacific markets draft similar statutes. Producers respond with dispersion-based barrier coatings and PFAS-free grease-proof chemistries that safeguard food while maintaining repulpability. Brand owners leverage these solutions to meet public sustainability pledges and evade upcoming plastic taxes.

Deforestation and Fiber-Sourcing Scrutiny

Implementation of the European Union Deforestation Regulation compels mills to trace wood back to plots verified as deforestation-free after December 2020, adding auditing costs and exposing non-compliant supply chains to import bans. Multinationals extend the same protocols worldwide, effectively globalizing compliance. Smaller converters face disproportionate administrative burdens, nudging them toward certification pooling or vertical partnerships with plantation owners. Premiums paid for certified logs increase the break-even point for certain grades, compressing margins until chain-of-custody systems mature.

Other drivers and restraints analyzed in the detailed report include:

- Light-Weighting Innovations Lowering Logistics Cost

- Rapid Growth of Packaged F&B in Asia-Pacific

- Volatile Recovered-Paper and Energy Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Recycled fiber secured a 72.10% share of the paperboard packaging market in 2025, underpinned by extensive curbside collection networks and maturing de-inking technologies. This segment is also projected to clock a 6.65% CAGR, outpacing virgin grades due to regulatory credits linked to circularity goals. The paperboard packaging market size for recycled grades is forecast to widen as brand owners mandate minimum post-consumer content for high-volume SKUs. Virgin fiber retains relevance where impeccable visual quality or high wet-strength is mandatory, such as cosmetics gift boxes and pharmaceutical blister cards.

Continuous investments in low-cost plantation forestry bolster recycled leadership. Suzano's new Brazilian eucalyptus complex provides 2.55 million t/year of high-brightness pulp that blends seamlessly with recovered streams, lowering average furnish costs for global mills. Certification through FSC and PEFC further differentiates recycled sheets, enabling converters to add carbon-neutral claims that resonate with eco-conscious consumers. Resulting supply security and branding leverage keep recycled fiber at the forefront of the paperboard packaging market.

Corrugated boxes captured 42.10% revenue share in 2025, propelled by shipment frequency spikes tied to omnichannel retail. Embedded moisture barriers and crush-resistant micro-flutes allow these boxes to traverse automated sortation systems with minimal damage, reinforcing their indispensability. Folding cartons, though smaller in tonnage, promise the fastest 5.55% CAGR, as high-graphics capabilities align with premium food and personal-care placement. The paperboard packaging market size for folding cartons is projected to expand alongside demand for shelf-ready packs that combine vivid print with easier recyclability.

On the innovation front, Greif's EnviroRAP(TM) showcases mono-material wrap formats that replace laminated mailers while retaining curbside recyclability. Parallel progress in digital corrugators lets converters print variable data at press speed, supporting localized holiday themes or influencer collaborations. Such flexibility differentiates corrugated solutions within the paperboard packaging market and sustains their lead as the workhorse of distribution.

The Paperboard Packaging Market Report is Segmented by Raw Material Source (Virgin Fibre, and Recycled Fibre), Product Type (Folding Cartons, Corrugated Boxes, and More), Packaging Format (Primary Packaging, Secondary Packaging, and More), End-User Industry (Food, Beverage, Healthcare, and More), and Geography (North America, South America, and More). The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

North America commanded 38.55% revenue share in 2025, buoyed by integrated recovered-fiber networks and state-level plastic-reduction mandates that steer converters toward curbside-recyclable solutions. Packaging Corporation of America's USD 1.8 billion containerboard acquisition bolsters regional capacity, evidencing consolidation that harnesses scale efficiencies. Retailers' same-day delivery services further stimulate demand for right-sized corrugated shippers, helping the paperboard packaging market sustain mid-single-digit growth despite energy-cost headwinds.

Asia-Pacific represents the fastest-expanding arena, clocking a 6.78% CAGR through 2031 as urban households buy more packaged staples and quick-service meals. China's export orders increasingly specify fiber-based transit wraps, while Vietnam's local industry eyes USD 3.5 billion in packaging revenue by 2026. Regional governments embed circular-economy clauses in new waste directives, granting tariff concessions to importers of recycled sheets. These policy levers, coupled with low-cost labor and expanding online retail, turn Asia-Pacific into the growth engine of the paperboard packaging market.

Europe sustains material innovations underpinned by regulations such as the PPWR and the EUDR, which tighten recyclability and sourcing standards. Sappi's EUR 500 million(USD 587.73 million) machine upgrade enhances lightweight coated capacity, while Mondi's acquisition spree widens folding-carton footprints across consumer-goods clusters. High recovery rates and consumer receptiveness to eco-labels maintain a robust baseline, although sluggish macro demand tempers tonnage growth. Still, stringent compliance hurdles create a moat that favors established players inside the paperboard packaging market.

- International Paper Company

- Smurfit WestRock

- Mondi plc

- Packaging Corporation of America

- Stora Enso Oyj

- Oji Holdings Corporation

- Nippon Paper Industries Co., Ltd.

- Rengo Co., Ltd.

- Metsa Board Oyj

- Graphic Packaging Holding Company

- Cascades Inc.

- Sonoco Products Company

- Nine Dragons Paper (Holdings) Ltd.

- Georgia-Pacific LLC

- Klabin S.A.

- Sappi Limited

- Mayr-Melnhof Karton AG

- Huhtamaki Oyj

- Visy Industries Holdings Pty Ltd.

- Seaboard Folding Box Company Inc.

- Clearwater Paper Corporation

- ITC Limited

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 E-commerce surge boosting corrugated-shipping demand

- 4.2.2 Plastic-substitution regulations favor fibre packaging

- 4.2.3 Light-weighting innovations lowering logistics cost

- 4.2.4 Rapid growth of packaged F&B in Asia-Pacific

- 4.2.5 AI-enabled on-demand custom printing

- 4.2.6 LatAm eucalyptus pulp boom lowering virgin-fibre cost

- 4.3 Market Restraints

- 4.3.1 Deforestation and fibre-sourcing scrutiny

- 4.3.2 Volatile recovered-paper and energy costs

- 4.3.3 Brand-owner pull-back on sustainability pledges

- 4.3.4 Flexible plastic pouches eroding share

- 4.4 Industry Value Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products and Services

- 4.5.5 Degree of Competitive Rivalry

- 4.6 The Impact of Macroeconomic Factors on the Market

- 4.7 Technological Outlook

- 4.8 Regulatory Landscape

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Raw Material Source

- 5.1.1 Virgin Fibre

- 5.1.2 Recycled Fibre

- 5.2 By Product Type

- 5.2.1 Folding Cartons

- 5.2.2 Corrugated Boxes

- 5.2.3 Rigid Boxes

- 5.2.4 Other Product types

- 5.3 By Packaging Format

- 5.3.1 Primary Packaging

- 5.3.2 Secondary Packaging

- 5.3.3 Transit / E-commerce Shipping

- 5.4 By End-user Industry

- 5.4.1 Food

- 5.4.2 Beverage

- 5.4.3 Healthcare

- 5.4.4 Personal Care and Cosmetics

- 5.4.5 Household Care

- 5.4.6 Electrical and Electronics

- 5.4.7 Other End-user Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Chile

- 5.5.2.4 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Spain

- 5.5.3.5 Italy

- 5.5.3.6 Rest of Europe

- 5.5.4 Asia-Pacific

- 5.5.4.1 China

- 5.5.4.2 India

- 5.5.4.3 Japan

- 5.5.4.4 Australia

- 5.5.4.5 South Korea

- 5.5.4.6 Vietnam

- 5.5.4.7 Rest of Asia-Pacific

- 5.5.5 Middle East and Africa

- 5.5.5.1 Middle East

- 5.5.5.1.1 Saudi Arabia

- 5.5.5.1.2 United Arab Emirates

- 5.5.5.1.3 Turkey

- 5.5.5.1.4 Rest of Middle East

- 5.5.5.2 Africa

- 5.5.5.2.1 South Africa

- 5.5.5.2.2 Nigeria

- 5.5.5.2.3 Egypt

- 5.5.5.2.4 Rest of Africa

- 5.5.5.1 Middle East

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Developments

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 International Paper Company

- 6.4.2 Smurfit WestRock

- 6.4.3 Mondi plc

- 6.4.4 Packaging Corporation of America

- 6.4.5 Stora Enso Oyj

- 6.4.6 Oji Holdings Corporation

- 6.4.7 Nippon Paper Industries Co., Ltd.

- 6.4.8 Rengo Co., Ltd.

- 6.4.9 Metsa Board Oyj

- 6.4.10 Graphic Packaging Holding Company

- 6.4.11 Cascades Inc.

- 6.4.12 Sonoco Products Company

- 6.4.13 Nine Dragons Paper (Holdings) Ltd.

- 6.4.14 Georgia-Pacific LLC

- 6.4.15 Klabin S.A.

- 6.4.16 Sappi Limited

- 6.4.17 Mayr-Melnhof Karton AG

- 6.4.18 Huhtamaki Oyj

- 6.4.19 Visy Industries Holdings Pty Ltd.

- 6.4.20 Seaboard Folding Box Company Inc.

- 6.4.21 Clearwater Paper Corporation

- 6.4.22 ITC Limited

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment