PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939164

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939164

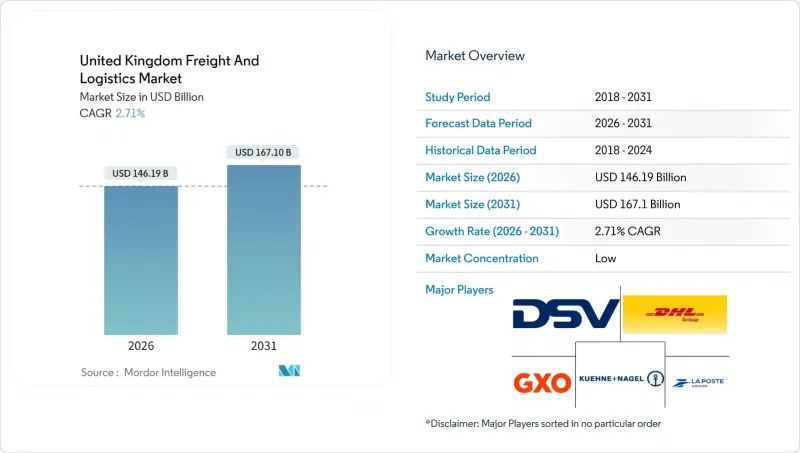

United Kingdom Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United Kingdom freight and logistics market is expected to grow from USD 142.33 billion in 2025 to USD 146.19 billion in 2026 and is forecast to reach USD 167.1 billion by 2031 at 2.71% CAGR over 2026-2031.

This steady trajectory reflects a mature yet adaptive sector that is reshaping itself around e-commerce fulfillment, manufacturing near-shoring, and digital customs processing. Parcel density gains in urban areas, automation of broker workflows, and infrastructure commitments at deep-sea ports are reinforcing throughput momentum, while an aging driver pool and geopolitical shipping shocks temper the growth curve. Balance across road, rail, sea, and air modes keeps the United Kingdom freight and logistics market resilient, even as Red Sea re-routing inflates inbound costs and lithium-battery insurance requirements complicate premium air cargo flows. Competitive intensity remains moderate, with recent blockbuster acquisitions indicating a shift toward scale, technology depth, and environmental compliance advantages.

United Kingdom Freight And Logistics Market Trends and Insights

E-Commerce Rebound Boosts Parcel Density

Robust U.K. online retail spending in 2025 is lifting parcel stops per route, which lowers per-delivery cost and improves same-day service economics. Amazon's exit from brick-and-mortar grocery and renewed focus on home delivery underline a digital-first mindset. Quick-commerce operators such as Co-op now reach 83% of households, while Gopuff's partnership with Morrisons repurposes daytime store capacity to dark-store operations. Dense origin-destination clusters in Greater London and Manchester have seen micro-fulfillment throughput rise 40-50% per square foot, encouraging further investment in urban sortation robotics. These density gains sustain the United Kingdom freight and logistics market by offsetting labor and fuel inflation and by anchoring scale for alternative-fuel fleets.

Manufacturing Near-Shoring Lifts Mid-Haul Volumes

Defense procurement, pharmaceuticals, and precision engineering are fueling a gradual relocation of supplier footprints from continental Europe back to the United Kingdom. Output from regional clusters in the North West and West Midlands is projected to rise 12% by 2033, adding mid-haul freight demand between industrial parks and export gateways. BAE Systems' new 96,000-square-foot facility in Sheffield exemplifies the shift, while 69% of manufacturers plan to deepen domestic sourcing. Consistent order flows smooth utilization on trunk routes, underpinning capacity investments by hauliers and rail-freight operators across the United Kingdom freight and logistics market.

Driver Workforce Ageing and Low Apprentice Intake

The median age of heavy-goods-vehicle operators has climbed past 55, while apprenticeship enrollments lag replacements by roughly 40%. Rising wage bills of 15-20% and tight certification windows push carriers toward autonomous-vehicle pilots and flexible shift scheduling. Scarcity is most pronounced in temperature-controlled and hazardous-materials niches, elevating operating risk across the United Kingdom freight and logistics market.

Other drivers and restraints analyzed in the detailed report include:

- Customs-Broker Automation Accelerates Digital Forwarding

- Growth in Online Grocery and Same-Day Delivery Scales Urban Micro-Fulfillment

- West-Coast Port Dredge Delays Strain Road Corridors

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing generated 36.85% of turnover in 2025, benefitting from pharmaceutical and aerospace clusters in the North West and South West. Domestic sourcing trends, with 69% of producers planning to add U.K. suppliers, anchor steady mid-haul volumes. Wholesale and Retail Trade, expanding at a 2.97% CAGR (2026-2031), reflects grocery e-commerce diffusion and omnichannel fulfillment.

The United Kingdom freight and logistics market share for Wholesale and Retail Trade is set to climb by 2 percentage points by 2031 as quick-commerce networks extend beyond London. Construction logistics ride public-sector infrastructure programs, while Oil, Gas, Mining, and Quarrying pivot to offshore wind and hydrogen pipelines. The "Others" bucket covers nascent verticals such as renewable-equipment logistics, reinforcing demand diversification across the United Kingdom freight and logistics market.

Freight Transport owned 63.02% of 2025 revenue in the United Kingdom freight and logistics market, leveraging seamless connectivity between ports, airports, and Midlands distribution hubs. Courier, Express, and Parcel services enjoy a 3.12% CAGR (2026-2031) on the back of higher parcel density and autonomous sortation rollouts. Active consolidation blurs traditional silos, with multi-service providers bundling transport, warehousing, and brokerage to win end-to-end contracts.

The United Kingdom freight and logistics market size for the Courier, Express, and Parcel segment is projected to reach USD 24.18 billion by 2031, supported by 24-hour delivery expectations. Warehousing and Storage gains from inventory-buffer strategies, while Freight Forwarding pivots on customs-automation economies. Specialized "Other Services", such as project cargo and reverse logistics, monetise the renewable-energy cycle and circular supply chains, showing resilience against macro-volatility.

The United Kingdom Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel, Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Advanced Supply Chain Group

- Americold (Including Americold Whitchurch)

- Ballyvesey Holdings, Ltd. (Including Montgomery Transport)

- CMA CGM Group (Including CEVA Logistics)

- Culina Group

- DACHSER

- Delamode Group (Formerly Xpediator PLC)

- DHL Group

- DP World (Including P&O Ferrymasters)

- DSV A/S (Including DB Schenker)

- Europa Worldwide Group

- Expeditors International of Washington, Inc.

- FedEx

- GBA Logistics

- Gregory Group

- GXO Logistics, Inc. (Including Wincanton PLC)

- Hellmann Worldwide Logistics

- Hoyer Group (Including Hoyer UK Ltd)

- Huboo

- Kinaxia Logistics Limited (Including Mark Thompson Transport)

- Kuehne+Nagel

- La Poste Group (Including DPD Group, and CitySprint (UK) Ltd.)

- Lineage, Inc.

- Maritime Group Ltd.

- Meachers Global Logistics

- Otto Group (Including Evri Limited)

- Owens Group

- Pall-Ex Group

- PD Ports (Owned by Brookfield Asset Management)

- Peel Ports Group

- Rhenus Group

- Samskip

- SITRA Group (Including Abbey Logistics Group)

- Solstor UK, Ltd.

- Swain Group

- Turners (Soham) Ltd.

- United Parcel Service of America, Inc. (UPS) (Including Coyote Logistics)

- W H Malcolm, Ltd.

- Walden Group (Including Moviantio)

- Whistl UK Ltd.

- XPO, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Rebound Boosts Parcel Density

- 4.25.2 Manufacturing Near-Shoring Lifts Mid-Haul Volumes

- 4.25.3 Customs-Broker Automation Accelerates Digital Forwarding

- 4.25.4 Growth in Online Grocery and Same-Day Delivery Scales Urban Micro-Fulfilment

- 4.25.5 Renewable-Energy Project-Cargo Surge

- 4.25.6 AI-Optimized Cold-Chain Capacity Gains

- 4.26 Market Restraints

- 4.26.1 Driver Workforce Ageing and Low Apprentice Intake

- 4.26.2 West-Coast Port Dredge Delays Strain Road Corridors

- 4.26.3 Red Sea Re-Routing Inflates UK Import Freight Rates

- 4.26.4 Lithium-Battery Insurance Hikes Curb Air-Freight Demand

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Buyers

- 4.28.3 Bargaining Power of Suppliers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 Advanced Supply Chain Group

- 6.4.2 Americold (Including Americold Whitchurch)

- 6.4.3 Ballyvesey Holdings, Ltd. (Including Montgomery Transport)

- 6.4.4 CMA CGM Group (Including CEVA Logistics)

- 6.4.5 Culina Group

- 6.4.6 DACHSER

- 6.4.7 Delamode Group (Formerly Xpediator PLC)

- 6.4.8 DHL Group

- 6.4.9 DP World (Including P&O Ferrymasters)

- 6.4.10 DSV A/S (Including DB Schenker)

- 6.4.11 Europa Worldwide Group

- 6.4.12 Expeditors International of Washington, Inc.

- 6.4.13 FedEx

- 6.4.14 GBA Logistics

- 6.4.15 Gregory Group

- 6.4.16 GXO Logistics, Inc. (Including Wincanton PLC)

- 6.4.17 Hellmann Worldwide Logistics

- 6.4.18 Hoyer Group (Including Hoyer UK Ltd)

- 6.4.19 Huboo

- 6.4.20 Kinaxia Logistics Limited (Including Mark Thompson Transport)

- 6.4.21 Kuehne+Nagel

- 6.4.22 La Poste Group (Including DPD Group, and CitySprint (UK) Ltd.)

- 6.4.23 Lineage, Inc.

- 6.4.24 Maritime Group Ltd.

- 6.4.25 Meachers Global Logistics

- 6.4.26 Otto Group (Including Evri Limited)

- 6.4.27 Owens Group

- 6.4.28 Pall-Ex Group

- 6.4.29 PD Ports (Owned by Brookfield Asset Management)

- 6.4.30 Peel Ports Group

- 6.4.31 Rhenus Group

- 6.4.32 Samskip

- 6.4.33 SITRA Group (Including Abbey Logistics Group)

- 6.4.34 Solstor UK, Ltd.

- 6.4.35 Swain Group

- 6.4.36 Turners (Soham) Ltd.

- 6.4.37 United Parcel Service of America, Inc. (UPS) (Including Coyote Logistics)

- 6.4.38 W H Malcolm, Ltd.

- 6.4.39 Walden Group (Including Moviantio)

- 6.4.40 Whistl UK Ltd.

- 6.4.41 XPO, Inc.

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment