PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939594

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939594

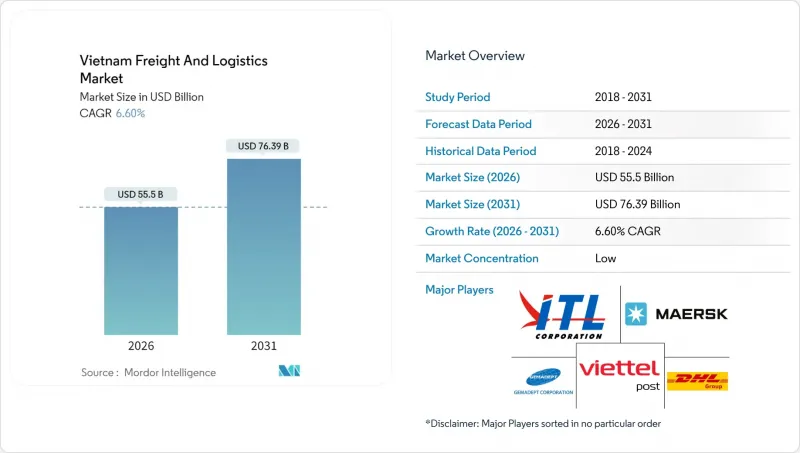

Vietnam Freight And Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Vietnam freight and logistics market is expected to grow from USD 52.06 billion in 2025 to USD 55.5 billion in 2026 and is forecast to reach USD 76.39 billion by 2031 at 6.6% CAGR over 2026-2031.

This trajectory reflects sustained manufacturing inflows, e-commerce parcel growth, and public spending of USD 15 billion on roads, ports, and airports. Structural tailwinds include near-shoring from China, ASEAN single-window customs digitalization, and rising demand for temperature-controlled distribution that together lift volumes across road, sea, and air corridors. Competitive intensity is sharpening as international integrators deepen local footprints while domestic operators scale through cold-chain and last-mile investments. The Vietnam freight and logistics market, therefore, benefits from a virtuous cycle of infrastructure, trade liberalization, and digital transformation that reduces dwell times and unlocks new service niches.

Vietnam Freight And Logistics Market Trends and Insights

E-commerce Parcel Boom Drives Last-Mile Innovation

Domestic parcel volumes jumped 45% in 2024 as online marketplaces proliferated and social-commerce blunted geographic constraints. The Vietnam freight and logistics market has seen courier networks deploy automated sorters and AI route engines that shrink average delivery windows from 48 to 24 hours. Yet fragmented last-mile networks mean per-parcel delivery costs remain 28% above Thailand, spurring providers to pool micro-hubs and leverage crowdsourced drivers to widen rural reach. Regulatory momentum adds tailwind: simplified clearance for parcels under USD 200 now cuts customs dwell from five days to one. Capital follows demand, with ViettelPost opening 15 robotic sort centers and Giao Hang Nhanh pledging commune-level coverage by 2025. These moves embed digital density that accelerates future volume scaling and entrenches CEP as the fastest-growing slice of the Vietnam freight and logistics market.

Near-Shoring Transforms Manufacturing Logistics

Electronics and apparel relocations from China lifted manufacturing logistics demand 28% in 2024 as global brands hedged geopolitical and cost risk. Northern clusters host high-value electronics flows that prefer airfreight; component uplift at Noi Bai Airport climbed 35% year-over-year, forcing capacity additions and slot reprioritization. Samsung's expansion alone requires 2,400 TEU moves monthly, while Foxconn and Luxshare each operate closed-loop corridors to export gateways. Apparel producers leverage road-sea combinations, redirecting lead times 40% shorter than legacy China lanes. Providers offering kitting, return-handling, and quality-control warehousing now command premium margins, signaling a shift from pure transport to integrated contract logistics within the Vietnam freight and logistics market.

Container Imbalance Creates Cost Pressures

An export-to-import ratio of 3:1 strands empties inland, raising average repositioning outlay to USD 85 per 20-foot box and USD 170 for 40-foot units. Container imbalance charges rose 25% in 2024 as availability dipped below 70% during peak coffee and textile seasons. Forwarders deploy tracking IoT tags and shared pools to lift utilization and shave 15-20% from separate carrier costs, yet structural trade asymmetry means headhaul surcharges are unlikely to abate quickly. The Vietnam freight and logistics market thus endures volatility that squeezes margins for SME shippers.

Other drivers and restraints analyzed in the detailed report include:

- ASEAN Single Window Accelerates Cross-Border Efficiency

- Cross-Border Road Freight Corridor Expansion

- Workforce Shortages Constrain Capacity Growth

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Manufacturing drove 35.12% of Vietnam freight and logistics market share in 2025, anchored by electronics and garment hubs that mandate precise inventory sync with overseas buyers. Tight cycle times spur RFID-enabled component kitting and postponement warehousing, raising third-party logistics penetration. Wholesale and retail trade is catching up, projected to rise 6.98% CAGR (2026-2031) as modern grocery, direct-to-consumer brands, and cross-border marketplaces widen SKUs and delivery nodes. Cold-chain protocols expand with seafood, fruit, and vaccines, where shipment failure costs far exceed logistics premiums and justify GDP-certified partners. Regulatory pushes for pharmaceutical traceability raise barriers, funneling demand toward players with validated processes, reinforcing consolidation trends inside the Vietnam freight and logistics market.

Traditional sectors such as agriculture and construction keep baseline tonnage but face modal substitution; barge and rail pilots in the Mekong Delta shift bulky rice and sand away from congested highways. Oil, gas, and mining logistics remain specialist, with higher safety compliance and charter-party complexity that reward niche forwarders.

Freight transport generated 64.12% of the Vietnam freight and logistics market size in 2025 as export manufacturing dictated bulk cargo flows. Yet courier, express, and parcel revenue is on course for a 7.52% CAGR (2026-2031), commandeering incremental share as social-commerce and cross-border shopping proliferate. The CEP surge pushes operators to automate hubs and integrate customs APIs, compressing cut-off-to-delivery cycles by half. Warehousing follows digital cues; temperature-controlled assets are set to grow at 7.89% CAGR (2026-2031), supported by aquaculture and vaccine supply chains. As blockchain bills of lading and IoT sensor networks become standard, service boundaries blur; freight transporters bundle real-time visibility and value-added packaging to secure margin against commoditization in the Vietnam freight and logistics market.

Continued freight-transport primacy masks intra-modal shifts. Road retains scale through 2031, but airfreight and express haulage capture discretionary shipments where velocity trumps cost. Digital freight platforms aggregate spot loads that raise truck utilization by 12%, attacking pain points of empty backhauls and manual paperwork. Integrated planning unlocks multimodal itineraries that blend road, sea, and rail, trimming CO2 and appealing to ESG-minded exporters.

The Vietnam Freight and Logistics Market Report is Segmented by End User Industry (Agriculture, Fishing, and Forestry, Construction, Manufacturing, Oil and Gas, Mining and Quarrying, Wholesale and Retail Trade, and Others) and by Logistics Function (Courier, Express, and Parcel (CEP), Freight Forwarding, Freight Transport, Warehousing and Storage, and Other Services). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- A.P. Moller - Maersk

- Aviation Logistics Corporation

- Bee Logistics Corporation

- DHL Group

- DSV A/S (Including DB Schenker)

- Expeditors International of Washington, Inc.

- FedEx

- Gemadept

- Giao Hang Nhanh

- Hai Minh Group

- Hop Nhat International Joint Stock Company

- Indo Trans Logistics Corporation

- Kuehne+Nagel

- MACS Maritime Joint Stock Company

- Noi Bai Express and Trading Joint Stock Company

- NYK (Nippon Yusen Kaisha) Line

- PetroVietnam Transportation Corporation (PVTrans)

- Phuong Trang Bus Joint Stock Company - FUTA Bus Lines

- Saigon Cargo Service Corporation (SCSC)

- Samsung SDS

- Sojitz Corporation

- Transimex

- U&I Logistics Corporation

- United Parcel Service of America, Inc. (UPS)

- Vietfracht HoChiMinh

- Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- Vietnam Maritime Corporation (Vinalines)

- ViettelPost (Including Viettel Logistics)

- Voltrans Logistics

- ZIM Integrated Shipping Services, Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Demographics

- 4.3 GDP Distribution by Economic Activity

- 4.4 GDP Growth by Economic Activity

- 4.5 Inflation

- 4.6 Economic Performance and Profile

- 4.6.1 Trends in E-Commerce Industry

- 4.6.2 Trends in Manufacturing Industry

- 4.7 Transport and Storage Sector GDP

- 4.8 Export Trends

- 4.9 Import Trends

- 4.10 Fuel Price

- 4.11 Trucking Operational Costs

- 4.12 Trucking Fleet Size by Type

- 4.13 Major Truck Suppliers

- 4.14 Logistics Performance

- 4.15 Modal Share

- 4.16 Maritime Fleet Load Carrying Capacity

- 4.17 Liner Shipping Connectivity

- 4.18 Port Calls and Performance

- 4.19 Freight Pricing Trends

- 4.20 Freight Tonnage Trends

- 4.21 Infrastructure

- 4.22 Regulatory Framework (Road and Rail)

- 4.23 Regulatory Framework (Sea and Air)

- 4.24 Value Chain and Distribution Channel Analysis

- 4.25 Market Drivers

- 4.25.1 E-Commerce Parcel Boom (B2C and C2C)

- 4.25.2 Near-Shoring of Electronics and Apparel Production into Vietnam

- 4.25.3 ASEAN "Single Window" Customs Digitalisation

- 4.25.4 Surge in Cross-Border Road Freight to China-Laos-Cambodia

- 4.25.5 Renewable-Energy Component Imports (Wind-Turbine Blades, Solar)

- 4.25.6 Cold-Chain Demand for Aquaculture Exports and Vaccine Logistics

- 4.26 Market Restraints

- 4.26.1 Domestic Container Imbalance and Empty-Repositioning Costs

- 4.26.2 Truck Driver Shortages and Ageing Workforce

- 4.26.3 Fragmented Last-Mile Network Driving High Mile-Per-Stop Cost

- 4.26.4 Increasing Carbon-Emission Compliance Costs (ETS-Style)

- 4.27 Technology Innovations in the Market

- 4.28 Porter's Five Forces Analysis

- 4.28.1 Threat of New Entrants

- 4.28.2 Bargaining Power of Suppliers

- 4.28.3 Bargaining Power of Buyers

- 4.28.4 Threat of Substitutes

- 4.28.5 Competitive Rivalry

5 Market Size and Growth Forecasts (Value, USD)

- 5.1 End User Industry

- 5.1.1 Agriculture, Fishing, and Forestry

- 5.1.2 Construction

- 5.1.3 Manufacturing

- 5.1.4 Oil and Gas, Mining and Quarrying

- 5.1.5 Wholesale and Retail Trade

- 5.1.6 Others

- 5.2 Logistics Function

- 5.2.1 Courier, Express, and Parcel (CEP)

- 5.2.1.1 By Destination Type

- 5.2.1.1.1 Domestic

- 5.2.1.1.2 International

- 5.2.1.1 By Destination Type

- 5.2.2 Freight Forwarding

- 5.2.2.1 By Mode of Transport

- 5.2.2.1.1 Air

- 5.2.2.1.2 Sea and Inland Waterways

- 5.2.2.1.3 Others

- 5.2.2.1 By Mode of Transport

- 5.2.3 Freight Transport

- 5.2.3.1 By Mode of Transport

- 5.2.3.1.1 Air

- 5.2.3.1.2 Pipelines

- 5.2.3.1.3 Rail

- 5.2.3.1.4 Road

- 5.2.3.1.5 Sea and Inland Waterways

- 5.2.3.1 By Mode of Transport

- 5.2.4 Warehousing and Storage

- 5.2.4.1 By Temperature Control

- 5.2.4.1.1 Non-Temperature Controlled

- 5.2.4.1.2 Temperature Controlled

- 5.2.4.1 By Temperature Control

- 5.2.5 Other Services

- 5.2.1 Courier, Express, and Parcel (CEP)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Key Strategic Move

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, and Recent Developments)

- 6.4.1 A.P. Moller - Maersk

- 6.4.2 Aviation Logistics Corporation

- 6.4.3 Bee Logistics Corporation

- 6.4.4 DHL Group

- 6.4.5 DSV A/S (Including DB Schenker)

- 6.4.6 Expeditors International of Washington, Inc.

- 6.4.7 FedEx

- 6.4.8 Gemadept

- 6.4.9 Giao Hang Nhanh

- 6.4.10 Hai Minh Group

- 6.4.11 Hop Nhat International Joint Stock Company

- 6.4.12 Indo Trans Logistics Corporation

- 6.4.13 Kuehne+Nagel

- 6.4.14 MACS Maritime Joint Stock Company

- 6.4.15 Noi Bai Express and Trading Joint Stock Company

- 6.4.16 NYK (Nippon Yusen Kaisha) Line

- 6.4.17 PetroVietnam Transportation Corporation (PVTrans)

- 6.4.18 Phuong Trang Bus Joint Stock Company - FUTA Bus Lines

- 6.4.19 Saigon Cargo Service Corporation (SCSC)

- 6.4.20 Samsung SDS

- 6.4.21 Sojitz Corporation

- 6.4.22 Transimex

- 6.4.23 U&I Logistics Corporation

- 6.4.24 United Parcel Service of America, Inc. (UPS)

- 6.4.25 Vietfracht HoChiMinh

- 6.4.26 Vietnam Foreign Trade Logistics Joint Stock Company (VINATRANS)

- 6.4.27 Vietnam Maritime Corporation (Vinalines)

- 6.4.28 ViettelPost (Including Viettel Logistics)

- 6.4.29 Voltrans Logistics

- 6.4.30 ZIM Integrated Shipping Services, Ltd.

7 Market Opportunities and Future Outlook

- 7.1 White-Space and Unmet-Need Assessment