PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940718

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940718

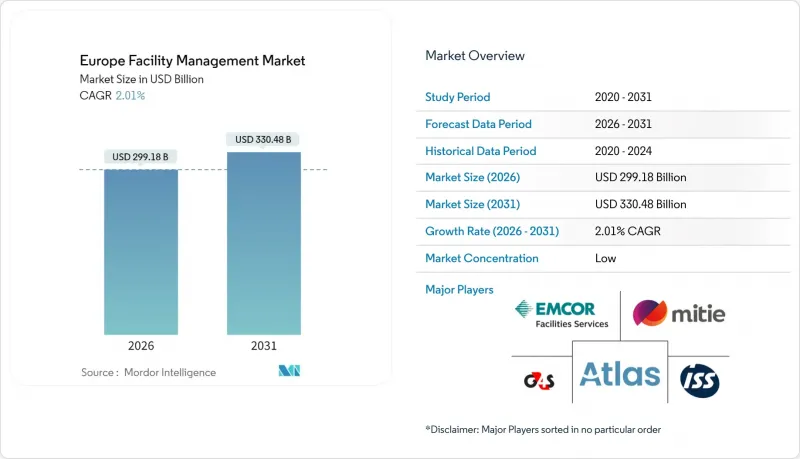

Europe Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

European Facility Management Market size in 2026 is estimated at USD 299.18 billion, growing from 2025 value of USD 293.28 billion with 2031 projections showing USD 330.48 billion, growing at 2.01% CAGR over 2026-2031.

A steady expansion reflects the sector's shift from cost-driven maintenance toward data-enabled performance services, tighter energy-efficiency mandates, and widening public-sector outsourcing. Hard services remain the industry's anchor as ageing building systems require intensive mechanical, electrical, and plumbing care, while soft services accelerate on the back of health, wellness, and experience-oriented workplaces. Rising energy prices since the Russia-Ukraine conflict have pushed clients to favor optimization contracts over time-and-materials tasks. Outsourcing gains scale as ESG reporting rules and digital-technology complexity demand specialized know-how. Private-equity interest, typified by Techem's USD 7.2 billion transaction, underlines confidence in the segment's recurring-revenue profile.

Europe Facility Management Market Trends and Insights

Aging Building Stock: Retrofit-Driven FM Spending

Three-quarters of the European building stock is more than 50 years old, creating sustained demand for comprehensive retrofit programmes that bundle technical maintenance with energy upgrades. Performance-contract models such as Centrica's 15-year deal at St George's University Hospitals, which cuts 6,000 tonnes of carbon and saves USD 1.1 million annually, illustrate the financial viability of retrofit-oriented facility services. German and French portfolios face the greatest urgency as Nearly-Zero-Energy Building standards tighten, pushing facility managers to integrate IoT sensors, predictive maintenance, and energy-performance analytics during refurbishments. The European Investment Bank estimates a EUR 185 billion yearly funding gap for energy efficiency, positioning facility service providers as key intermediaries for capital access.

Public-Sector Outsourcing Momentum Post-Fiscal Austerity

Government departments are transferring multi-service bundles to external providers to meet efficiency targets and ESG disclosure obligations. The UK Department for Work and Pensions awarded ISS a seven-year contract worth USD 175 million per year, consolidating cleaning, catering, and technical maintenance under one roof. Nordic and German municipalities follow suit, evidenced by VINCI Facilities' decade-long framework with Lincolnshire County Council that prioritises collaborative energy management. Health-care estates are prominent adopters as 24/7 operations, infection control, and high-energy HVAC loads demand specialist support.

Economic Pressures (Inflation, Cost Optimisation)

Rising labour, material, and energy inputs prompt clients to renegotiate contracts, curbing discretionary FM spend. CBRE notes that while 35% of organisations raised FM budgets in 2023, 29% still listed supply-chain disruption as the top threat. Sodexo's European business recorded only 2.1% organic growth for the first half of fiscal 2025 as healthcare clients delayed tenders. Margin pressure is acute in Southern and Eastern Europe, where price sensitivity drives commoditisation.

Other drivers and restraints analyzed in the detailed report include:

- Energy Price Volatility Accelerating Energy-Optimisation Services

- ESG Reporting Mandates Requiring Data-Driven Solutions

- Fragmented EU Regulatory Regimes Hindering Standardised Delivery

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services hold 61.05% of the European facility management market in 2025, underlining the necessity of MEP, HVAC, and fire-safety upkeep across an ageing building base. Persistent retrofit activity keeps the European facility management market size for hard services expanding despite moderate industry growth. Predictive asset management gains traction as clients look to extend equipment life cycles and comply with energy-use regulations.

Soft services, though smaller, deliver a 4.61% forecast CAGR as employee-experience strategies prioritise advanced cleaning, concierge, and security packages. Hybrid work drives demand for space booking, flexible catering, and touchless access control, threading technology through traditional frontline functions. Integration opportunities arise where soft-service data, such as footfall analytics, feed back into energy algorithms, further embedding providers in client operational planning.

Europe Facility Management Market is Segmented by Service Type (Hard Services and Soft Services), Offering Type (In-House and Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, and Other End-User Industries), and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Mitie Group PLC

- Emcor Facilities Services WLL

- Atlas FM Ltd.

- G4S Facilities Management UK Ltd.

- ISS Global

- Engie FM Ltd. (Cofely AG)

- Andron Facilities Management

- Apleona GmbH

- Dussmann Group

- Vinci Facilities Ltd.

- Okin Group

- Aramark Corporation

- CBRE Group Inc.

- Assured Europe

- Jones Lang LaSalle Inc.

- Sodexo SA

- Johnson Controls International plc

- Bouygues Energies and Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates in Europe Commercial Real Estate

- 4.1.2 Profitability Benchmarks of Major FM Providers

- 4.1.3 Workforce Indicators - Skilled and Unskilled Labor Participation

- 4.1.4 Facility Management Market Share (%) by Service Type

- 4.1.5 Facility Management Market Share (%) by Hard Services

- 4.1.6 Facility Management Market Share (%) by Soft Services

- 4.1.7 Urbanization and Population Growth in Top Metro Areas

- 4.1.8 Sector Investment Priorities in Europe Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.1.10 EU Green Deal Energy-Efficiency Targets Impact on FM Demand

- 4.1.11 Technology Integration: IoT and AI Transforming Service Delivery

- 4.1.12 Changing Workplace Dynamics: Hybrid Work Reshaping FM Priorities

- 4.2 Market Drivers

- 4.2.1 Aging Building Stock: Retrofit-Driven FM Spending

- 4.2.2 Public Sector Outsourcing Momentum Post-Fiscal Austerity

- 4.2.3 Energy Price Volatility Accelerating Energy-Optimization FM Services

- 4.2.4 ESG Reporting Mandates Requiring Data-Driven FM Solutions

- 4.2.5 Post-Pandemic Health and Safety Certification Demand

- 4.2.6 Private Equity Consolidation Driving Integrated FM Adoption

- 4.3 Market Restraint

- 4.3.1 Economic Pressures (Inflation, Cost Optimisation)

- 4.3.2 Fragmented EU Regulatory Regimes Hindering Standardised Delivery

- 4.3.3 Limited PropTech Interoperability Increasing Integration Costs

- 4.3.4 Cybersecurity Risks to Connected Building Systems

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUES)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Slovenia

- 5.4.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Mitie Group PLC

- 6.4.2 Emcor Facilities Services WLL

- 6.4.3 Atlas FM Ltd.

- 6.4.4 G4S Facilities Management UK Ltd.

- 6.4.5 ISS Global

- 6.4.6 Engie FM Ltd. (Cofely AG)

- 6.4.7 Andron Facilities Management

- 6.4.8 Apleona GmbH

- 6.4.9 Dussmann Group

- 6.4.10 Vinci Facilities Ltd.

- 6.4.11 Okin Group

- 6.4.12 Aramark Corporation

- 6.4.13 CBRE Group Inc.

- 6.4.14 Assured Europe

- 6.4.15 Jones Lang LaSalle Inc.

- 6.4.16 Sodexo SA

- 6.4.17 Johnson Controls International plc

- 6.4.18 Bouygues Energies and Services

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)