PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940780

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940780

Asia Pacific Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

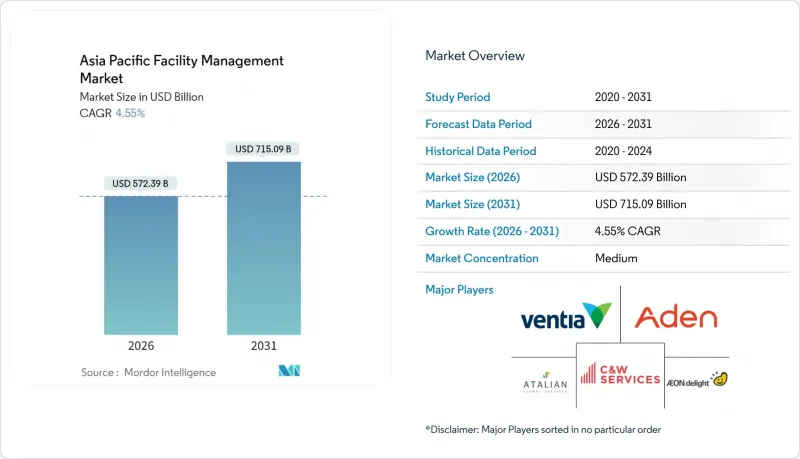

The Asia Pacific facility management market was valued at USD 547.48 billion in 2025 and estimated to grow from USD 572.39 billion in 2026 to reach USD 715.09 billion by 2031, at a CAGR of 4.55% during the forecast period (2026-2031).

Regional demand is anchored in stricter ESG compliance, rapid data-center roll-outs, and the uptake of AI-enabled building operating systems. Hard services continue to dominate spend, yet soft services are gaining momentum as occupiers elevate workplace experience and security priorities. Outsourcing grows steadily on the back of rising operational complexity, while macro headwinds such as supply-chain cost inflation and uneven regulation temper near-term expansion.

Asia Pacific Facility Management Market Trends and Insights

Rising Outsourcing in Building Management

Corporate real-estate teams are shifting from fragmented in-house models toward integrated outsourcing to access specialized regulatory, digital, and sustainability expertise. CBRE reported 16% year-on-year net-revenue growth in its facilities-management segment for Q1 2025, with technology, healthcare, and life-science clients as primary contributors. Integrated service contracts simplify vendor management and link performance to measurable outcomes, with the five-year renewal of ISS's global agreement with Barclays illustrating the appeal of bundled, cross-regional delivery. Outsourcing uptake is especially strong in labor-constrained markets such as Japan and Singapore, where aging workforces elevate the value of external technical specialists. Local providers that demonstrate compliance credentials and digitally traceable service quality are gaining competitive advantages. Over the medium term, outsourcing penetration is expected to climb as digital platforms enable transparent cost benchmarking and support pay-for-performance pricing models.

Heightened Safety and Security Needs

Governments are tightening workplace-safety statutes, compelling occupiers to upgrade monitoring and training protocols. Singapore's 2025 regulations on machinery and combustible dust have raised compliance thresholds, driving demand for specialist facility partners versed in real-time risk analytics. AI-enabled devices such as hybrid floor-wetness sensors that detect spills or condensation are moving from pilot to mainstream deployment, as demonstrated by UnaBiz Singapore's 2024 launch.Multisite corporates require unified dashboards that normalize data across jurisdictions while honoring local reporting rules. Providers with mature digital safety suites can deliver predictive incident prevention, lowering insurance premiums and downtime costs. The heightened focus on employee well-being fuels incremental spend on access control, indoor-air quality sensors, and smart-evacuation systems across dense urban campuses.

High Implementation Costs

Up-front capital for smart-building hardware, software licenses, and compliance upgrades can exceed USD 300,000 for a mid-size property, creating adoption hurdles for small and mid-tier owners. Inflation in equipment and labor costs further stretches payback timelines, even though pilot projects regularly demonstrate double-digit energy reductions. Manufacturers integrating IoT-based predictive maintenance still face recovery periods of two to three years, as illustrated by Azbil Corporation's deployment at PT. Aspex Kumbong in Indonesia. Many occupiers sequence implementations in phases to manage cash flow, but partial roll-outs limit the synergy gains of fully integrated platforms. Providers that structure outcome-based pricing or equipment-as-a-service models can mitigate the barrier, yet balance-sheet limitations among regional SMEs keep cost as the most immediate drag on market expansion.

Other drivers and restraints analyzed in the detailed report include:

- Technological Advancements in Facility Management

- ESG-Driven Green Building Certification Adoption

- Fragmented Regulatory Standards Across Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Soft services generated faster expansion, recording a 6.05% CAGR through 2031 as employers elevate employee-experience metrics and deploy AI-assisted security, concierge, and cleaning solutions. The Asia Pacific facility management market size for soft services is benefiting from the rollout of robotics for routine cleaning and the integration of occupancy analytics into help-desk applications. Contactless visitor management and AI-based surveillance systems now form mandatory bid requirements in high-grade offices across Singapore, Tokyo, and Sydney. In parallel, advanced catering platforms that link dietary analytics to procurement systems are gaining popularity in corporate campuses looking to meet wellness commitments.

Hard services retained 55.72% revenue share in 2025, supported by critical infrastructure maintenance including MEP, HVAC, and fire-safety systems. Predictive analytics adds new value layers: the Asia Pacific facility management market share for MEP providers is reinforced by use cases such as Yamaha Motor's robotic automation, which has cut factory labor costs by 60%. AI-optimized chillers, exemplified by the St. Regis Bangkok pilot, showcase measurable 9% energy savings and extend equipment life cycles, drawing interest from both owners and energy-service companies. Fire-system vendors are bundling IoT sensors with cloud dashboards to transition from inspection-based models to real-time risk mitigation.

Asia-Pacific Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, and More), and Geography (China, India, Japan, Korea, Indonesia, Thailand, Rest of Asia-Pacific). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Aden Group

- Aeon Delight Co. Ltd (AEON Co. Ltd)

- ATALIAN Global Services

- Broadspectrum (Ventia)

- CBRE Group Inc.

- C&W Facility Services Inc.

- Commercial Building Maintenance Corp.

- CPG Corporation

- Cushman & Wakefield plc

- DTSS Facility Services

- EMCOR Group Inc.

- G4S Facilities Management

- ISS Facility Services

- Jones Lang LaSalle (JLL)

- OCS Group International Ltd.

- Sodexo S.A.

- UEMS Solutions

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%) by Service Type

- 4.1.5 Facility Management Market Share (%) by Hard Services

- 4.1.6 Facility Management Market Share (%) by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in Asia Pacific Infrastructure Pipeline

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Market Driver

- 4.2.1 Rising Outsourcing in Building Management

- 4.2.2 Heightened Safety and Security Needs

- 4.2.3 Technological Advancements in Facility Management

- 4.2.4 ESG-Driven Green Building Certification Adoption

- 4.2.5 Expansion of Data Centre Construction Across Asia-Pacific

- 4.2.6 Proliferation of Life-Sciences and Healthcare Facilities Requiring Specialized FM Services

- 4.3 Market Restraint

- 4.3.1 High Implementation Costs

- 4.3.2 Fragmented Regulatory Standards Across Countries

- 4.3.3 Low Digital Maturity Among Traditional FM Clients

- 4.3.4 Short FM Contract Tenures Limiting Long-Term Investment Payback

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

- 5.4 By Country

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Korea

- 5.4.5 Indonesia

- 5.4.6 Thailand

- 5.4.7 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Aden Group

- 6.4.2 Aeon Delight Co. Ltd (AEON Co. Ltd)

- 6.4.3 ATALIAN Global Services

- 6.4.4 Broadspectrum (Ventia)

- 6.4.5 CBRE Group Inc.

- 6.4.6 C&W Facility Services Inc.

- 6.4.7 Commercial Building Maintenance Corp.

- 6.4.8 CPG Corporation

- 6.4.9 Cushman & Wakefield plc

- 6.4.10 DTSS Facility Services

- 6.4.11 EMCOR Group Inc.

- 6.4.12 G4S Facilities Management

- 6.4.13 ISS Facility Services

- 6.4.14 Jones Lang LaSalle (JLL)

- 6.4.15 OCS Group International Ltd.

- 6.4.16 Sodexo S.A.

- 6.4.17 UEMS Solutions

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)