PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940763

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940763

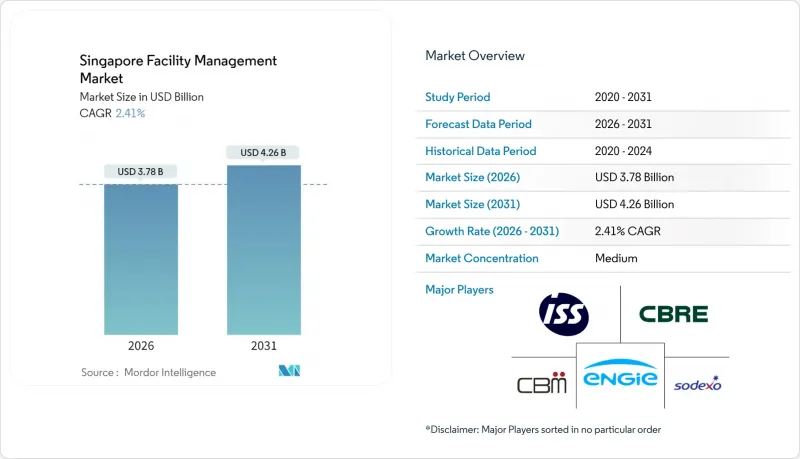

Singapore Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Singapore facility management market was valued at USD 3.69 billion in 2025 and estimated to grow from USD 3.78 billion in 2026 to reach USD 4.26 billion by 2031, at a CAGR of 2.41% during the forecast period (2026-2031).

Growth is steady rather than explosive because Singapore's built environment is already well-developed, so demand pivots toward smarter service delivery instead of new square footage. Widespread deployment of IoT sensors, cloud dashboards, and data-driven workflows under the Smart Nation program is reshaping service contracts, nudging customers toward longer-tenure, outcome-based agreements. Tighter foreign-worker quotas and escalating wages continue to push automation, while mandatory BCA Green Mark Plus rules accelerate investment in energy-efficient retrofits. Competition is shifting from price-led bidding to technology-rich value propositions as clients expect seamless hard and soft service integration with guaranteed key-performance outcomes.

Singapore Facility Management Market Trends and Insights

Outsourcing of Non-core Operations Accelerating

Organizations are handing off building operations so they can focus on core revenue drivers. Since May 2020, every public-sector contract for security has had to comply with Security Outcome-Based Contracting, forcing bidders to prove technology capabilities rather than supply headcount. CapitaLand Integrated Commercial Trust illustrates how extensive outsourcing can become: property management for its USD 17.9 billion portfolio is handled by specialist subsidiaries that run leasing, engineering, and sustainability programs end-to-end. Access to advanced analytics, computer-vision patrols, and predictive maintenance tools that would be cost-prohibitive to build in-house further strengthens the outsourcing rationale. As environmental disclosure rules tighten, clients also rely on external FM partners for carbon-reporting expertise. Collectively, these dynamics raise the bar for service providers while expanding contract scope and duration within the Singapore facility management market.

Infrastructure Boom in MRT-Linked Districts

Singapore is adding entire rail corridors, each embedding long-term O&M obligations. The Land Transport Authority's USD 355.2 million Maju station civil package for Cross Island Line Phase 2 and the nine-year Jurong Region Line operating license awarded to the SBS Transit and RATP Dev consortium require AI-driven condition monitoring from day one. Asset owners, therefore, lock in integrated FM partners early, guaranteeing multi-decade revenue streams for vendors proficient in track-side facilities, station utilities, and crowd-flow analytics. Knock-on effects spread to retail podiums, office towers, and residential projects clustered around new stations, all of which demand unified building systems to ensure a frictionless commuter experience. This rail-centric development model underpins service line diversification and regional spillover growth for the Singapore facility management market.

Highly Fragmented Local Vendor Base

Hundreds of micro-scale cleaning and security firms make contract administration cumbersome. Each additional subcontractor adds onboarding time, cybersecurity exposure, and interface risk, prompting large owners to consolidate suppliers. BCA now offers competency-based accreditations, but public-agency acceptance remains partial. Until aggregation or certification gains speed, disparate standards will temper efficiency gains in the Singapore facility management market.

Other drivers and restraints analyzed in the detailed report include:

- Mandatory BCA Green Mark Plus Compliance

- Ageing Commercial Stock Requiring Lifecycle Upgrades

- Tight Foreign-Worker Quotas and Rising Labour Costs

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services represented 53.62% of 2025 revenue within the Singapore facility management market share because mechanical, electrical, and plumbing systems must operate flawlessly in a humid tropical climate. Regulatory obligations for fire-safety certifications and lift-maintenance logs sustain baseline demand. Momentum toward predictive analytics is palpable, exemplified by the Green Mark chiller portal that digests vibration and temperature data to prevent downtime. Clients increasingly value lifecycle-cost optimization over reactive fixes, prompting bundled hard-FM contracts with outcome guarantees.

Soft services are expanding at 2.99% CAGR as outcome-based contracting decouples pricing from headcount. Security Outcome-Based Contracting compels guards to use drones, video analytics, and incident-reporting apps, redefining manpower deployment. Cleaning vendors adopt real-time quality sensors, while tenant-engagement apps coordinate catering and concierge tasks. Although soft services still trail hard services in absolute value, their technology-enabled rebound illustrates how the Singapore facility management market evolves from labour-intensive routines to data-validated experiences.

Outsourcing held 62.98% of the Singapore facility management market size in 2025 because clients prefer one-stop specialists for compliance, warranty management, and sustainability reporting. Integrated FM contracts that fuse engineering, environmental, and hospitality tasks gain traction, with CapitaLand bundling leasing, technical, and ESG services under single-vendor accountability. Automated ticketing platforms and SLA dashboards lock in performance transparency, which owners increasingly treat as a risk-transfer mechanism.

In-house delivery, though just 37.02% in 2025, is forecast to grow 3.88% CAGR as data-center operators and government agencies seek tighter control over cybersecurity and critical systems. BCA Academy's new smart-building curricula underpin this shift by supplying certified engineers versed in digital twins, IoT cybersecurity, and fault diagnostics. Hybrid models are also emerging where owners retain analytics and strategy while outsourcing boots-on-ground execution, reflecting nuanced demand patterns in the Singapore facility management market.

The Singapore Facility Management Market Report is Segmented by Service Type (Hard Services, and Soft Services), Offering Type (In-House, and Outsourced [Single FM, Bundled FM, and Integrated FM]), End-User Industry (Commercial/Retail/Restaurants, Manufacturing/Industrial, and More), Facility Type (Commercial Buildings, Industrial Facilities, and More), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Abacus Property Management Pte. Ltd.

- ACMS Facilities Management Pte. Ltd.

- CBM Pte. Ltd.

- CBRE Group, Inc.

- Certis CISCO Security Pte. Ltd.

- Compass Group PLC

- Cushman and Wakefield PLC

- ENGIE Services Singapore Pte. Ltd.

- Exceltec Property Management Pte. Ltd.

- ISS A/S

- Jones Lang LaSalle Incorporated

- OCS Group International Limited

- Savills (Singapore) Pte. Ltd.

- Serco Group PLC

- Sodexo Singapore Pte. Ltd.

- United Tec Engineering Pte. Ltd.

- UTiZ Facilities Management Services Pte. Ltd.

- Vinci Facilities S.A.S.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Outsourcing of Non-core Operations Accelerating

- 4.2.2 Infrastructure Boom in MRT-Linked Districts

- 4.2.3 Mandatory BCA Green Mark Plus Compliance

- 4.2.4 Ageing Commercial Stock Requiring Lifecycle Upgrades

- 4.2.5 Smart Estates under Singapore Smart Nation Drive

- 4.2.6 Integrated Facilities Contracts in Public Healthcare

- 4.3 Market Restraints

- 4.3.1 Highly Fragmented Local Vendor Base

- 4.3.2 Tight Foreign-Worker Quotas and Rising Labour Costs

- 4.3.3 Complex Tender Regulations for Government Sites

- 4.3.4 Limited Scalability in Island-State Geography

- 4.4 Industry Value-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Impact of Macroeconomic Factors

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Products and Services

- 4.8.5 Intensity of Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-User Industry

- 5.3.1 Commercial, Retail and Restaurants

- 5.3.2 Manufacturing and Industrial

- 5.3.3 Government, Infrastructure and Public Entities

- 5.3.4 Institutional

- 5.3.5 Other End-user Industries

- 5.4 By Facility Type

- 5.4.1 Commercial Buildings

- 5.4.2 Industrial Facilities

- 5.4.3 Public Infrastructure

- 5.4.4 Institutional Buildings

- 5.4.5 Other Facility Types

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Abacus Property Management Pte. Ltd.

- 6.4.2 ACMS Facilities Management Pte. Ltd.

- 6.4.3 CBM Pte. Ltd.

- 6.4.4 CBRE Group, Inc.

- 6.4.5 Certis CISCO Security Pte. Ltd.

- 6.4.6 Compass Group PLC

- 6.4.7 Cushman and Wakefield PLC

- 6.4.8 ENGIE Services Singapore Pte. Ltd.

- 6.4.9 Exceltec Property Management Pte. Ltd.

- 6.4.10 ISS A/S

- 6.4.11 Jones Lang LaSalle Incorporated

- 6.4.12 OCS Group International Limited

- 6.4.13 Savills (Singapore) Pte. Ltd.

- 6.4.14 Serco Group PLC

- 6.4.15 Sodexo Singapore Pte. Ltd.

- 6.4.16 United Tec Engineering Pte. Ltd.

- 6.4.17 UTiZ Facilities Management Services Pte. Ltd.

- 6.4.18 Vinci Facilities S.A.S.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-need Assessment