PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940796

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940796

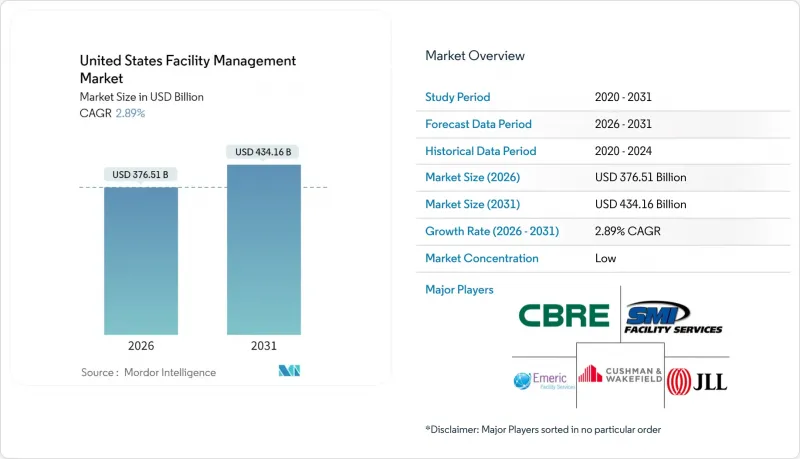

United States Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The United States facility management market was valued at USD 365.93 billion in 2025 and estimated to grow from USD 376.51 billion in 2026 to reach USD 434.16 billion by 2031, at a CAGR of 2.89% during the forecast period (2026-2031).

Commercial real-estate vacancy at 14.1% in office assets contrasts with robust industrial absorption, shaping divergent demand for services. Hard services hold sway because organizations cannot postpone HVAC, fire-safety or infrastructure upkeep, yet soft services gain ground as post-pandemic workplaces demand heightened security and wellness protocols. Regulation is equally decisive; the Inflation Reduction Act allocates USD 975 million to federal building upgrades, accelerating demand for energy-efficient retrofits. Technology integration-from IoT sensors to AI-based predictive maintenance-reshapes operating models by cutting downtime and optimizing utilities.

United States Facility Management Market Trends and Insights

Urbanization and Population Growth in Major Metros

Sun Belt hubs such as Austin and Phoenix continue to attract businesses and residents, increasing demand for both new facilities and retrofits that incorporate smart-building platforms. Facility managers in these markets must juggle advanced automation with legacy infrastructure across mixed portfolios. Knowledge-economy tenants emphasize flexible spaces, pushing service providers to offer real-time occupancy analytics. Climate resilience has become integral after successive extreme-weather events, intensifying requirements for emergency maintenance planning. These combined pressures elevate service complexity and costs.

Sector Investment Priorities in United States Infrastructure Bills

Federal outlays direct USD 975 million to upgrade 40 million sq ft of public buildings, anchoring a spill-over of similar standards at state level. Buy-American and prevailing-wage clauses inflate labor costs, compelling facility managers to refine procurement and workforce strategies. Grid-modernization spending adds responsibilities for EV-charger upkeep and energy-storage integration. Compliance tracking now factors prominently into FM contracts as owners seek assurance of bill eligibility. Thus, public spending shapes private service design.

Profitability Rates of Major FM Players

Operating expenses exceeded revenue growth in 2024, shrinking margins and constraining tech investment. ABM Industries posted 3.3% revenue expansion but faced wage and utility inflation that eroded gains. Fragmented competition limits pricing power, especially for costly cyber-security and regulatory services. Elevated electricity now equals 58.9% of utility spend, forcing either pass-through pricing or service downgrades. The squeeze pushes small providers toward consolidation or niche specialization.

Other drivers and restraints analyzed in the detailed report include:

- Regulatory Drivers Specific to Labour and Safety Standards

- Technology-Led Integrated FM (IoT, BMS, AI-Based Predictive Maintenance)

- Workforce Indicators - Labor Participation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Hard services controlled 58.45% of the United States facility management market in 2025 as clients prioritized non-discretionary asset upkeep. Predictive maintenance tools and IoT sensors are turning legacy MEP tasks into data-driven routines that curb unplanned downtime. Compliance with ever-tighter fire-safety and energy codes bolsters demand even amid cost pressures. The United States facility management market size for hard services will continue to edge upward given regulation-driven upgrades. Soft services, expanding at a 3.74% CAGR, now bundle AI-enabled surveillance, infection-control cleaning, and flexible catering models aligning with hybrid work.

Soft-service providers differentiate through ESG-aligned cleaning chemicals and real-time occupancy data that right-size staffing. Security contracts increasingly incorporate cyber-physical monitoring of access-control devices. As post-pandemic employee-experience initiatives endure, workplace support offerings gain relevance. However, labour shortages inflate wages, challenging profitability. The ecosystem thus evolves around integrated platforms that merge hard-asset health with occupant wellness metrics across the broader United States facility management market.

The United States Facility Management Market Report is Segmented by Service Type (Hard Services, Soft Services), Offering Type (In-House, Outsourced), End-User Industry (Commercial, Hospitality, Institutional and Public Infrastructure, Healthcare, Industrial and Process, and More), and Geography (Northeast, Southeast, Midwest, Southwest, West). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- ABM Industries

- Emcor Group Inc.

- CBRE Group Inc.

- Jones Lang LaSalle IP, Inc.

- Cushman & Wakefield PLC

- Sodexo Inc.

- ISS Facility Services Inc.

- GDI Integrated Facility Services

- Kellermeyer Bergensons Services

- Guardian Service Industries Inc.

- AHI Facility Services Inc.

- Emeric Facility Services

- SMI Facility Services

- Shine Management and Facility Services

- Haworth Inc.

- Servicon Systems Inc.

- UG2 Facility Services

- Alpine Building Maintenance

- Aramark

- Broadway Building Services

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.1.1 Current Occupancy Rates

- 4.1.2 Profitability Rates of Major FM Players

- 4.1.3 Workforce Indicators - Labor Participation

- 4.1.4 Facility Management Market Share (%) - by Service Type

- 4.1.5 Facility Management Market Share (%) - by Hard Services

- 4.1.6 Facility Management Market Share (%) - by Soft Services

- 4.1.7 Urbanization and Population Growth in Major Metros

- 4.1.8 Sector Investment Priorities in US Infrastructure Bills

- 4.1.9 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2 Drivers

- 4.2.1 Urbanization and Population Growth in Major Metros

- 4.2.2 Sector Investment Priorities in US Infrastructure Bills

- 4.2.3 Regulatory Drivers Specific to Labour and Safety Standards

- 4.2.4 Technology-Led Integrated FM (IoT, BMS, AI-Based Predictive Maintenance)

- 4.2.5 Building Performance Standards Mandates Driving Retro-Commissioning Services

- 4.2.6 Inflation Reduction Act Tax Incentives Accelerating Decarbonization Retrofit Demand

- 4.3 Restraints

- 4.3.1 Profitability Rates of Major FM Players

- 4.3.2 Workforce Indicators - Labor Participation

- 4.3.3 Rising Commercial Real Estate Vacancies in Urban Cores

- 4.3.4 Increasing Cybersecurity Liability Exposure in Connected Building Systems

- 4.4 Value Chain Analysis

- 4.5 PESTEL Analysis

- 4.6 Regulatory and Legislative Framework for Market Entrants

- 4.7 Impact of Macroeconomic Indicators on FM Demand

- 4.8 Porter's Five Forces Analysis

- 4.8.1 Bargaining Power of Suppliers

- 4.8.2 Bargaining Power of Buyers

- 4.8.3 Threat of New Entrants

- 4.8.4 Threat of Substitute Services

- 4.8.5 Intensity of Competitive Rivalry

- 4.9 Investment and Funding Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Service Type

- 5.1.1 Hard Services

- 5.1.1.1 Asset Management

- 5.1.1.2 MEP and HVAC Services

- 5.1.1.3 Fire Systems and Safety

- 5.1.1.4 Other Hard FM Services

- 5.1.2 Soft Services

- 5.1.2.1 Office Support and Security

- 5.1.2.2 Cleaning Services

- 5.1.2.3 Catering Services

- 5.1.2.4 Other Soft FM Services

- 5.1.1 Hard Services

- 5.2 By Offering Type

- 5.2.1 In-house

- 5.2.2 Outsourced

- 5.2.2.1 Single FM

- 5.2.2.2 Bundled FM

- 5.2.2.3 Integrated FM

- 5.3 By End-user Industry

- 5.3.1 Commercial (IT and Telecom, Retail and Warehouses, etc.)

- 5.3.2 Hospitality (Hotels, Eateries, Large-scale Restaurants)

- 5.3.3 Institutional and Public Infrastructure (Govt, Education, Transportation)

- 5.3.4 Healthcare (Public and Private Facilities)

- 5.3.5 Industrial and Process (Manufacturing, Energy, Mining)

- 5.3.6 Other End-user Industries (Multi-housing, Entertainment, Sports and Leisure)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves and Partnerships

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 ABM Industries

- 6.4.2 Emcor Group Inc.

- 6.4.3 CBRE Group Inc.

- 6.4.4 Jones Lang LaSalle IP, Inc.

- 6.4.5 Cushman & Wakefield PLC

- 6.4.6 Sodexo Inc.

- 6.4.7 ISS Facility Services Inc.

- 6.4.8 GDI Integrated Facility Services

- 6.4.9 Kellermeyer Bergensons Services

- 6.4.10 Guardian Service Industries Inc.

- 6.4.11 AHI Facility Services Inc.

- 6.4.12 Emeric Facility Services

- 6.4.13 SMI Facility Services

- 6.4.14 Shine Management and Facility Services

- 6.4.15 Haworth Inc.

- 6.4.16 Servicon Systems Inc.

- 6.4.17 UG2 Facility Services

- 6.4.18 Alpine Building Maintenance

- 6.4.19 Aramark

- 6.4.20 Broadway Building Services

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Technology-led Integrated FM (IoT, BMS, AI-based Predictive Maintenance)

- 7.3 ESG-compliant FM Solutions Demand

- 7.4 Future Service-Model Shifts (Outcome-based Contracts)