PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940893

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940893

Africa Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

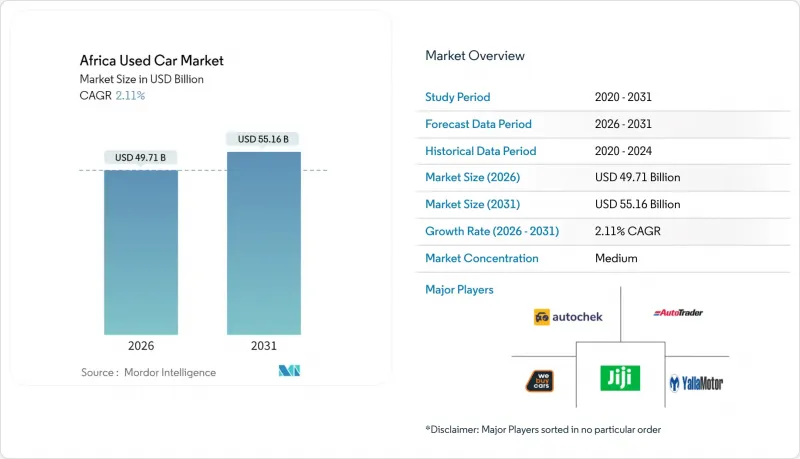

The Africa used car market is expected to grow from USD 48.68 billion in 2025 to USD 49.71 billion in 2026 and is forecast to reach USD 55.16 billion by 2031 at 2.11% CAGR over 2026-2031.

Heightened affordability constraints, tighter import regulations, and a steady pivot toward digital retail channels define the growth path. South Africa remains the largest single geography, yet Uganda emerges as the fastest-growing market as regional trade pacts unlock cross-border vehicle flows. SUVs dominate volumes, digital pure-plays outpace all other sales formats, and organized vendors gradually erode informal trader dominance as institutional capital and professional management gain traction. Meanwhile, rising imports of Euro-spec hybrid and electric vehicles (EVs) signal an early transition toward cleaner mobility options across key East African corridors.

Africa Used Car Market Trends and Insights

High Cost of New Cars and Affordability Gap

Only 2% of Nigeria's 180 million citizens could afford a new vehicle in 2024, underlining the affordability gulf that pushes consumers toward used imports. In Ethiopia, the tax framework takes a striking approach to vehicle regulation, imposing staggering duties that can soar up to 500% on older internal-combustion engine vehicles. In stark contrast, electric vehicles (EVs) enjoy a generous exemption from these hefty taxes, steering potential buyers toward either nearly new petrol and diesel models or fully electrified options that come without the burden of duty. This significant price gap creates a robust and sustained demand for the used car market across Africa, a trend expected to persist well into 2030 and beyond. The landscape of vehicle ownership is shifting dramatically, driven by these economic incentives and environmental considerations.

Expansion of Vehicle-financing Options

Regional lenders are filling a decades-long credit void by rolling out asset-backed loans for used purchases in Nigeria, Uganda, and Ghana, while South African banks now offer cross-border financing. The European Investment Bank estimates Africa needs USD 194 billion annually to meet SDGs, with monetary conditions easing through 2025, supporting loan availability . Uganda's currency has strengthened, and the easing of shilling lending rates has made it easier for businesses and consumers to afford mid-range imports. This favorable shift in the economic landscape opens up new opportunities for trade and purchasing power, allowing for a wider selection of goods to become accessible to the market.

Stringent Import-age and Emissions Rules

Kenya enforces an eight-year age cap and tighter 2025 emissions standards that lifted import prices 10-20% . Nigeria has increased tariffs, while Ghana has imposed restrictions on importing vehicles older than ten years. These regulatory shifts are creating a patchwork of rules that are pinching dealer margins tightly. Though policymakers are pursuing strategies to stimulate local vehicle assembly, the immediate consequence has been a constricted supply that dampens short-term growth in the used car market across Africa.

Other drivers and restraints analyzed in the detailed report include:

- Growing Internet Penetration and Online Classifieds

- Rapid Urbanization Driving Mobility Demand

- Export Bans in Source Countries

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs and MUVs held 59.88% of the Africa used car market share in 2025 and will post a 4.64% CAGR to 2031. Robust ground clearance, flexible cargo capacity, and seven-seat configurations meet both urban commute and rural haulage demands. Sedans still claim volume in densely populated city centers where parking is tight, yet buyers are migrating to crossovers that combine sedan comfort with SUV utility.

Manufacturers are responding swiftly: Geely's Completely Knocked-Down plant in Egypt targets 30,000 Coolray SUVs annually, reflecting OEM conviction in sustained SUV appetite. Ride-hailing operators increasingly favor compact SUVs, citing higher earning potential than hatchbacks. Consequently, SUV residual values remain resilient, reinforcing their appeal to organized dealers who prioritize turnover speed and financing eligibility.

Petrol powertrains commanded 67.70% of the Africa used car market size in 2025, while hybrid and EV imports will expand at 10.82% CAGR through 2031. Diesel engines continue to assert their dominance among commercial operators, who appreciate their formidable torque and impressive fuel efficiency. However, these operators are now navigating an increasingly stringent landscape of emissions regulations that challenge their reliance on traditional diesel power.

The hybrid surge is policy-led: Ethiopia's ICE ban funnels duty-free electrified stock into Addis Ababa showrooms. Rwanda's zero-rate VAT on EVs and Morocco's USD-backed battery-assembly incentives compound momentum. Range anxiety persists due to sparse charging networks, yet informal solutions solar micro-grids at fuel stations, are proliferating and lowering early-adopter barriers.

The Africa Used Car Market Report is Segmented by Vehicle Type (Hatchbacks, Sedans, and More), Fuel Type (Petrol, Diesel, and More), Price Segment (Below USD 5, 500, USD 5, 500-10, 999, and More), Sales Channel (Online Digital Classified Portals, Pure-Play E-Retailers, and More), Vendor Type (Organized and Unorganized), Vehicle Age, and Country. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Autochek Africa

- Erata Motors

- AutoTrader South Africa

- WeBuyCars (Pty) Ltd

- Westvaal Motors (PTY) Ltd

- CFAO Mobility South Africa

- KIFAL Auto

- Sylndr

- Peach Cars

- Carzami Inc.

- AutoTager

- Abdul Latif Jameel Motors

- Halfway Group (Hey Halfway)

- YallaMotor

- Cars 4 Africa

- Automark South Africa

- CMH Ford

- Southern Motor Holdings (PTY) Ltd (SMH Group)

- Global Cars Trading FZ LLC

- cars2africa

- Rola Motor Group

- AUTO24

- CarMax East Africa Ltd

- Jiji Cars

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 High Cost of New Cars and Affordability Gap

- 4.2.2 Expansion of Vehicle-financing Options

- 4.2.3 Growing Internet Penetration and Online Classifieds

- 4.2.4 Rapid Urbanization Driving Mobility Demand

- 4.2.5 Influx of Euro-spec Hybrid/EV Used Cars

- 4.2.6 OEM-certified Pre-owned Programs

- 4.3 Market Restraints

- 4.3.1 Stringent Import-age and Emissions Rules

- 4.3.2 Export Bans in Source Countries

- 4.3.3 Margin Squeeze from Digital Price Transparency

- 4.3.4 Weak After-sales Service Network

- 4.4 Regulatory Landscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Rivalry

5 Market Size & Growth Forecasts (Value, USD)

- 5.1 By Vehicle Type

- 5.1.1 Hatchbacks

- 5.1.2 Sedans

- 5.1.3 SUVs and MUVs

- 5.2 By Fuel Type

- 5.2.1 Petrol

- 5.2.2 Diesel

- 5.2.3 Hybrid and Electric

- 5.2.4 Others (LPG, CNG, etc.)

- 5.3 By Price Segment

- 5.3.1 Below USD 5,500

- 5.3.2 USD 5,500 - 10,999

- 5.3.3 USD 11,000 - 21,999

- 5.3.4 >= USD 22,000

- 5.4 By Sales Channel

- 5.4.1 Online Digital Classified Portals

- 5.4.2 Pure-play e-Retailers

- 5.4.3 Dealer/OEM Online Platforms

- 5.4.4 Physical Franchise Dealerships

- 5.4.5 Independent Used-Car Lots

- 5.4.6 Auction Houses (Physical and Online Hybrid)

- 5.4.7 Peer-to-Peer (Private) Sales

- 5.5 By Vendor Type

- 5.5.1 Organized

- 5.5.2 Unorganized

- 5.6 By Vehicle Age

- 5.6.1 0 -2 Years

- 5.6.2 3-5 Years

- 5.6.3 6-8 Years

- 5.6.4 Above 8 Years

- 5.7 By Country

- 5.7.1 South Africa

- 5.7.2 Morocco

- 5.7.3 Algeria

- 5.7.4 Egypt

- 5.7.5 Nigeria

- 5.7.6 Ghana

- 5.7.7 Kenya

- 5.7.8 Ethiopia

- 5.7.9 Tanzania

- 5.7.10 Uganda

- 5.7.11 Rest of Africa

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Autochek Africa

- 6.4.2 Erata Motors

- 6.4.3 AutoTrader South Africa

- 6.4.4 WeBuyCars (Pty) Ltd

- 6.4.5 Westvaal Motors (PTY) Ltd

- 6.4.6 CFAO Mobility South Africa

- 6.4.7 KIFAL Auto

- 6.4.8 Sylndr

- 6.4.9 Peach Cars

- 6.4.10 Carzami Inc.

- 6.4.11 AutoTager

- 6.4.12 Abdul Latif Jameel Motors

- 6.4.13 Halfway Group (Hey Halfway)

- 6.4.14 YallaMotor

- 6.4.15 Cars 4 Africa

- 6.4.16 Automark South Africa

- 6.4.17 CMH Ford

- 6.4.18 Southern Motor Holdings (PTY) Ltd (SMH Group)

- 6.4.19 Global Cars Trading FZ LLC

- 6.4.20 cars2africa

- 6.4.21 Rola Motor Group

- 6.4.22 AUTO24

- 6.4.23 CarMax East Africa Ltd

- 6.4.24 Jiji Cars

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-need Assessment