PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937393

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1937393

Vietnam Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

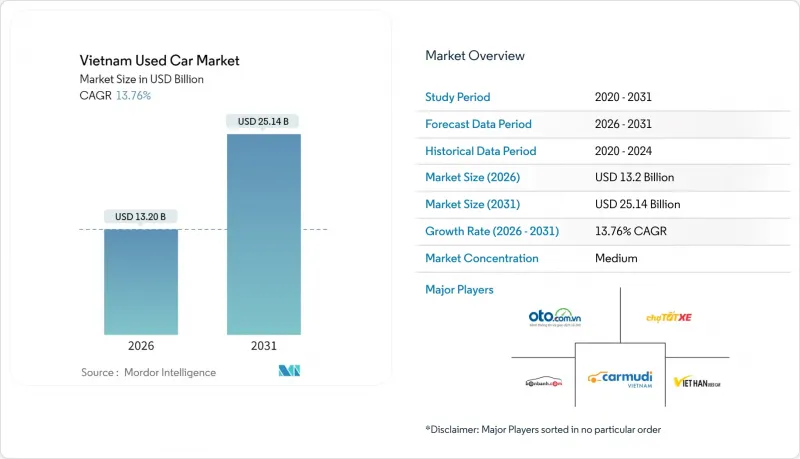

The Vietnam used car market size in 2026 is estimated at USD 13.2 billion, growing from 2025 value of USD 11.60 billion with 2031 projections showing USD 25.14 billion, growing at 13.76% CAGR over 2026-2031.

Rising disposable incomes, widening price gaps between new and pre-owned vehicles, and tightening emissions rules accelerate used-vehicle adoption nationwide. Online marketplaces already guide most purchase journeys, while certified dealerships extend professional retail standards beyond core metros. Vehicle financing at loan-to-value ratios above 80% broadens access for first-time buyers, even as looming Euro-5 import rules steer demand toward younger, cleaner inventory. These forces together position the Vietnamese used car market among Southeast Asia's fastest-growing mobility ecosystems.

Vietnam Used Car Market Trends and Insights

Rising Price Delta Between New and Used Cars

New-car sticker prices keep climbing faster than depreciation curves. The gap between brand-new and 3-year-old models tops a major share for best-selling nameplates such as the Toyota Vios and Honda City, comparatively high from 2022. Import duties, currency moves, and richer standard trims lift new-car MSRPs, while domestic purchasing power pins used-car values. Buyers, therefore, view 3-5-year-old units as smart substitutes delivering modern safety tech at roughly half the original cost. Fleet managers likewise exploit the spread to refresh assets without overshooting budgets. The widening delta will keep funneling demand toward the Vietnam used car market throughout the forecast horizon.

Growing Availability of Vehicle-Financing at Above 80% LTV

Local banks now extend loan-to-value ratios for cars under seven years old, up from just two years ago. Enhanced data-driven valuation tools and partnerships with digital platforms lower underwriting risk and speed approvals. Higher LTV terms unlock demand among younger consumers who prefer monthly payments over cash deals. Specialized products for certified inventory even bundle warranty coverage, which lifts buyer confidence and supports premium pricing. As competition among lenders intensifies, financing penetration is set to deepen across the Vietnamese used car market.

Looming Euro-5 Emissions Adoption for Imports (2027)

From 2027, all imported light vehicles must meet Euro-5 standards, with Hanoi and HCMC considering earlier enforcement. Prices for 2010-2017 imports already slipped in early 2025 as buyers anticipate compliance costs. Dealers holding older inventory face accelerated depreciation and potential write-downs. Still, the rule also nudges demand toward 3-5-year-old, lower-emission models, thereby shifting the mix rather than shrinking the Vietnam used car market outright.

Other drivers and restraints analyzed in the detailed report include:

- Digital Marketplaces' Expansion Into Tier-2 and Tier-3 Cities

- OEM-Backed Certified-Pre-Owned Programs Ramp-Up

- Low Odometer-Data Transparency and Tampering

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs and MPVs accounted for 44.72% of the Vietnam used car market share in 2025, within the Vietnam used car market share, reflecting consumer preference for high ground clearance and family-oriented versatility. The Vietnam used car market size attributed to SUVs and MPVs is projected to expand at a 14.12% CAGR through 2031, buoyed by fleet disposals from ride-hailing firms favoring utility vehicles for cabin comfort . Domestic maker VinFast captures this sentiment with tiered SUV offerings that span entry to premium brackets. Sedans retained relevance among cost-focused commuters but ceded momentum to more spacious formats.

Growing road-trip culture and investments in highway networks sustain resale values for SUVs, reinforcing a positive feedback cycle for first owners. Meanwhile, hatchbacks serve niche demand in inner-city corridors where parking constraints dominate purchase decisions. Collectively, these trends indicate a structural tilt toward utility body styles that will continue to shape inventory availability and pricing dynamics within the Vietnam used car industry.

Although petrol cars represented 84.63% of the Vietnam used car market share in 2025, battery electric units marked the fastest clip at an 18.28% CAGR, underscoring early electrification undercurrents. VinFast delivered over 87,000 EVs in 2024 across Vietnam market, ensuring sizeable future secondary inventory . The Vietnam used car market size for EVs will leap once the first-wave lease terms conclude in 2026. Diesel retains a foothold in commercial use but faces unfavorable tax treatment, pushing operators to hybrid or newer petrol options for compliance.

Charging infrastructure gaps persist, yet many prospective buyers are open to an EV in their next purchase. Government registration-fee waivers until 2027 keep the total cost of ownership attractive. As a result, battery electric supply and demand trajectories will likely intersect sooner than infrastructure skeptics forecast, granting EVs an outsized influence on future Vietnam used car market share.

Online platforms aggregated 58.55% of the Vietnam used car market share in 2025, mirroring broader e-commerce uptake across consumer categories. The Vietnam used car market size transacted digitally is forecast to grow 14.45% per year through 2031 as mobile-first interfaces streamline everything from search to financing. Peer-to-peer uploads still dominate rural listings, but verified dealer storefronts within the same apps now handle financing and warranty upsells that attract urban millennials.

Offline dealers pivot toward hybrid models, offering virtual tours and test-drive delivery at the customer's doorstep. This convergence blurs channel boundaries yet reinforces the overarching digital ethos. Ultimately, seamless online discovery paired with structured after-sales will remain the cornerstone of value creation across the Vietnam used car industry.

The Vietnam Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, and More), Fuel Type (Petrol, Diesel, and More), Sales Channel (Online Marketplace and Certified Offline Dealership), Vehicle Age (Less Than 3 Years, 3-5 Years, and More), Price Band (Below USD 7 K, USD 7-15 K, and More), Vendor Type, Mileage and Region. The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Oto.com.vn

- Chợ Tốt Xe

- Bonbanh.com

- Carmudi Vietnam

- Hien Toyota

- Thanh Xuan Ford

- Viet Han Used Cars

- LSH Auto

- Thaco Auto

- Nhat Hung Auto

- Thang Phong Auto

- VUCAR

- Viet Tuan Auto

- Saigon Luxury Cars

- Motorist Vietnam Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Price Delta Between New and Used Cars

- 4.2.2 Growing Availability of Vehicle-Financing at Above 80% LTV

- 4.2.3 Digital Marketplaces' Expansion Into Tier-2 and Tier-3 Cities

- 4.2.4 OEM-Backed Certified-Pre-Owned Programs Ramp-Up

- 4.2.5 Fleet Off-Loads From Ride-Hailing and Logistics Operators

- 4.2.6 Grey-Import Clamp-Downs Redirecting Supply to Domestic Market

- 4.3 Market Restraints

- 4.3.1 Looming Euro-5 Emissions Adoption for Imports (2027)

- 4.3.2 Low Odometer-Data Transparency and Tampering

- 4.3.3 Prospective Carbon-Tax on Above 10-Year-Old Vehicles

- 4.3.4 Patchy Warranty/After-Sales Ecosystem

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook (AI-driven inspection, blockchain OBD logs)

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 Market Size & Growth Forecasts (Value (USD))

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 SUV and MPV

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Hybrid

- 5.2.4 Battery Electric

- 5.2.5 Other Alternative Fuels

- 5.3 By Sales Channel

- 5.3.1 Online Marketplace

- 5.3.2 Certified Offline Dealership

- 5.4 By Vehicle Age

- 5.4.1 Less than 3 Years

- 5.4.2 3-5 Years

- 5.4.3 5-8 Years

- 5.4.4 Above 8 Years

- 5.5 By Price Band

- 5.5.1 Below USD 7 k

- 5.5.2 USD 7-15 k

- 5.5.3 USD 15-30 k

- 5.5.4 Above USD 30 k

- 5.6 By Vendor Type

- 5.6.1 Organized

- 5.6.2 Unorganized

- 5.7 By Mileage

- 5.7.1 Below 20,000 km

- 5.7.2 20,001-50,000 km

- 5.7.3 Above 50,000 km

- 5.8 By Region

- 5.8.1 North Vietnam

- 5.8.2 Central Vietnam

- 5.8.3 South Vietnam

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global Level Overview, Market Level Overview, Core Segments, Financials as Available, Strategic Information, Market Rank/Share for Key Companies, Products and Services, SWOT Analysis, and Recent Developments)

- 6.4.1 Oto.com.vn

- 6.4.2 Chợ Tốt Xe

- 6.4.3 Bonbanh.com

- 6.4.4 Carmudi Vietnam

- 6.4.5 Hien Toyota

- 6.4.6 Thanh Xuan Ford

- 6.4.7 Viet Han Used Cars

- 6.4.8 LSH Auto

- 6.4.9 Thaco Auto

- 6.4.10 Nhat Hung Auto

- 6.4.11 Thang Phong Auto

- 6.4.12 VUCAR

- 6.4.13 Viet Tuan Auto

- 6.4.14 Saigon Luxury Cars

- 6.4.15 Motorist Vietnam Co., Ltd.

7 Market Opportunities & Future Outlook

- 7.1 White-space & Unmet-Need Assessment