PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934762

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934762

South-East Asia Used Car - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

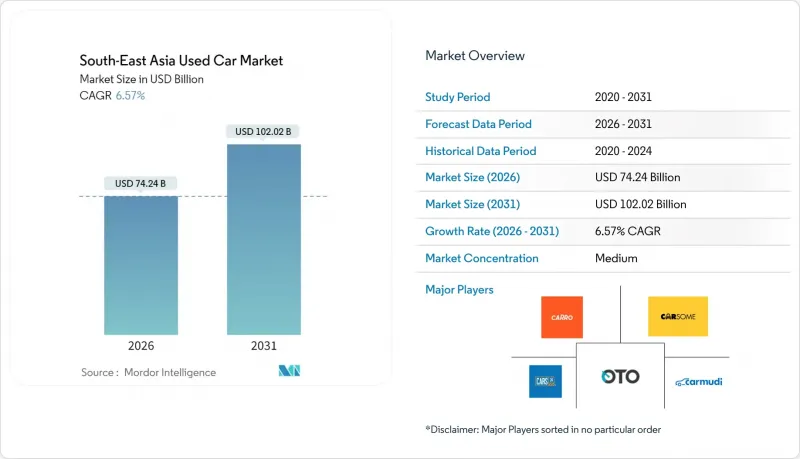

The Southeast Asia used car market was valued at USD 69.66 billion in 2025 and estimated to grow from USD 74.24 billion in 2026 to reach USD 102.02 billion by 2031, at a CAGR of 6.57% during the forecast period (2026-2031).

Strong vehicle turnover, a steady pipeline of nearly-new SUVs, and rapid digitization of the retail journey underpin this expansion, while organized dealer networks gain traction through standardized quality and financing partnerships. The Southeast Asia used car market benefits from rising disposable incomes, urban congestion that favors smaller vehicle upgrades, and government incentives that stimulate both electric vehicle adoption and structured scrappage programs. Online platforms strengthen bargaining power through AI-driven pricing that narrows informational asymmetries, and integrated financing unlocks demand from underbanked buyers. Malaysia's elimination of new-car taxes on selected segments and Thailand's favorable import rules for older vehicles further shape regional cross-border trade flows.

South-East Asia Used Car Market Trends and Insights

Rising Sales Through Online Channels and Digital Marketplaces

Digital marketplace adoption fundamentally reshapes transaction patterns as platforms capture increasing market share through superior customer acquisition and retention mechanisms. Carsome achieved EBITDA positivity in Q1 2024 with 48% year-on-year gross profit per unit improvement, while consolidating cloud infrastructure with Google Cloud to enhance AI-driven customer experiences. The shift toward digital channels accelerates in urban markets where smartphone penetration exceeds 80%, enabling remote vehicle inspection, digital documentation, and integrated financing solutions that reduce transaction friction. Online platforms leverage data analytics to optimize pricing algorithms, creating competitive advantages over traditional dealerships that rely on manual valuation processes.

Growth in Organized Dealership Networks and Certified Pre-Owned Programs

Organized dealership expansion reflects consumer demand for standardized quality assurance and warranty protection, particularly as vehicle complexity increases with hybrid and electric powertrains. OEM-backed certified pre-owned programs gain traction as manufacturers like Toyota, Honda, and Mercedes-Benz establish dedicated used vehicle divisions with comprehensive inspection protocols and extended warranty coverage. Regulatory compliance requirements increasingly favor organized dealers who maintain proper documentation, tax compliance, and consumer protection standards, creating structural advantages over informal market participants. The shift toward organized networks accelerates in markets with strengthening regulatory frameworks, particularly Indonesia and Vietnam, where government initiatives promote formal sector participation through tax incentives and simplified licensing procedures.

Dominance of Unorganized Dealers and Roadside Lots

Unorganized dealer prevalence constrains market professionalization and limits access to formal financing channels, creating structural inefficiencies that suppress overall transaction volumes. These informal channels lack standardized inspection protocols, warranty provisions, and financing partnerships, forcing consumers to rely on cash transactions that exclude significant portions of the potential buyer base. Rural market penetration remains dominated by roadside dealers who leverage local relationships and flexible negotiation practices, yet struggle to provide quality assurance or post-purchase support that builds long-term customer loyalty.

Other drivers and restraints analyzed in the detailed report include:

- Increasing Turnover of New-Car Sales Feeding Used Supply

- Availability of Integrated Financing and Insurance Solutions

- Lack of Standardized Vehicle-Condition Reporting Protocols

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

SUVs command 30.98% of the Southeast Asia used car market share in 2025, reflecting consumer preference shifts toward higher ground clearance and perceived safety advantages in Southeast Asian urban environments. The electric vehicle segment within the SUV category allows the overall segment to surge at a 26.15% CAGR through 2031, driven by government incentives and improving charging infrastructure across major metropolitan areas. Hatchbacks maintain a strong presence in price-sensitive segments, particularly in Indonesia and Vietnam, where compact vehicle affordability aligns with middle-class purchasing power. At the same time, sedans face declining demand as consumers migrate toward utility-focused vehicle formats. Multi-Purpose Vehicles (MPVs) capture significant market share in family-oriented demographics, with models like Mitsubishi Xpander leading Vietnamese sales in Q1 2025.

The shift toward SUVs accelerates as urbanization increases demand for vehicles capable of handling diverse road conditions, from city traffic to occasional rural excursions. Vietnamese market data reveals sedan sales declining in the first half of 2025, with consumers increasingly favoring higher-riding vehicles that offer superior visibility and perceived safety advantages. This trend creates cascading effects in the used car market, where SUV inventory commands premium pricing. At the same time, sedan values face downward pressure, fundamentally altering dealer inventory strategies and financing risk assessments across the region.

Gasoline-powered vehicles account for 72.13% of the Southeast Asia used car market share in 2025, supported by established refueling infrastructure and lower upfront costs than alternative fuel technologies. Electric vehicles represent the fastest-growing segment at 26.05% CAGR, though adoption faces challenges from limited charging infrastructure and battery degradation concerns that impact resale values. Diesel vehicles concentrate in commercial and heavy-duty applications, while alternative fuels, including LPG, CNG, and hybrid systems, gain traction in markets with supportive government policies and fuel cost advantages.

Indonesia's extension of 100% luxury tax exemption for electric vehicles through 2025 stimulates EV adoption, though sales declined 15% in 2024 due to reduced consumer purchasing power and anticipation of new model launches. The used EV market remains nascent due to rapid technological advancement that accelerates depreciation rates, with battery performance limiting consumer confidence in pre-owned electric vehicles. Singapore's EV market leadership in Southeast Asia creates demonstration effects that influence regional adoption patterns. However, infrastructure limitations in secondary cities constrain widespread electric vehicle penetration across the broader ASEAN market.

Vehicles aged 4-6 years captured 37.98% of the Southeast Asia used car market share in 2025, representing the optimal balance between depreciation, functionality, and financing accessibility for middle-income consumers. The 0-3 year segment grows fastest at 18.62% CAGR through 2031, driven by increasing new car turnover rates and consumer preference for near-new vehicles with remaining manufacturer warranties. Vehicles aged 7-10 years maintain steady demand in price-sensitive segments, while the 10+ year category faces regulatory pressure from emissions standards and scrappage incentives designed to modernize vehicle fleets.

The concentration in mid-life vehicles reflects financing accessibility, as banks and NBFCs prefer lending against assets with predictable depreciation curves and sufficient remaining useful life to secure loan terms. Vietnam's economic growth in 2024 expands the addressable market for 4-6 year vehicles, as rising incomes enable consumers to upgrade from older vehicles or enter car ownership for the first time. Government scrappage policies increasingly target vehicles over 15 years old, creating artificial demand acceleration for replacement vehicles in the 4-8 year age range that offer modern safety and emissions compliance features.

The Southeast Asia Used Car Market Report is Segmented by Vehicle Type (Hatchback, Sedan, SUV, MPV), Fuel Type (Gasoline, and More), Vehicle Age (0-3 Years, and More), Mileage (Under 30K Km, and More), Sales Channel (Online, Offline), Vendor Type (Organized, Unorganized), Purchase Method (Outright, and Financed), and Geography (Indonesia, and More). The Market Forecasts are Provided in Terms of Value (USD) and Volume (Units).

List of Companies Covered in this Report:

- Carro

- Carsome

- Cars24 Services Pvt Ltd

- Carousell

- OLX

- iCar Asia (Carlist.my)

- myTukar

- BeliMobilGue.co.id

- Carmudi

- Oto.com

- Automart PH

- Mercedes-Benz Certified

- Toyota U Trust

- Honda Certified Pre-Owned

- BMW Premium Selection

- Nissan Intelligent Choice

- Hyundai Promise

- Mitsubishi Diamond Certified

- Isuzu Used Car Program

- LausAutoGroup (Carmix)

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 Introduction

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 Research Methodology

3 Executive Summary

4 Market Landscape

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising sales through online channels and digital marketplaces

- 4.2.2 Growth in organized dealership networks and certified-pre-owned programs

- 4.2.3 Increasing turnover of new-car sales (especially SUVs) feeding used supply

- 4.2.4 Availability of integrated financing and insurance solutions

- 4.2.5 Government circular-economy and scrappage incentives accelerating trade-ins

- 4.2.6 AI-driven inspection/pricing platforms boosting buyer trust

- 4.3 Market Restraints

- 4.3.1 Dominance of unorganized dealers and roadside lots

- 4.3.2 Lack of standardized vehicle-condition reporting protocols

- 4.3.3 Emerging import restrictions on older used vehicles

- 4.3.4 Reduced private-car ownership in urban areas due to mobility-as-a-service

- 4.4 Value/Supply-Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Landscape

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Competitive Rivalry

5 Market Size and Growth Forecasts (Value (USD) and Volume (Units))

- 5.1 By Vehicle Type

- 5.1.1 Hatchback

- 5.1.2 Sedan

- 5.1.3 Sport-Utility Vehicle (SUV)

- 5.1.4 Multi-Purpose Vehicle (MPV)

- 5.2 By Fuel Type

- 5.2.1 Gasoline

- 5.2.2 Diesel

- 5.2.3 Electric

- 5.2.4 Alternative Fuels (LPG/CNG/Hybrid)

- 5.3 By Vehicle Age

- 5.3.1 0 to 3 Years

- 5.3.2 4 to 6 Years

- 5.3.3 7 to 10 Years

- 5.3.4 More than 10 Years

- 5.4 By Mileage

- 5.4.1 Less than 30 000 km

- 5.4.2 30 001 to 60 000 km

- 5.4.3 60 001 to 100 000 km

- 5.4.4 More than 100 000 km

- 5.5 By Sales Channel

- 5.5.1 Online

- 5.5.2 Offline

- 5.6 By Vendor Type

- 5.6.1 Organized

- 5.6.2 Unorganized

- 5.7 By Purchase Method

- 5.7.1 Outright Purchase

- 5.7.2 Financed Purchase

- 5.7.2.1 Captive Financing

- 5.7.2.2 Bank Financing

- 5.7.2.3 Non-Banking Financial Companies (NBFC)

- 5.8 By Country (Southeast Asia)

- 5.8.1 Indonesia

- 5.8.2 Thailand

- 5.8.3 Vietnam

- 5.8.4 Malaysia

- 5.8.5 Philippines

- 5.8.6 Singapore

- 5.8.7 Other Countries (Cambodia, Laos, Myanmar, Brunei)

6 Competitive Landscape

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (Includes Global-level Overview, Market-level Overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Carro

- 6.4.2 Carsome

- 6.4.3 Cars24 Services Pvt Ltd

- 6.4.4 Carousell

- 6.4.5 OLX

- 6.4.6 iCar Asia (Carlist.my)

- 6.4.7 myTukar

- 6.4.8 BeliMobilGue.co.id

- 6.4.9 Carmudi

- 6.4.10 Oto.com

- 6.4.11 Automart PH

- 6.4.12 Mercedes-Benz Certified

- 6.4.13 Toyota U Trust

- 6.4.14 Honda Certified Pre-Owned

- 6.4.15 BMW Premium Selection

- 6.4.16 Nissan Intelligent Choice

- 6.4.17 Hyundai Promise

- 6.4.18 Mitsubishi Diamond Certified

- 6.4.19 Isuzu Used Car Program

- 6.4.20 LausAutoGroup (Carmix)

7 Market Opportunities and Future Outlook

- 7.1 White-space and Unmet-Need Assessment

- 7.2 Improved focus on bundled value-added services (Financing, insurance, extended warranty, subscription plans)