Need help finding what you are looking for?

Contact Us

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687837

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1687837

Vietnam Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030)

PUBLISHED:

PAGES: 190 Pages

DELIVERY TIME: 2-3 business days

SELECT AN OPTION

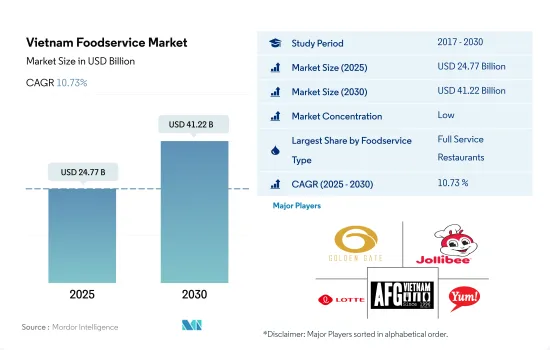

The Vietnam Foodservice Market size is estimated at 24.77 billion USD in 2025, and is expected to reach 41.22 billion USD by 2030, growing at a CAGR of 10.73% during the forecast period (2025-2030).

Michelin Guide and Vietnam Tourism Promote Vietnamese Cuisine drives the expansion of the full service restaurants across the country

- Due to Vietnam's expansive and diverse culinary culture, full-service restaurants hold the highest market share in the country. In 2021, China was the leading nationality of foreign visitors to Vietnam, with nearly 57.7 thousand Chinese tourists, followed by South Korea, with 32.5 thousand visitors. Asian cuisine is the most popular in Vietnam, accounting for over 40% of the cuisine share in 2022. This demand stems from tourists from Asian countries and residents, as Vietnamese cuisine shares similarities with other Pan-Asian cuisines. In 2022, the collaboration between the Michelin Guide and the Vietnam National Administration of Tourism presented significant expansion opportunities for promoting Vietnamese cuisine globally.

- The cloud kitchen market is experiencing rapid growth in Vietnam, primarily due to its ease of use and the opportunities it provided to the foodservice industry during the pandemic. Many restaurants that faced operational challenges during the COVID-19-related lockdown transitioned to virtual operations, taking advantage of centralized food production facilities for multiple restaurants, especially for deliveries. In June 2022, CloudEats, a cloud kitchen based in the Philippines and Vietnam, secured a USD 7 million investment for expansion across Southeast Asia. Vietnam is home to various online delivery platforms and cloud kitchens, including GrabFood, Now, GrabKitchen, and GoFood, providing opportunities for exponential growth.

- Vietnam showed a moderate recovery from the COVID-19 pandemic, witnessing a 13.22% increase in market value from 2021 to 2022, owing to the incorporation of online food delivery services and automated kitchen technologies.

Vietnam Foodservice Market Trends

Vietnamese quick service restaurant market is highly competitive, with local and international chains dominating

- Cloud kitchen outlets are the fastest-growing, and they are projected to register a CAGR of 3.72% during the forecast period. One of the primary drivers of the cloud kitchen market in Vietnam is the growing demand for online food delivery services, such as GoFood, GrabFood, Baemin, and Lala. These apps reach a wider customer base and streamline the ordering and delivery process. Cloud kitchens are also leveraging data analytics to gain insights into customer preferences and behavior and optimize menu offerings and pricing.

- Full service outlets are expected to be the second fastest-growing, registering a CAGR of 0.35% during the forecast period. Asian cuisine holds a major share of the market. Vietnam has experienced a steady increase in international tourism in recent years, with many tourists coming from Asia. For example, there were 17,546 visitor arrivals from Taiwan, 16,592 visitor arrivals from Japan, 11,502 from Southeast Asia, and 10,920 from Thailand in 2022. As a result, there has been a growing demand for Asian cuisine in Vietnam to cater to these tourists.

- Quick service restaurants are highly competitive in the market. McDonald's, Burger King, KFC, Lotteria, Jollibee, and Pizza Hut are well-established competitors with 20, 140, 200, 60, and 50 outlets, respectively, in the QSR market. Vietnamese prefer authentic fast-food concepts and international options such as Banh mi, a Vietnamese sandwich made with a crusty baguette and filled with various ingredients such as grilled pork, pate, pickled vegetables, and fresh herbs. Similarly, Pho is a traditional Vietnamese soup made with rice noodles and a flavorful broth, often served with beef or chicken and fresh herbs.

Cloud kitchens in Vietnam saw the highest average order value in 2022, driven by online meal delivery

- In Vietnam, the AOV was the highest for cloud kitchens, at USD 3.45 in 2022. An increase in the demand for online meal delivery is driving the expansion of the cloud kitchen market. In Vietnam, the overall spending on food delivery services reached USD 1.1 billion in 2022. Online meal ordering and delivery services grew in popularity after the pandemic. Popular dishes offered by cloud kitchens in Vietnam are pizza and pasta, both priced at an average of USD 2.4 per 300 g. In 2022, the cost of the most popular dishes served by cloud kitchen was fixed at the average order value of USD 2.2.

- Vietnam is one of the affluent nations in the Asian region and a significant hub for travel. The gastronomic diversity that can be found throughout the country's numerous cantons serves to further emphasize its multi-ethnic and multilingual nature. Indian, Korean, and other Asian cuisines are more widely consumed nationwide. The average order value for Asian cuisine meals is USD 1.75 per 300 g.

- The full-service restaurants' average order value is expected to record a CAGR of 5.35% during the study period. FSR is implementing new technologies and services to cater to customers who are becoming more accustomed to convenience. Mobile payments, internet ordering, and home delivery are becoming more prevalent in full-service areas of the market. Due to the expanding number of dining options available to consumers, including pre-packaged restaurant meals, pricing is becoming a more crucial problem. Emerging competitors, such as providers of subscription meal kits, could further disrupt the industry in the future.

Vietnam Foodservice Industry Overview

The Vietnam Foodservice Market is fragmented, with the top five companies occupying 1.28%. The major players in this market are Golden Gate JSC, Jollibee Foods Corporation, Lotte GRS Co. Ltd, The Al Fresco's Group Vietnam and Yum! Brands Inc. (sorted alphabetically).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

Product Code: 66440

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY & KEY FINDINGS

2 REPORT OFFERS

3 INTRODUCTION

- 3.1 Study Assumptions & Market Definition

- 3.2 Scope of the Study

- 3.3 Research Methodology

4 KEY INDUSTRY TRENDS

- 4.1 Number Of Outlets

- 4.2 Average Order Value

- 4.3 Regulatory Framework

- 4.3.1 Vietnam

- 4.4 Menu Analysis

5 MARKET SEGMENTATION (includes market size in Value in USD, Forecasts up to 2030 and analysis of growth prospects)

- 5.1 Foodservice Type

- 5.1.1 Cafes & Bars

- 5.1.1.1 By Cuisine

- 5.1.1.1.1 Bars & Pubs

- 5.1.1.1.2 Cafes

- 5.1.1.1.3 Juice/Smoothie/Desserts Bars

- 5.1.1.1.4 Specialist Coffee & Tea Shops

- 5.1.2 Cloud Kitchen

- 5.1.3 Full Service Restaurants

- 5.1.3.1 By Cuisine

- 5.1.3.1.1 Asian

- 5.1.3.1.2 European

- 5.1.3.1.3 Latin American

- 5.1.3.1.4 Middle Eastern

- 5.1.3.1.5 North American

- 5.1.3.1.6 Other FSR Cuisines

- 5.1.4 Quick Service Restaurants

- 5.1.4.1 By Cuisine

- 5.1.4.1.1 Bakeries

- 5.1.4.1.2 Burger

- 5.1.4.1.3 Ice Cream

- 5.1.4.1.4 Meat-based Cuisines

- 5.1.4.1.5 Pizza

- 5.1.4.1.6 Other QSR Cuisines

- 5.1.1 Cafes & Bars

- 5.2 Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

6 COMPETITIVE LANDSCAPE

- 6.1 Key Strategic Moves

- 6.2 Market Share Analysis

- 6.3 Company Landscape

- 6.4 Company Profiles (includes Global Level Overview, Market Level Overview, Core Business Segments, Financials, Headcount, Key Information, Market Rank, Market Share, Products and Services, and Analysis of Recent Developments).

- 6.4.1 CP All PCL

- 6.4.2 Golden Gate JSC

- 6.4.3 Imex Pan Pacific Group

- 6.4.4 Jollibee Foods Corporation

- 6.4.5 Lotte GRS Co. Ltd

- 6.4.6 Mesa Group

- 6.4.7 Restaurant Brands International Inc.

- 6.4.8 Starbucks Corporation

- 6.4.9 The Al Fresco's Group Vietnam

- 6.4.10 Yum! Brands Inc.

7 KEY STRATEGIC QUESTIONS FOR FOODSERVICE CEOS

8 APPENDIX

- 8.1 Global Overview

- 8.1.1 Overview

- 8.1.2 Porter's Five Forces Framework

- 8.1.3 Global Value Chain Analysis

- 8.1.4 Market Dynamics (DROs)

- 8.2 Sources & References

- 8.3 List of Tables & Figures

- 8.4 Primary Insights

- 8.5 Data Pack

- 8.6 Glossary of Terms

Have a question?

SELECT AN OPTION

Have a question?

Questions? Please give us a call or visit the contact form.