PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716708

PUBLISHER: Global Market Insights Inc. | PRODUCT CODE: 1716708

Used Cars Market Opportunity, Growth Drivers, Industry Trend Analysis, and Forecast 2025 - 2034

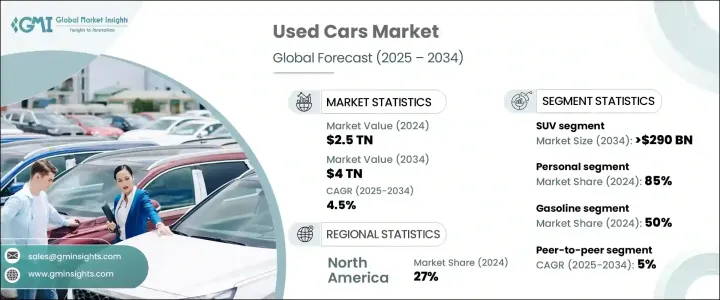

The Global Used Car Market was valued at USD 2.5 trillion in 2024 and is projected to grow at a CAGR of 4.5% between 2025 and 2034. The rising demand for pre-owned vehicles stems from their affordability compared to new cars, making them an attractive option for budget-conscious buyers. As new vehicles depreciate rapidly, consumers can acquire relatively recent models at a fraction of the original price. This affordability factor drives demand among first-time buyers, middle-income families, and businesses looking to expand their fleets without a substantial financial burden.

Economic uncertainty and inflationary pressures have further strengthened the appeal of the used car market. With the cost of new vehicles rising due to supply chain disruptions, semiconductor shortages, and higher manufacturing expenses, pre-owned cars offer a cost-effective alternative without compromising on quality. Consumers today are more value-conscious than ever, opting for vehicles that provide long-term reliability and resale value. Certified pre-owned (CPO) programs backed by automakers and dealerships are also gaining traction, offering extended warranties and quality assurance, boosting consumer confidence in the market. Additionally, the growing adoption of digital platforms has made it easier for buyers to research, compare, and purchase used cars online, streamlining the entire buying experience. The integration of AI-powered pricing tools and vehicle history reports ensures transparency, further driving the market growth.

| Market Scope | |

|---|---|

| Start Year | 2024 |

| Forecast Year | 2025-2034 |

| Start Value | $2.5 Trillion |

| Forecast Value | $4 Trillion |

| CAGR | 4.5% |

Many high-income individuals continue to favor private vehicle ownership for lifestyle and convenience. Beyond financial savings, used cars cater to the increasing need for mobility, especially in urban areas where public transportation may not always be reliable. The wide variety of available pre-owned models meets diverse consumer preferences, from fuel-efficient compact cars to feature-packed SUVs and luxury vehicles. The expansion of shared mobility services, such as ride-hailing and leasing programs, has also contributed to the market's growth, as these services regularly refresh their fleets, supplying a steady stream of well-maintained used cars.

The market is segmented by vehicle type, including hatchbacks, sedans, SUVs, and others. The SUV segment is expected to generate USD 290 billion by 2034, driven by its strong build, spacious interiors, and versatility for both urban and off-road driving. Consumers favor SUVs due to their perceived safety, higher resale value, and adaptability to changing road conditions. With increasingly unpredictable weather patterns, buyers are shifting preferences toward durable and high-performing vehicles. Compact and mid-size SUVs are particularly popular, reshaping the market and influencing automakers' strategies.

Based on end-use, the used car market is divided into personal and commercial segments. The personal segment dominated in 2024, accounting for 85% of the market share. Used cars provide consumers with a practical and cost-effective ownership experience, offering lower initial costs, reduced insurance premiums, and access to attractive financing options. Competitive interest rates and flexible installment plans make pre-owned vehicles more accessible, fueling demand in this segment.

North America Used Car Market generated USD 583 billion in 2024, with the U.S. leading in vehicle ownership. Millions of registered vehicles on American roads create a high turnover, ensuring a steady supply of pre-owned cars. This dynamic market benefits from continuous vehicle replacements, making a diverse selection of used cars readily available. Digital marketplaces, dealership networks, and CPO programs further support industry expansion, reinforcing North America's position as a key player in the global used car market.

Table of Contents

Chapter 1 Methodology & Scope

- 1.1 Research design

- 1.1.1 Research approach

- 1.1.2 Data collection methods

- 1.2 Base estimates & calculations

- 1.2.1 Base year calculation

- 1.2.2 Key trends for market estimation

- 1.3 Forecast model

- 1.4 Primary research and validation

- 1.4.1 Primary sources

- 1.4.2 Data mining sources

- 1.5 Market scope & definition

Chapter 2 Executive Summary

- 2.1 Industry 3600 synopsis, 2021 - 2034

Chapter 3 Industry Insights

- 3.1 Industry ecosystem analysis

- 3.1.1 Supplier landscape

- 3.1.1.1 Raw material suppliers

- 3.1.1.2 Component suppliers

- 3.1.1.3 Manufacturers

- 3.1.1.4 Technology providers

- 3.1.1.5 End Use

- 3.1.2 Profit margin analysis

- 3.1.1 Supplier landscape

- 3.2 Technology & innovation landscape

- 3.3 Patent analysis

- 3.4 Regulatory landscape

- 3.5 Price trends

- 3.6 Impact forces

- 3.6.1 Growth drivers

- 3.6.1.1 Affordability and cost savings

- 3.6.1.2 Rising disposable income and urbanization

- 3.6.1.3 High depreciation of new cars

- 3.6.1.4 Growth of online platforms and digitalization

- 3.6.1.5 Availability of financing and loan options

- 3.6.2 Industry pitfalls & challenges

- 3.6.2.1 Lack of standardization and quality assurance

- 3.6.2.2 Rising competition from new car sales and leasing models

- 3.6.1 Growth drivers

- 3.7 Growth potential analysis

- 3.8 Porter's analysis

- 3.9 PESTEL analysis

Chapter 4 Competitive Landscape, 2024

- 4.1 Introduction

- 4.2 Company market share analysis

- 4.3 Competitive positioning matrix

- 4.4 Strategic outlook matrix

Chapter 5 Market Estimates & Forecast, By Vehicle, 2021 - 2034 ($Bn, Units)

- 5.1 Key trends

- 5.2 Hatchback

- 5.3 Sedan

- 5.4 SUV

- 5.5 Others

Chapter 6 Market Estimates & Forecast, By Fuel, 2021 - 2034 ($Bn, Units)

- 6.1 Key trends

- 6.2 Gasoline

- 6.3 Diesel

- 6.4 Hybrid

- 6.5 Electric

- 6.6 Others

Chapter 7 Market Estimates & Forecast, By Sales Channel, 2021 - 2034 ($Bn, Units)

- 7.1 Key trends

- 7.2 Peer-to-peer

- 7.3 Franchised dealers

- 7.4 Independent dealers

Chapter 8 Market Estimates & Forecast, By End Use, 2021 - 2034 ($Bn, Units)

- 8.1 Key trends

- 8.2 Personal

- 8.3 Commercial

Chapter 9 Market Estimates & Forecast, By Region, 2021 - 2034 ($Bn, Units)

- 9.1 Key trends

- 9.2 North America

- 9.2.1 U.S.

- 9.2.2 Canada

- 9.3 Europe

- 9.3.1 UK

- 9.3.2 Germany

- 9.3.3 France

- 9.3.4 Italy

- 9.3.5 Spain

- 9.3.6 Russia

- 9.3.7 Nordics

- 9.4 Asia Pacific

- 9.4.1 China

- 9.4.2 India

- 9.4.3 Japan

- 9.4.4 Australia

- 9.4.5 South Korea

- 9.4.6 Southeast Asia

- 9.5 Latin America

- 9.5.1 Brazil

- 9.5.2 Mexico

- 9.5.3 Argentina

- 9.6 MEA

- 9.6.1 UAE

- 9.6.2 South Africa

- 9.6.3 Saudi Arabia

Chapter 10 Company Profiles

- 10.1 Alibaba

- 10.2 Asbury Automotive Group

- 10.3 AUDI

- 10.4 AutoNation

- 10.5 Avis Budget Group

- 10.6 CarMax

- 10.7 CARS24

- 10.8 Carvana

- 10.9 eBay

- 10.10 Group 1 Automotive

- 10.11 Hendrick Automotive Group

- 10.12 Hertz Global Holdings

- 10.13 Lithia Motors

- 10.14 Mahindra First Choice Wheels

- 10.15 Maruti Suzuki True Value

- 10.16 Penske Automotive Group

- 10.17 Scout24 AG

- 10.18 Sonic Automotive

- 10.19 TrueCar

- 10.20 Van Tuyl Group