PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934665

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1934665

China Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

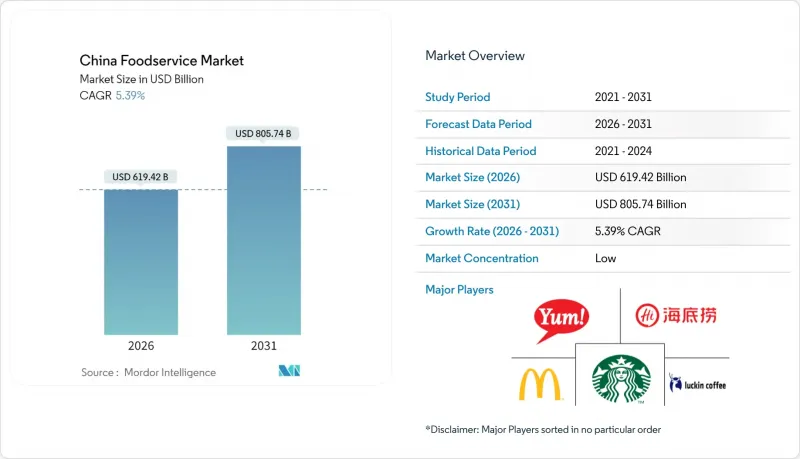

The China food service market was valued at USD 587.75 billion in 2025 and estimated to grow from USD 619.42 billion in 2026 to reach USD 805.74 billion by 2031, at a CAGR of 5.39% during the forecast period (2026-2031).

Despite challenges from deflation-driven price wars, the China food service market continues to grow. Operators are adopting digital ordering systems, optimizing delivery processes, and expanding regionally to manage margin pressures. Urban consumers are increasingly demanding diverse and convenient dining options, driving the growth of both quick-service and full-service restaurants. Shifting consumer preferences toward healthier food options, vegetarian and vegan meals, and fusion cuisines are driving menu diversification. Full-service dining remains culturally significant, while quick-service outlets and cloud kitchens are rapidly expanding in lower-tier cities, where value and convenience are key factors. Companies are investing in AI-driven supply chains and kitchen automation to boost productivity. Additionally, government-issued consumption vouchers are providing a short-term boost to discretionary spending.

China Foodservice Market Trends and Insights

Augmented demand for vegan and plant-based menus

In China, as vegetarianism gains traction, a niche but expanding market for plant-based alternatives is emerging. ProVeg International reveals that 98% of Chinese consumers are inclined to eat more plant-based foods once they understand the health benefits . This growing focus on health-conscious dining has led major chains to introduce plant-based options. Local fast-food brands are innovatively combining traditional Chinese vegetarian dishes with modern formats. This trend is particularly prominent in tier-1 cities, where younger demographics with higher disposable incomes display greater environmental awareness. Moreover, the government's Big Food initiative, which encourages a diversified food supply system, indirectly supports the growth of alternative proteins. Urban restaurant operators are finding that plant-based menu items not only attract health-conscious consumers but also enable premium pricing, highlighting the rising importance of dietary diversity.

Changing consumer preferences and dining habits

The post-pandemic dining landscape has fundamentally altered consumer behavior, with delivery orders now accounting for 90% of digital sales at major chains like Yum China in 2024. As consumers focus more on convenience and value, the pre-prepared food market is exceed CNY 500 billion in 2024 , according to the China Food Circulation Association. The growth of cultural tourism has driven increased food and beverage consumption during holidays, with sales surging during events such as the Mid-Autumn Festival. Consumers aged 18-24, now the leading market segment, emphasize cost-effectiveness and authentic local flavors over international brand appeal. This trend has enabled local chains like Tastien to thrive by integrating traditional Chinese elements into fast-food concepts.

Food Safety Concerns and Regulatory Scrutiny

Regulatory compliance costs are escalating as China implements 50 new food safety standards and 9 amendments in 2025, including comprehensive updates to food labeling requirements under GB 7718-2025. The National Food Safety Standard for Food Additives (GB 2760-2024), which takes effect in February 2025, requires substantial reformulation and testing, driving up operational costs for food service operators. Moreover, school food service providers must comply with new guidelines for cleaning and disinfecting reusable dining utensils, necessitating specialized equipment and training. To address the complexity, the China National Center for Food Safety Risk Assessment has issued 98 FAQs on national food safety standards. While these measures aim to improve food safety, they present considerable challenges for smaller operators with limited resources for compliance.

Other drivers and restraints analyzed in the detailed report include:

- Growth of quick-service restaurants and fast casual concepts

- Expansion of ghost kitchens and cloud kitchens

- Escalating labour-cost inflation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, full-service restaurants held a leading 38.05% share of China's food service market, highlighting sustained consumer interest in experiential dining. This segment thrives due to China's rich culinary traditions, urbanization, rising disposable incomes, and increasing demand for diverse, high-quality dining experiences. However, cloud kitchens are expected to surpass all other formats over the forecast period, with a projected 6.14% CAGR. By eliminating dine-in facilities, these kitchens reduce operational costs while enhancing scalability and flexibility.

Operators like Yum China are integrating their dine-in expertise with delivery-optimized menus, showcasing a convergence of dining formats. At the same time, McDonald's and domestic competitors are rapidly expanding their QSR networks, ensuring a steady supply of convenient locations. Cafes and bars are also gaining momentum by offering specialty beverages that increase average ticket sizes. The growth trajectory, however, depends heavily on effective cost management. Cloud-only models avoid high-street rents and adjust staffing based on order volumes, making them particularly appealing to new entrants in China's food service industry. In response, full-service restaurants are introducing delivery-friendly menu items and semi-automated kitchens to maintain profitability. This competitive environment emphasizes the importance of menu innovation and service efficiency, driving the evolution of China's food service market.

Chained operators controlled 51.92% of the China food service market in 2025 and are forecast to expand at a 5.82% CAGR, benefiting from procurement scale and standardized processes. As China's food service market expands, chains effectively manage aggressive discounting without compromising profitability. On the other hand, independent outlets, while maintaining hyper-local flavors and personalized service, face liquidity challenges due to rising rents and wages.

Chain consolidation is transforming China's foodservice market, enhancing efficiency through centralized management, scalable operations, cost savings, consistent quality, and superior customer experiences. This trend is especially evident in quick-service restaurants (QSRs), driven by consumer demand for fast, reliable dining and supported by digital ordering and delivery platforms. Digital transformation further strengthens chain dominance. Additionally, new Ministry of Commerce regulations on foodservice management introduce reporting and sanitation requirements, which chains can efficiently address through centralized back-office platforms.

The China Foodservice Market Report is Segmented by Foodservice Type (Cafes and Bars, Cloud Kitchen, Full-Service Restaurants, Quick-Service Restaurants), Outlet (Chained Outlet, Independent Outlet), Location (Leisure, Lodging, Retail, Standalone, Travel), Cuisine Type (Asian, European, Latin American, Middle Eastern, North American, Other Cuisines), and Geography. The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Yum! Brands Inc.

- Restaurant Brands International Inc.

- McDonald's Corp.

- Starbucks Corp.

- Domino's Pizza Inc.

- Papa John's International Inc.

- Haidilao International Holding Ltd.

- Inner Mongolia Xiao Wei Yang Chained Food Service Co. Ltd.

- China Quanjude (Group) Co. Ltd.

- Doctor Associates Inc. (Subway)

- Luckin Coffee Inc.

- Nayuki Holdings Ltd.

- HeyTea (Shenzhen Meixixi Food and Beverage)

- Jiumaojiu International Holdings Ltd.

- Guangzhou Restaurant Group Co. Ltd.

- Sichuan Haohuanluo Food Service Co. Ltd.

- Xibei Catering Group

- Xiaoguan Tea Co. Ltd.

- Burger King (China)

- Xiaohongshu Cafe Brands

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Augmented demand for vegan and plant-based menus

- 4.2.2 Changing consumer preferences and dining habits

- 4.2.3 Growth of quick-service restaurants and fast casual concepts

- 4.2.4 Expansion of ghost kitchens and cloud kitchens

- 4.2.5 Increased urbanization and lifestyle changes

- 4.2.6 AI-driven kitchen automation and robotics

- 4.3 Market Restraints

- 4.3.1 Food safety concerns and regulatory scrutiny

- 4.3.2 Escalating labour-cost inflation

- 4.3.3 Dependence on technology adaptation

- 4.3.4 Stricter food-waste recycling mandates

- 4.4 Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS

- 5.1 By Foodservice Type

- 5.1.1 Cafes and Bars

- 5.1.2 Cloud Kitchen

- 5.1.3 Full-Service Restaurants

- 5.1.4 Quick-Service Restaurants

- 5.2 By Outlet

- 5.2.1 Chained Outlet

- 5.2.2 Independent Outlet

- 5.3 By Location

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Standalone

- 5.3.5 Travel

- 5.4 By Cuisine Type

- 5.4.1 Full Service Restaurants

- 5.4.1.1 Asian

- 5.4.1.2 European

- 5.4.1.3 Latin American

- 5.4.1.4 Middle Eastern

- 5.4.1.5 North American

- 5.4.1.6 Other Full-Service Restaurant Cuisine

- 5.4.1.7 Quick Service Cuisine

- 5.4.2 Quick Service Cuisine

- 5.4.2.1 Bakeries

- 5.4.2.2 Burger

- 5.4.2.3 Ice Cream

- 5.4.2.4 Meat-Based Cuisine

- 5.4.2.5 Other Quick Service Cuisine

- 5.4.3 Cafes and Bars

- 5.4.3.1 Bars and Pubs

- 5.4.3.2 Cafes

- 5.4.3.3 Juices/Smoothies/Desserts

- 5.4.3.4 Specialty Coffee and Tea

- 5.4.4 Cloud Kitchen (Overall Only)

- 5.4.1 Full Service Restaurants

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Yum! Brands Inc.

- 6.4.2 Restaurant Brands International Inc.

- 6.4.3 McDonald's Corp.

- 6.4.4 Starbucks Corp.

- 6.4.5 Domino's Pizza Inc.

- 6.4.6 Papa John's International Inc.

- 6.4.7 Haidilao International Holding Ltd.

- 6.4.8 Inner Mongolia Xiao Wei Yang Chained Food Service Co. Ltd.

- 6.4.9 China Quanjude (Group) Co. Ltd.

- 6.4.10 Doctor Associates Inc. (Subway)

- 6.4.11 Luckin Coffee Inc.

- 6.4.12 Nayuki Holdings Ltd.

- 6.4.13 HeyTea (Shenzhen Meixixi Food and Beverage)

- 6.4.14 Jiumaojiu International Holdings Ltd.

- 6.4.15 Guangzhou Restaurant Group Co. Ltd.

- 6.4.16 Sichuan Haohuanluo Food Service Co. Ltd.

- 6.4.17 Xibei Catering Group

- 6.4.18 Xiaoguan Tea Co. Ltd.

- 6.4.19 Burger King (China)

- 6.4.20 Xiaohongshu Cafe Brands

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK