PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940624

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940624

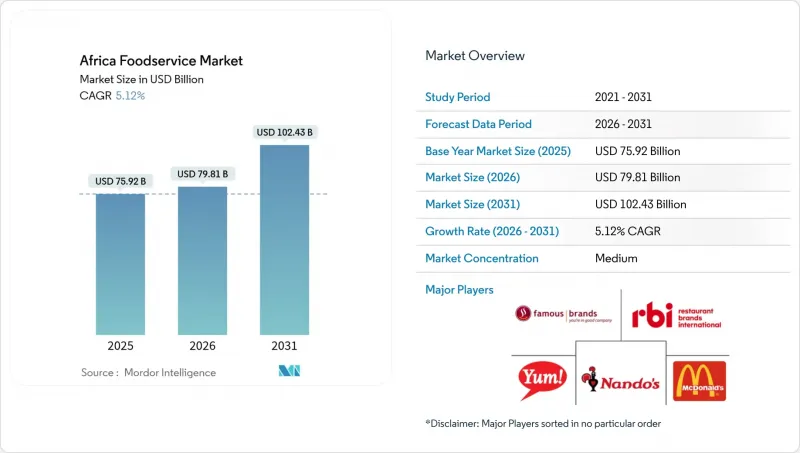

Africa Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The African foodservice market is expected to grow from USD 75.92 billion in 2025 to USD 79.81 billion in 2026 and is forecast to reach USD 102.43 billion by 2031 at 5.12% CAGR over 2026-2031.

The African foodservice market is expanding rapidly, driven by urbanization, a youthful population, and technological advancements. Urban migration and busier lifestyles are increasing demand for convenient dining options like Quick-Service Restaurants (QSRs) and Cloud Kitchens. As of 2024, Africa's urbanization rate was nearly 45.5%, according to the World Bank. Rising disposable incomes among the growing middle class further enable frequent dining out and access to diverse, quality meals. Technological adoption, including smartphones and food delivery apps, is transforming the market. For example, in January 2025, KFC introduced a WhatsApp ordering system in South Africa to reduce data costs and improve accessibility. The rise of cloud kitchens, highlighted by the Cloud Kitchen Convention in April 2025, reflects the industry's shift toward efficiency. Changing consumer preferences for healthier, high-quality options are driving menu innovation, such as Food Service India's Ramadan-special Haleem Grain Base launched in March 2025. Additionally, growth in tourism and hospitality supports the market, with international brands like McDonald's and local players such as Famous Brands Limited and Vida e Caffe expanding to capitalize on this evolving landscape.

Africa Foodservice Market Trends and Insights

Rapid urban middle-class expansion and rising disposable income

Rapid urban middle-class expansion and the corresponding rise in disposable income are primary catalysts for the African foodservice market's growth, altering consumption patterns across the continent. As more people move to urban centers, faster-paced lifestyles increase reliance on convenient dining solutions like Quick-Service Restaurants (QSRs) and online delivery services. This shift coincides with a growing middle class allocating more discretionary income to leisure dining and diverse culinary experiences. The OECD-FAO Agricultural Outlook 2024-2033 highlights how urbanization drives food system transformation and demand for processed, diverse food items globally, including in Africa. Private sector entities are adapting with innovations; for instance, McDonald's increasingly uses app-based pickup systems to reduce reliance on third-party platforms and address demands for convenience and efficiency. These examples illustrate the link between rising spending power and the boom in accessible, varied foodservice options.

Proliferation of mobile ordering and delivery platforms accelerating off-premise sales

Mobile ordering and delivery platforms are rapidly transforming the African foodservice market, capitalizing on widespread smartphone use and a growing demand for convenience. As urban consumers increasingly turn to digital ordering, dining habits are shifting from traditional dine-in experiences to delivery and takeaway services. For example, the Global System for Mobile Communications Association projected a 50% mobile penetration rate in Sub-Saharan Africa by 2025. Additionally, the industry's growth has been fueled by strategic partnerships between restaurants and aggregators, with major players such as Jumia Foods, Uber Eats, Bolt Foods, and Glovo leading the charge in key markets like Nigeria, Kenya, and South Africa.

Fragmented informal sector complicating food-safety compliance

The fragmented and large-scale nature of Africa's informal foodservice sector restrains market growth by complicating food-safety compliance and deterring consumers seeking formal hygiene assurances. This sector, which dominates food market demand in sub-Saharan Africa, operates outside formal regulatory frameworks due to high business turnover, vendor mobility, and lack of infrastructure like potable water and waste disposal. These conditions lead to inconsistent food safety knowledge and practices, contributing to a high burden of foodborne illnesses. Government and association sources highlight these challenges; for instance, a 2025 NIH study on Namibian informal markets found moderate food safety knowledge but poor practices, such as inadequate temperature control. Similarly, a 2024 PMC analysis of South Africa's food safety framework noted the "complexity and fragmentation of the regulatory landscape," complicating enforcement. Initiatives like the EU-funded FS4Africa project, launched in January 2024, aim to address issues like microbial contamination and weak traceability. However, persistent safety concerns and regulatory ambiguity limit consumer trust and hinder formal foodservice operators from establishing uniform safety standards across the market.

Other drivers and restraints analyzed in the detailed report include:

- Expansion of malls and formal retail anchors creating foodservice space

- AfCFTA-enabled intra-African supply-chain integration lowering sourcing costs

- High food inflation eroding consumer purchasing power

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud kitchens are forecast to expand at a 7.42% CAGR from 2026 to 2031, the fastest growth among foodservice types, as operators exploit delivery aggregators to test menu concepts without committing to high-street leases that can consume 15% to 20% of revenue in tier-1 cities. Quick-Service Restaurants held 39.22% of the market in 2025, anchored by international chains such as KFC, McDonald's, and Domino's, that benefit from global supply-chain scale and marketing budgets that local competitors cannot match. Full-Service Restaurants, spanning Asian, European, Middle Eastern, and North American cuisines, are growing steadily as urban professionals seek experiential dining, yet their capital intensity and labor costs limit scalability compared to quick-service formats. Cafes and Bars, including specialist coffee shops and juice bars, are carving niches in mall food courts and office districts, where foot traffic justifies premium pricing for artisanal beverages.

Yum! Brands opened approximately 2,900 KFC restaurants globally in 2024, with Africa representing a priority growth corridor where same-store sales grew 15% in fiscal 2023, driven by value-meal promotions and mobile-ordering integration, according to the Yum! Brands Annual Report 2024. McDonald's plans to reach 50,000 restaurants worldwide by 2027, with Africa and the Middle East targeted for 300 to 400 new openings, emphasizing drive-thru formats that reduce dine-in labor costs and accelerate order throughput, according to the McDonald's Corporation Annual Report 2024. Cloud kitchens in Lagos and Nairobi are leveraging platforms like Chowdeck and Glovo to operate multiple virtual brands, burgers, sushi, and salads from a single kitchen, a strategy that amortizes fixed costs across diverse revenue streams and hedges against single-cuisine demand volatility. Bakeries and ice-cream parlors within the quick-service segment are benefiting from impulse-purchase dynamics, particularly in malls where families allocate discretionary spending to treats rather than full meals, a behavioral pattern that persists even during inflationary cycles.

Chained outlets are projected to grow at an 7.73% CAGR from 2026 to 2031, surpassing the growth of independent outlets, which hold a 68.30% market share in 2025. Chains benefit from standardized operating procedures, centralized procurement, and digital loyalty programs, which independents struggle to replicate. Independent outlets dominate numerically due to lower capital and regulatory requirements, but their fragmentation weakens supplier bargaining power and exposes them to input-cost shocks, eroding margins. Spur Corporation, with 726 restaurants in 15 countries, opened 21 South African and 12 international outlets in the first half of fiscal 2025, targeting secondary cities with lower competition and lease rates 30% to 40% below Johannesburg or Cape Town, as per Spur Corporation's Interim Results 2025. Famous Brands closed 47 underperforming outlets in the first half of 2024, including 14 Steers, 11 Fishaways, and 5 Debonairs, to focus on high-traffic locations and delivery-optimized formats, according to Famous Brands' Interim Results 2024.

Restaurant Brands International acquired Carrols Restaurant Group, a 1,017-unit Burger King franchisee, for USD 1 billion in May 2024, signaling a shift toward ownership in high-growth markets where operational control justifies capital investment. In South Africa, Nando's, with approximately 300 outlets and a ZAR 28 billion (USD 1.5 billion) brand value, secures prime mall locations ahead of smaller competitors. Independent operators are forming buying cooperatives to negotiate bulk discounts on essentials like cooking oil, flour, and packaging, narrowing but not eliminating the cost gap with chains. Digital ordering is another challenge; chains invest in proprietary apps and CRM systems to track customer preferences and automate promotions, while independents rely on third-party aggregators that charge 20% to 30% commissions and control customer relationships, a disadvantage that compounds over time.

The Africa Foodservice Market Report is Segmented by Foodservice Type (Cafes and Bars, Cloud Kitchen, Full-Service Restaurants, and Quick Service Restaurants), Outlet (Chained Outlets and Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, and Travel), and Service Type (Dine-In, Takeaway, and Delivery). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Famous Brands Limited

- Yum! Brands Inc.

- McDonald's Corporation

- Restaurant Brands International

- Nando's Group Holdings

- Spur Corporation Ltd.

- Domino's Pizza Inc.

- Bidfood (Bidvest Foodservice)

- Sodexo SA

- Compass Group PLC

- Food Concepts PLC

- Chowdeck

- Glovo

- Spaza Eats

- Sundry Foods Ltd.

- Eat & Go Ltd.

- Tantalizers PLC

- Sweet Sensation Confectionery Ltd.

- Galito's Holdings

- Pedros Flame-Grilled Chicken

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid urban middle-class expansion and rising disposable income

- 4.2.1.1 Proliferation of mobile ordering and delivery platforms accelerating off-premise sales

- 4.2.1.2 Expansion of malls and formal retail anchors creating foodservice space

- 4.2.1.3 AfCFTA-enabled intra-African supply-chain integration lowering sourcing costs

- 4.2.1.4 Surge in cold-chain investment improving perishables distribution reach

- 4.2.1.5 Renewable-energy-powered kitchens mitigating load-shedding risk

- 4.2.1 Rapid urban middle-class expansion and rising disposable income

- 4.3 Market Restraints

- 4.3.1 Fragmented informal sector complicating food-safety compliance

- 4.3.1.1 High food inflation eroding consumer purchasing power

- 4.3.1.2 Persistent power outages and energy-price volatility

- 4.3.1.3 Talent shortages in digital logistics and food-safety technology

- 4.3.1 Fragmented informal sector complicating food-safety compliance

5 KEY INDUSTRY TRENDS

- 5.1 Number of Outlets

- 5.2 Average Order Value

- 5.3 Regulatory Framework

- 5.4 Menu Analysis

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Foodservice Type

- 6.1.1 Cafes and Bars

- 6.1.1.1 By Cuisine

- 6.1.1.1.1 Bars and Pubs

- 6.1.1.1.2 Cafes

- 6.1.1.1.3 Juice/Smoothie/Desserts Bars

- 6.1.1.1.4 Specialist Coffee and Tea Shops

- 6.1.1.1 By Cuisine

- 6.1.2 Cloud Kitchen

- 6.1.3 Full Service Restaurants

- 6.1.3.1 By Cuisine

- 6.1.3.1.1 Asian

- 6.1.3.1.2 European

- 6.1.3.1.3 Latin American

- 6.1.3.1.4 Middle Eastern

- 6.1.3.1.5 North American

- 6.1.3.1.6 Other FSR Cuisines

- 6.1.3.1 By Cuisine

- 6.1.4 Quick Service Restaurants

- 6.1.4.1 By Cuisine

- 6.1.4.1.1 Bakeries

- 6.1.4.1.2 Burger

- 6.1.4.1.3 Ice Cream

- 6.1.4.1.4 Meat-based Cuisines

- 6.1.4.1.5 Pizza

- 6.1.4.1.6 Other QSR Cuisines

- 6.1.4.1 By Cuisine

- 6.1.1 Cafes and Bars

- 6.2 By Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 By Location

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Standalone

- 6.3.5 Travel

- 6.4 By Service Type

- 6.4.1 Dine-In

- 6.4.2 Takeaway

- 6.4.3 Delivery

- 6.5 By Geography

- 6.5.1 Nigeria

- 6.5.2 Ghana

- 6.5.3 Ethiopia

- 6.5.4 Kenya

- 6.5.5 South Africa

- 6.5.6 Rest of Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Share Analysis

- 7.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 7.4.1 Famous Brands Limited

- 7.4.2 Yum! Brands Inc.

- 7.4.3 McDonald's Corporation

- 7.4.4 Restaurant Brands International

- 7.4.5 Nando's Group Holdings

- 7.4.6 Spur Corporation Ltd.

- 7.4.7 Domino's Pizza Inc.

- 7.4.8 Bidfood (Bidvest Foodservice)

- 7.4.9 Sodexo SA

- 7.4.10 Compass Group PLC

- 7.4.11 Food Concepts PLC

- 7.4.12 Chowdeck

- 7.4.13 Glovo

- 7.4.14 Spaza Eats

- 7.4.15 Sundry Foods Ltd.

- 7.4.16 Eat & Go Ltd.

- 7.4.17 Tantalizers PLC

- 7.4.18 Sweet Sensation Confectionery Ltd.

- 7.4.19 Galito's Holdings

- 7.4.20 Pedros Flame-Grilled Chicken

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK