PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939735

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939735

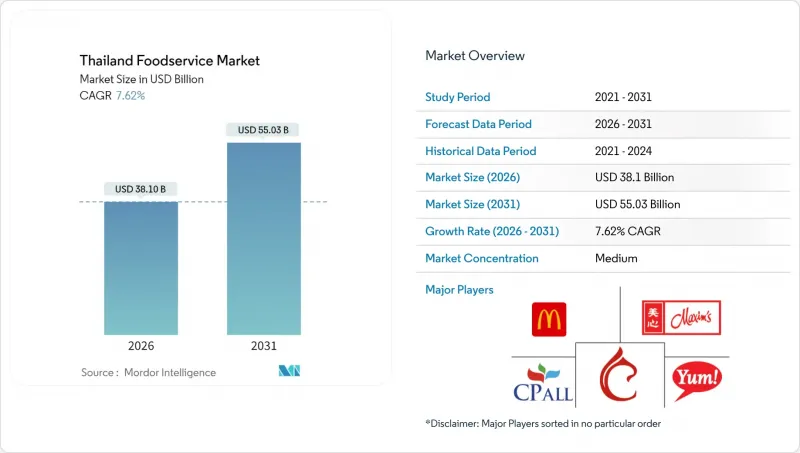

Thailand Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

The Thailand foodservice market is expected to grow from USD 35.4 billion in 2025 to USD 38.1 billion in 2026 and is forecast to reach USD 55.03 billion by 2031 at 7.62% CAGR over 2026-2031.

The market growth is driven by tourism recovery, increased adoption of digital ordering platforms, and growing consumer demand for convenience. Cloud kitchens and delivery applications are enabling restaurants to expand their reach beyond traditional physical locations. The market benefits from Thailand's extensive retail network, high smartphone adoption rates, and a growing middle-class population seeking diverse dining options. Competition is increasing as international chains adapt their menus to local preferences, domestic companies enhance their omnichannel presence, and technology-focused businesses use data analytics to predict consumer behavior. However, growth varies across market segments, with rising costs and stricter food safety regulations affecting profit margins despite overall revenue growth.

Thailand Foodservice Market Trends and Insights

Surging Demand for Convenience and Ready-to-Eat

Thailand's rapid urbanization and evolving lifestyle patterns have fundamentally transformed how consumers approach their daily meals, with a clear preference for convenient dining solutions. The ready-to-eat segment has experienced remarkable growth, particularly in cloud kitchens, which have emerged as the fastest-growing foodservice category at CAGR through 2030. This transformation directly responds to the demanding schedules of urban professionals and demonstrates how food delivery has become an essential part of daily dining habits. The convenience trend has expanded beyond delivery services to encompass grab-and-go options at convenience stores, where CP All's extensive 7-Eleven network functions as an integral distribution channel for ready-to-eat meals, effectively leveraging Thailand's comprehensive retail infrastructure to adapt to modern consumer behavior.

Emergence of Plant-Based and Flexitarian Food Trends

Thailand's plant-based food market has expanded beyond traditional Buddhist vegetarian offerings to include modern plant-based alternatives. The market growth is driven by health-conscious consumers and environmental sustainability advocates. Urban millennials and Gen Z consumers are shifting their dietary preferences toward wellness and ethical consumption. International companies, including Impossible Foods and Beyond Meat, have formed distribution partnerships with Thai retailers and restaurants. Local manufacturers are developing plant-based alternatives using regional ingredients such as jackfruit, mushrooms, and soy protein. Government health initiatives supporting reduced meat consumption and increased vegetable intake have created favorable regulatory conditions, accelerating adoption across foodservice segments.

Rising Costs of Imported Ingredients and Packaging Materials

Thailand's foodservice sector faces significant margin pressure from rising import costs, particularly affecting international cuisine restaurants and premium dining establishments. Ingredient cost inflation has reached double digits in 2024, with imported proteins, dairy products, and specialty ingredients experiencing the highest increases due to global supply chain disruptions and currency fluctuations . The growth in food delivery has driven up packaging material costs, while sustainable packaging requirements add further expenses. Restaurants are implementing menu engineering, portion optimization, and supplier diversification strategies, though these measures often lead to reduced profit margins or increased consumer prices. The Thai Food and Drug Administration's import regulations require extensive documentation and testing for food ingredients, creating additional compliance costs that particularly affect smaller operators who lack economies of scale in procurement.

Other drivers and restraints analyzed in the detailed report include:

- Rise of Food Truck, Pop-Up, and Alternative Dining Models

- Strong Cafe and Coffee Culture-Expanding Beyond Metropolitan Areas

- Stringent Government Food Safety and Labeling Regulations

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quick Service Restaurants maintain their market dominance with a substantial 50.68% share in 2025, reflecting the strong consumer preference in Thailand for cost-effective and accessible dining solutions. This segment's success stems from its ability to meet the demands of urban professionals and families who require efficient meal options in their daily routines. Full Service Restaurants have demonstrated resilience by maintaining their core dine-in operations while strategically expanding into takeaway and delivery services to meet evolving consumer needs.

Cloud Kitchens are experiencing remarkable growth at a 25.08% CAGR through 2031, driven by widespread adoption of digital ordering platforms and changing consumer behavior patterns in food delivery services. The cafe and bar segment continues to flourish as Thailand's coffee culture matures, particularly with the expansion of specialty coffee establishments. This growth extends beyond the capital, with notable development in key tourist and commercial centers like Chiang Mai and Phuket, where both local and international consumers drive demand for premium coffee experiences and nightlife entertainment.

The Thai foodservice landscape remains firmly in the hands of independent operators, who control 73.78% of the market in 2025. This dominance stems from Thailand's deeply rooted entrepreneurial dining culture and the country's diverse regional cuisine preferences. Independent establishments have successfully maintained their market position by leveraging their operational advantages, including reduced overhead costs, the ability to adapt menus quickly to local tastes, and well-established community relationships that foster customer loyalty.

While independent restaurants continue to lead the market, chained outlets are experiencing significant growth at 8.02% CAGR. These chains are capitalizing on their substantial financial resources, implementing efficient standardized operations, and building strong brand recognition that resonates particularly well with younger demographics and tourism segments seeking reliable dining experiences. The independent sector, however, faces mounting challenges from escalating operational costs and increasingly complex regulatory compliance requirements that naturally favor larger operators with economies of scale. In response to these pressures, independent restaurant owners are adopting collaborative approaches, forming informal networks and purchasing cooperatives to enhance their competitive position while maintaining their unique market identities.

The Thailand Foodservice Market Report Segments the Industry Into Foodservice Type (Cafe and Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), and Service Type (Dine-In, Takeaway, and Delivery). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Central Plaza Hotel PCL

- CP All PCL

- Yum! Brands Inc.

- Maxim's Caterers Ltd.

- McThai Co. Ltd.

- Minor International PCL

- MK Restaurant Group PCL

- Panthera Group Co. Ltd.

- Food Capitals PCL

- PTT Oil & Retail Business PCL

- Thai Beverage PCL

- Global Franchise Architects Co.

- Zen Corporation Group PCL

- Starbucks Coffee

- Black Canyon (Thailand)

- S&P Syndicate PCL

- Oishi Group PCL

- AU Bon Pain (Thailand)

- The Pizza Company

- After You Dessert Cafe PCL

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 KEY INDUSTRY TRENDS

- 4.1 Number of Outlets

- 4.2 Average Order Value

- 4.3 Regulatory Framework

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Surging demand for convenience and ready-to-eat

- 5.2.2 Expansion of international/QSR and specialty restaurant brands

- 5.2.3 Emergence of plant-based and flexitarian food trends

- 5.2.4 Rise of food truck, pop-up, and alternative dining models

- 5.2.5 Strong cafe and coffee culture-expanding beyond metropolitan areas

- 5.2.6 Proliferation of high-quality bakery and dessert brands

- 5.3 Market Restraints

- 5.3.1 Rising costs of imported ingredients and packaging materials

- 5.3.2 Stringent government food safety and labeling regulations

- 5.3.3 Supply chain vulnerability to climate/weather shocks

- 5.3.4 Fragmented supplier landscape and distribution inefficiencies

- 5.4 Regulatory Outlook

- 5.5 Porter's Five Forces

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Foodservice Type

- 6.1.1 Cafe and Bars

- 6.1.1.1 By Cuisine

- 6.1.1.1.1 Bars and Pubs

- 6.1.1.1.2 Cafe

- 6.1.1.1.3 Juice/Smoothie/Desserts Bars

- 6.1.1.1.4 Specialist Coffee and Tea Shops

- 6.1.1.1 By Cuisine

- 6.1.2 Cloud Kitchen

- 6.1.3 Full Service Restaurants

- 6.1.3.1 By Cuisine

- 6.1.3.1.1 Asian

- 6.1.3.1.2 European

- 6.1.3.1.3 Latin American

- 6.1.3.1.4 Middle Eastern

- 6.1.3.1.5 North American

- 6.1.3.1.6 Other FSR Cuisines

- 6.1.3.1 By Cuisine

- 6.1.4 Quick Service Restaurants

- 6.1.4.1 By Cuisine

- 6.1.4.1.1 Bakeries

- 6.1.4.1.2 Burger

- 6.1.4.1.3 Ice Cream

- 6.1.4.1.4 Meat-based Cuisines

- 6.1.4.1.5 Pizza

- 6.1.4.1.6 Other QSR Cuisines

- 6.1.4.1 By Cuisine

- 6.1.1 Cafe and Bars

- 6.2 By Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 By Locations

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Sandalone

- 6.3.5 Travel

- 6.4 By Service Type

- 6.4.1 Dine-in

- 6.4.2 Takeaway

- 6.4.3 Delivery

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Ranking Analysis

- 7.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 7.4.1 Central Plaza Hotel PCL

- 7.4.2 CP All PCL

- 7.4.3 Yum! Brands Inc.

- 7.4.4 Maxim's Caterers Ltd.

- 7.4.5 McThai Co. Ltd.

- 7.4.6 Minor International PCL

- 7.4.7 MK Restaurant Group PCL

- 7.4.8 Panthera Group Co. Ltd.

- 7.4.9 Food Capitals PCL

- 7.4.10 PTT Oil & Retail Business PCL

- 7.4.11 Thai Beverage PCL

- 7.4.12 Global Franchise Architects Co.

- 7.4.13 Zen Corporation Group PCL

- 7.4.14 Starbucks Coffee

- 7.4.15 Black Canyon (Thailand)

- 7.4.16 S&P Syndicate PCL

- 7.4.17 Oishi Group PCL

- 7.4.18 AU Bon Pain (Thailand)

- 7.4.19 The Pizza Company

- 7.4.20 After You Dessert Cafe PCL

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK