PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939687

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1939687

United Kingdom Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

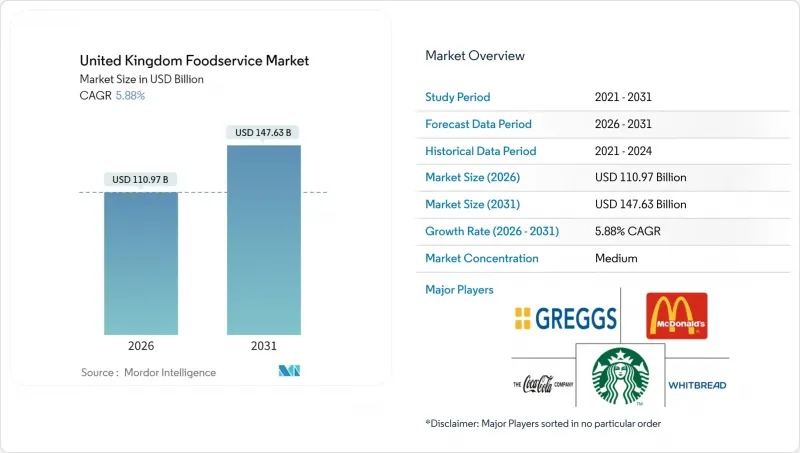

The United Kingdom foodservice market is expected to grow from USD 104.81 billion in 2025 to USD 110.97 billion in 2026 and is forecast to reach USD 147.63 billion by 2031 at 5.88% CAGR over 2026-2031.

Persistent consumer demand for convenience, technology-enabled ordering, and experiential dining is steering capital toward delivery infrastructure, menu innovation, and omnichannel engagement. Operators that embed artificial-intelligence insights into inventory planning, labor scheduling, and targeted promotions are widening margin buffers even as labor inflation and energy costs tighten unit economics. Rapid uptake of hybrid models, blending dine-in ambiance with robust off-premise fulfillment, has rewritten location economics by pairing high-street visibility with distributed "dark" production facilities. Sustainability compliance is becoming an equally strong growth catalyst: chains that invest early in carbon-neutral kitchens and transparent ingredient sourcing are capturing the expanding pool of values-driven diners.

United Kingdom Foodservice Market Trends and Insights

Rise of food delivery apps

Food delivery apps have significantly transformed revenue streams and consumer access for foodservice operators, enabling them to overcome traditional dine-in limitations through expanded geographic reach. Partnerships such as Uber Eats with Pret A Manger demonstrate how third-party aggregators enhance customer acquisition and brand visibility. However, they introduce challenges like commission fees ranging from 15% to 30% per order. This financial pressure has driven restaurants to redesign physical spaces with dedicated delivery preparation zones, ensuring efficient order fulfillment while maintaining dine-in standards. Operators are increasingly integrating real-time technology to balance relationships with aggregator platforms and their own direct-to-consumer tools, aiming to retain margins and build customer loyalty. High-street chains like Greggs leverage proprietary apps for personalized offers and efficient order batching while maintaining a presence on third-party platforms to maximize exposure. To support omnichannel growth, workflows, kitchen operations, and shift patterns are restructured, with investments in automation or specialized delivery teams enhancing efficiency. As delivery becomes a core revenue driver, strict controls over order tracking, packaging, and time management are essential to uphold service quality. However, reliance on delivery apps raises concerns about fluctuating commission rates and disintermediation risks, prompting a focus on data ownership and customer engagement through proprietary channels. The integration of digital ordering, aggregator partnerships, and in-house platforms requires operators to adapt continuously, balancing new revenue opportunities with cost management and brand control.

Increased demand for healthier, vegan, low-calorie, and allergen-free menu options

Health-conscious consumption patterns are reshaping the foodservice industry, driving both major chains and independent operators to innovate and expand their offerings beyond traditional dietary restrictions and allergen avoidance. For instance, Pizza Hut has introduced plant-based pizzas and sides to cater to the vegan demographic, which, according to The Vegan Society in 2024, has grown to approximately 2 million people (3% of Great Britain) . McDonald's has also developed a vegan menu, including the McPlant burger, Vegetable Deluxe, Spicy Veggie One wrap, Veggie Dippers, and select breakfast items, balancing indulgent classics with health-focused alternatives to meet the diverse demands of its consumers. Menu development is increasingly incorporating trends such as lower-calorie options, allergen-free items, and functional foods, aligning with the World Health Organization's updated dietary guidance that emphasizes reduced consumption of processed foods. Regulatory requirements for transparent nutritional labeling and ingredient sourcing, driven by the Food Standards Agency (FSA) allergen management rules, necessitate comprehensive staff training and supply chain visibility. While these regulations pose challenges, they also create opportunities for premiumization through clean-label positioning. As clean-label and sustainability considerations gain prominence, ingredient sourcing practices and eco-friendly packaging are becoming critical marketing tools. The evolving regulatory landscape and shifting consumer preferences are accelerating innovation and operational changes, making health-conscious and transparent menus essential for growth and customer loyalty.

Food and labour cost inflation

Food and labor cost inflation is exerting significant pressure on the United Kingdom foodservice market, compelling operators to adjust menu pricing, sourcing strategies, and operational protocols to remain viable amidst shrinking profit margins. Rising labor costs, driven by substantial minimum wage increases and higher employer contributions in 2025, are particularly challenging for brands like Wetherspoons, which face the dual burden of escalating wage bills and increasing costs for key ingredients and energy. This combination of inflationary pressures has led to frequent menu price adjustments, with quick-service chicken and burger outlets often implementing the largest price increases, while casual dining chains focus on operational efficiencies and moderate price hikes to manage higher staff costs. To maintain perceived value and address input cost inflation, many businesses are adopting data-driven pricing strategies, optimizing menu offerings, and reallocating staff resources to protect profitability without alienating cost-sensitive customers. Additionally, operators are engaging in more intense supplier negotiations, pursuing strategic sourcing initiatives, and facing heightened vulnerability to supply chain disruptions, particularly in volatile food categories such as oils, dairy, and proteins. As inflation continues to impact both food and labor costs, the need for efficiency has become critical. Organizations are increasingly automating processes, investing in multisite analytics, and revisiting loyalty programs or promotional strategies to sustain customer traffic while preserving margins. The cumulative effect is an industry-wide challenge, where inflation amplifies operational complexities, requiring businesses to adapt quickly and demonstrate resilience in the face of evolving consumer expectations and persistent cost pressures.

Other drivers and restraints analyzed in the detailed report include:

- Emergence and rapid growth of cloud/ghost kitchens

- Growing consumer interest in authentic global cuisines and fusion menus

- Rising competition drives need for differentiation

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Quick service restaurants (QSRs) are projected to maintain market leadership with a 33.78% share in 2025. This reflects consumer preferences for speed, convenience, and value, which align with economic uncertainty and time-constrained lifestyles. Meanwhile, cloud kitchens are expected to achieve an impressive 12.10% compound annual growth rate (CAGR) through 2031, indicating a significant shift toward delivery-optimized formats. These formats reduce customer-facing real estate costs while maximizing kitchen efficiency. Full-service restaurants face challenges due to their traditional dine-in model, which involves higher labor costs and premium locations. However, their diverse cuisine offerings, ranging from Asian to European concepts, provide differentiation opportunities that QSR formats cannot easily replicate. Cafes and bars benefit from trends in social gatherings and remote work, which drive daytime traffic. Specialist coffee shops, in particular, capitalize on premium pricing through artisanal positioning and experiential elements.

The evolution of the foodservice segment highlights the role of technology in reshaping operational models. Cloud kitchens leverage data analytics to optimize menu offerings and delivery routes, providing efficiencies that traditional restaurants cannot match. For example, McDonald's digital transformation initiatives, such as AI-powered drive-through ordering and mobile app integration, illustrate how established QSR operators invest in technology to maintain competitive advantages against delivery-native competitors. Additionally, regulatory compliance is becoming increasingly complex, as different foodservice types face varying health and safety requirements. Full-service establishments, in particular, require more comprehensive staff training and customer interaction protocols compared to delivery-focused formats.

Independent outlets are projected to hold a 56.72% market share in 2025, with a compound annual growth rate (CAGR) of 6.35% through 2031. This growth underscores their resilience despite challenges such as technology adoption costs and supply chain complexities. The performance of independent outlets reflects consumer preferences for authentic, locally-sourced dining experiences, which these operators deliver more effectively compared to standardized chain formats. In contrast, chained outlets benefit from economies of scale in purchasing, marketing, and technology deployment. However, their growth rates remain lower than those of independents, indicating that operational efficiency alone cannot fully address consumer demand for unique dining experiences and stronger community connections.

The competitive landscape between independent and chained outlets is evolving as independent operators increasingly adopt chain-like practices. These include franchise-style partnerships and shared service platforms that enhance technology and purchasing capabilities while preserving local identity. For example, McDonald's expansion strategy, which combines company-owned locations with franchise partnerships, demonstrates how chains can balance standardization with local market adaptation. Independent operators, on the other hand, leverage their flexibility in menu innovation and customer relationship management. However, they face growing pressure to invest in digital ordering systems and delivery partnerships, which require significant capital investments typically associated with larger operators. Additionally, compliance with Food Standards Agency (FSA) regulations adds operational complexity for independents, particularly those without dedicated compliance staff. While this creates challenges, it also establishes barriers to entry that protect established operators from new competition.

The United Kingdom Foodservice Market Report is Segmented by Foodservice Type (Cafes and Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Locations (Leisure, Lodging, Retail, Standalone, Travel), and Service Type (Dine-In, Takeaway, and Delivery). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- The Coca-Cola Company (Costa Coffee)

- Doctor's Associates Inc.

- Domino's Pizza Group plc

- Greggs plc

- Marston's PLC

- McDonald's Corporation

- Mitchells & Butlers PLC

- Nando's Group Holdings Ltd.

- Yum! Brands, Inc.

- PizzaExpress Limited

- Starbucks Corporation

- Stonegate Group

- The Restaurant Group PLC

- Whitbread PLC

- JAB Holding Company (Pret A Manger Ltd)

- Greene King Ltd.

- Restaurant Brands International

- BrewDog plc

- Joe and The Juice UK

- Five Guys Holdings, Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rise of food delivery apps

- 4.2.2 Increased demand for healthier, vegan, low-calorie, and allergen-free menu options

- 4.2.3 Emergence and rapid growth of cloud/ghost kitchens

- 4.2.4 Growing consumer interest in authentic global cuisines and fusion menus

- 4.2.5 Social media trends and "Instagrammable" dining shape consumer choices

- 4.2.6 Menu simplification and value offers

- 4.3 Market Restraints

- 4.3.1 Food and labour cost inflation

- 4.3.2 Rising competition drives need for differentiation

- 4.3.3 Brand loyalty erosion

- 4.3.4 Sustainability-reporting compliance costs

- 4.4 Supply Chain Analysis

- 4.5 Technological Outlook

- 4.6 Regulatory Framework

- 4.7 Porter's Five Forces

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Suppliers

- 4.7.3 Bargaining Power of Buyers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

- 4.8 Key Industry Trends

- 4.8.1 Number of Outlets

- 4.8.2 Average Order Value

- 4.8.3 Menu Analysis

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Foodservice Type

- 5.1.1 Cafes and Bars

- 5.1.1.1 Bars and Pubs

- 5.1.1.2 Cafe

- 5.1.1.3 Juice/Smoothie/Desserts Bars

- 5.1.1.4 Specialist Coffee and Tea Shops

- 5.1.2 Cloud Kitchen

- 5.1.3 Full Service Restaurants

- 5.1.3.1 Asian

- 5.1.3.2 European

- 5.1.3.3 Latin American

- 5.1.3.4 Middle Eastern

- 5.1.3.5 North American

- 5.1.3.6 Other FSR Cuisines

- 5.1.4 Quick Service Restaurants

- 5.1.4.1 Bakeries

- 5.1.4.2 Burger

- 5.1.4.3 Ice Cream

- 5.1.4.4 Meat-based Cuisines

- 5.1.4.5 Pizza

- 5.1.4.6 Other QSR Cuisines

- 5.1.1 Cafes and Bars

- 5.2 By Outlet

- 5.2.1 Chained Outlets

- 5.2.2 Independent Outlets

- 5.3 By Locations

- 5.3.1 Leisure

- 5.3.2 Lodging

- 5.3.3 Retail

- 5.3.4 Sandalone

- 5.3.5 Travel

- 5.4 By Service Type

- 5.4.1 Dine-in

- 5.4.2 Takeaway

- 5.4.3 Delivery

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 The Coca-Cola Company (Costa Coffee)

- 6.4.2 Doctor's Associates Inc.

- 6.4.3 Domino's Pizza Group plc

- 6.4.4 Greggs plc

- 6.4.5 Marston's PLC

- 6.4.6 McDonald's Corporation

- 6.4.7 Mitchells & Butlers PLC

- 6.4.8 Nando's Group Holdings Ltd.

- 6.4.9 Yum! Brands, Inc.

- 6.4.10 PizzaExpress Limited

- 6.4.11 Starbucks Corporation

- 6.4.12 Stonegate Group

- 6.4.13 The Restaurant Group PLC

- 6.4.14 Whitbread PLC

- 6.4.15 JAB Holding Company (Pret A Manger Ltd)

- 6.4.16 Greene King Ltd.

- 6.4.17 Restaurant Brands International

- 6.4.18 BrewDog plc

- 6.4.19 Joe and The Juice UK

- 6.4.20 Five Guys Holdings, Inc.

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK