PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940887

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940887

Southeast Asia Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

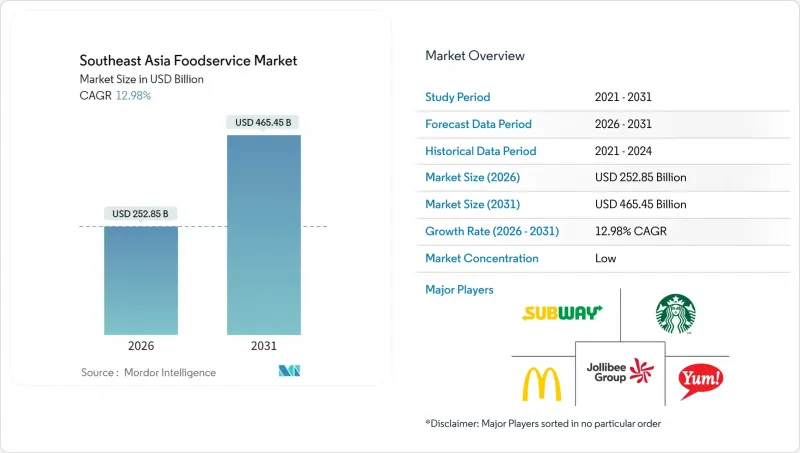

The Southeast Asia foodservice market is expected to grow from USD 223.80 billion in 2025 to USD 252.85 billion in 2026 and is forecast to reach USD 465.45 billion by 2031 at 12.98% CAGR over 2026-2031.

Economic growth, urbanization, and rising smartphone use are expanding the consumer base for restaurants and delivery services. Between 2022 and 2023, international visitor arrivals nearly doubled, boosting spending at hotels and street-side venues. The rise of quick service formats and cloud kitchens underscores a market shift in Southeast Asia, prioritizing convenience, speed, and a leaner expansion model. While independent operators dominate the outlet landscape, chained groups are rapidly scaling, harnessing franchising, technology, and centralized purchasing. Delivery aggregators, spearheaded by Grab, are intensifying competition, pushing restaurants to refine their commission strategies and in-store economics for better profitability.

Southeast Asia Foodservice Market Trends and Insights

Rapid Adoption of Digital Ordering and Delivery

Digital ordering platforms have transformed the foodservice value chain in Southeast Asia, offering more than just convenience. These platforms use real-time data to help restaurants accurately predict demand and manage inventory more efficiently. This has enabled many restaurants to reduce food waste by up to 23% through predictive ordering systems. Vietnam is leading this digital transformation, supported by rapid urbanization-now exceeding 40%-and a large online population of approximately 88 million internet users in 2024. Apps like Grab are reshaping the market with integrated business models that combine food delivery, digital payments, loyalty programs, and merchant financing into a single platform. This integration not only increases customer lifetime value for platforms but also helps restaurants lower their customer acquisition costs. As these digital ecosystems expand, they are improving operational efficiency and redefining how restaurants engage with consumers in Southeast Asia's fast-changing foodservice market.

Cloud and Virtual Kitchens Drive Concept Testing and Market Reach

Cloud kitchens, which initially gained traction during the pandemic, have now become a crucial growth strategy in Southeast Asia's foodservice market. These kitchens enable restaurant brands to test new ideas and expand rapidly while keeping costs significantly lower-requiring 60-70% less investment compared to traditional dine-in restaurants. However, as the market matures, challenges like high delivery costs and limited brand differentiation are leading to consolidation. This trend is particularly evident in Singapore, where several operators have shut down. To remain competitive, leading cloud kitchen players are focusing on innovation. They are adopting vertical farming to ensure a fresh supply of ingredients and using AI-driven tools to optimize menus. These strategies help reduce ingredient costs by 15-20% while maintaining consistent quality across their virtual brands. Additionally, companies like GoTo are implementing hybrid models that combine cloud kitchens with a few physical outlets. This approach improves brand visibility and strengthens customer engagement. These developments highlight a broader transformation in the region's foodservice market, where technology and strategic expansion are reshaping how restaurant brands operate and grow.

Fragmented Regulations and Licensing Complexity

Restaurant chains operating across multiple ASEAN markets face significant challenges due to differing regulations. Compliance costs for operators managing businesses in more than three jurisdictions typically account for 8-12% of their revenue In Indonesia, companies must handle complex halal certification requirements, while Thailand enforces strict foreign ownership rules. Singapore adds to the complexity with its stringent food safety standards. These varying regulations demand specialized local expertise and dedicated compliance systems. Moreover, the lack of mutual recognition agreements for food safety certifications forces businesses to maintain separate quality assurance systems, increasing operational costs by 15-20% compared to competitors focused on a single market. Although recent efforts toward ASEAN economic integration show potential, implementation is not expected until after 2027, offering little immediate relief for businesses looking to expand.

Other drivers and restraints analyzed in the detailed report include:

- Personalization Through Build-Your-Own Formats and Data-Driven Offers

- Tourism and Hospitality Integration Boosts Dining

- Supply Chain Volatility for Perishables

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

In 2025, Quick Service Restaurants (QSRs) hold a strong 42.20% market share in Southeast Asia. Their dominance is driven by efficient operations and the use of technology, which ensure consistent customer experiences across various markets. By implementing standardized processes and kitchen automation systems, QSRs have reduced their reliance on labor by 25-30%. This approach helps them manage rising wage costs while maintaining high service standards. Leading chains like McDonald's and KFC have made significant investments in digital ordering systems and mobile payment options. McDonald's, for instance, reports that most of its orders in Southeast Asia now come through digital channels. The segment continues to grow, supported by a cultural shift toward convenient dining and the busy lifestyles of the expanding middle class in urban areas of Indonesia, Thailand, and Vietnam.

Cloud Kitchens are the fastest-growing segment in the foodservice industry, with a projected CAGR of 18.62% through 2031. These kitchens are transforming the industry by focusing on delivery operations, which eliminate the need for front-of-house expenses and prime locations. Initially a solution during the pandemic, cloud kitchens have now become a key growth strategy. They allow established brands to test new ideas with 60-70% lower capital investment compared to traditional outlets. GoTo's plan to open 400 franchise stores by 2025 highlights the integration of cloud kitchens with digital platforms. This model provides restaurant partners with essential technology support, including payment processing, customer acquisition, and inventory management. However, in mature markets like Singapore, operators face challenges such as standing out in a crowded market and improving delivery efficiency as consolidation pressures increase.

In 2025, independent outlets hold a dominant 69.10% market share, reflecting Southeast Asia's strong preference for authentic, locally-inspired food experiences. These outlets, often family-owned and passed down through generations, thrive by offering flexible menus and culturally authentic dishes. They play a vital role as community gathering spots, especially in densely populated urban areas. Their ability to quickly adapt to local tastes and seasonal ingredients gives them an edge in customer satisfaction, often surpassing chain competitors through personalized service and customized menus. However, independent operators face growing challenges, including rising costs of ingredients, stricter regulatory requirements, and the need to adopt new technologies. Larger operators, with their administrative resources and economies of scale, are better equipped to handle these pressures.

Chained outlets are expanding rapidly, with a compound annual growth rate (CAGR) of 13.29%. Their growth is driven by better access to funding and efficient operational systems, enabling them to scale quickly across multiple markets. By investing in technology and streamlining supply chains, chains reduce food costs by 15-20% while maintaining consistent quality across locations. This gives them a significant competitive advantage over independent operators. For example, Jollibee has expanded to 200 stores in Vietnam and acquired Compose Coffee for USD 340 million, showcasing how regional chains combine cultural relevance with operational efficiency to compete with global brands. Franchise models are also gaining popularity, as they combine the efficiency of chain operations with local market expertise. This approach allows for faster expansion, reduces capital requirements for parent companies, and provides independent entrepreneurs with proven business systems.

The Southeast Asia Foodservice Market Report is Segmented by Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, Delivery), and Geography (Indonesia, Malaysia, Philippines, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- Doctor's Associates Inc.

- Domino's Pizza, Inc.

- Inspire Brands Inc.

- Jollibee Foods Corporation

- Marrybrown Sdn Bhd

- McDonald's Corporation

- Minor International PCL

- Nando's Group Holdings Ltd

- Restaurant Brands International Inc.

- Secret Recipe Cakes & Cafe Sdn Bhd

- Starbucks Corporation

- Thai Beverage PCL

- The Wendy's Company

- Tung Lok Restaurants (2000) Ltd

- Yum! Brands Inc.

- Zen Corporation Group PCL

- BreadTalk Group Ltd

- JDE Peet's N.V

- Max's Group, Inc.

- Church's Texas Chicken

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption of Digital Ordering and Delivery

- 4.2.2 Cloud and Virtual Kitchens Drive Concept Testing and Market Reach

- 4.2.3 Personalization Through Build-Your-Own Formats and Data-Driven Offers

- 4.2.4 Tourism and Hospitality Integration Boosts Dining

- 4.2.5 Health and Wellness Trends Focus on Clean Labels and Plant-Forward Menus

- 4.2.6 End-To-End Operational Tech Including Pos, Kitchen Automation, and Contactless Payments

- 4.3 Market Restraints

- 4.3.1 Fragmented Regulations and Licensing Complexity

- 4.3.2 Supply Chain Volatility for Perishables

- 4.3.3 Rising Labor Costs and Staff Shortages

- 4.3.4 Aggregator Commissions and Last-Mile Costs Reduce Profitability.

- 4.4 Regulatory lanscape

- 4.5 Technological Outlook

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Suppliers

- 4.6.3 Bargaining Power of Buyers

- 4.6.4 Threat of Substitutes

- 4.6.5 Competitive Rivalry

5 KEY INDUSTRY TRENDS

- 5.1 Number Of Outlets

- 5.2 Average Order Value

- 5.3 Menu Analysis

6 MARKET SEGMENTATION

- 6.1 Foodservice Type

- 6.1.1 Cafes & Bars

- 6.1.1.1 By Cuisine

- 6.1.1.1.1 Bars & Pubs

- 6.1.1.1.2 Cafes

- 6.1.1.1.3 Juice/Smoothie/Desserts Bars

- 6.1.1.1.4 Specialist Coffee & Tea Shops

- 6.1.1.1 By Cuisine

- 6.1.2 Cloud Kitchen

- 6.1.3 Full Service Restaurants

- 6.1.3.1 By Cuisine

- 6.1.3.1.1 Asian

- 6.1.3.1.2 European

- 6.1.3.1.3 Latin American

- 6.1.3.1.4 Middle Eastern

- 6.1.3.1.5 North American

- 6.1.3.1.6 Other FSR Cuisines

- 6.1.3.1 By Cuisine

- 6.1.4 Quick Service Restaurants

- 6.1.4.1 By Cuisine

- 6.1.4.1.1 Bakeries

- 6.1.4.1.2 Burger

- 6.1.4.1.3 Ice Cream

- 6.1.4.1.4 Meat-based Cuisines

- 6.1.4.1.5 Pizza

- 6.1.4.1.6 Other QSR Cuisines

- 6.1.4.1 By Cuisine

- 6.1.1 Cafes & Bars

- 6.2 Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 Location

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Standalone

- 6.3.5 Travel

- 6.4 Service Type

- 6.4.1 Dine-in

- 6.4.2 Takeaway

- 6.4.3 Delivery

- 6.5 Country

- 6.5.1 Indonesia

- 6.5.2 Malaysia

- 6.5.3 Philippines

- 6.5.4 Singapore

- 6.5.5 Thailand

- 6.5.6 Vietnam

- 6.5.7 Rest of Southeast Asia

7 COMPETITIVE LANDSCAPE

- 7.1 Key Strategic Moves

- 7.2 Market Share Analysis

- 7.3 Company Landscape

- 7.4 Company Profiles

- 7.4.1 Doctor's Associates Inc.

- 7.4.2 Domino's Pizza, Inc.

- 7.4.3 Inspire Brands Inc.

- 7.4.4 Jollibee Foods Corporation

- 7.4.5 Marrybrown Sdn Bhd

- 7.4.6 McDonald's Corporation

- 7.4.7 Minor International PCL

- 7.4.8 Nando's Group Holdings Ltd

- 7.4.9 Restaurant Brands International Inc.

- 7.4.10 Secret Recipe Cakes & Cafe Sdn Bhd

- 7.4.11 Starbucks Corporation

- 7.4.12 Thai Beverage PCL

- 7.4.13 The Wendy's Company

- 7.4.14 Tung Lok Restaurants (2000) Ltd

- 7.4.15 Yum! Brands Inc.

- 7.4.16 Zen Corporation Group PCL

- 7.4.17 BreadTalk Group Ltd

- 7.4.18 JDE Peet's N.V

- 7.4.19 Max's Group, Inc.

- 7.4.20 Church's Texas Chicken

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK