PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940885

PUBLISHER: Mordor Intelligence | PRODUCT CODE: 1940885

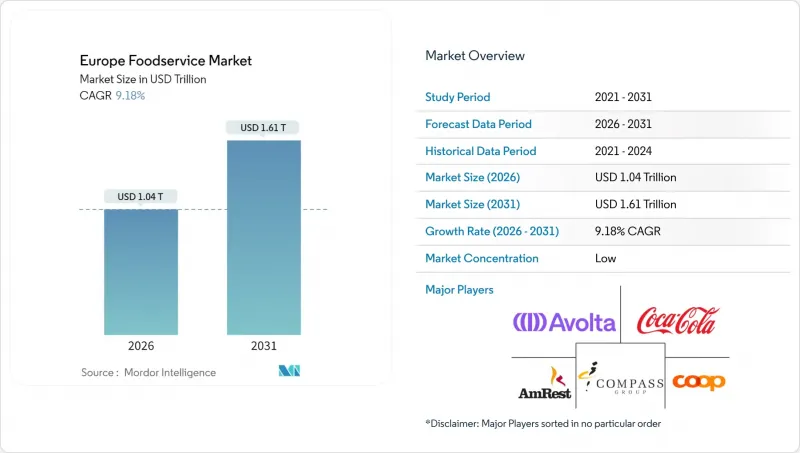

Europe Foodservice - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031)

Europe Foodservice Market market size in 2026 is estimated at USD 1.04 trillion, growing from 2025 value of USD 0.95 trillion with 2031 projections showing USD 1.61 trillion, growing at 9.18% CAGR over 2026-2031.

The market demonstrates robust expansion due to consumers increasingly seeking convenient dining solutions that align with their busy lifestyles. The harmonization of regulations across the European Union has created a more unified operating environment, while restaurants and food establishments continuously innovate their menus to incorporate sustainable practices and health-focused offerings. Foodservice businesses that have successfully implemented user-friendly digital ordering platforms, established transparent ingredient sourcing practices, and developed diverse menu options for the growing flexitarian consumer base are experiencing substantial growth opportunities. This shift reflects a fundamental change in consumer behavior towards convenient, on-the-go dining solutions. The competitive landscape remains intense as standardized food safety regulations make cross-border expansion more accessible for larger operators. However, these same regulations increase operational compliance costs for smaller establishments, ultimately driving market consolidation within the European foodservice industry.

Europe Foodservice Market Trends and Insights

Increased Demand for Convenience and Ready-to-Eat Meals

European consumers increasingly seek efficient dining solutions that align with modern urban lifestyles and hybrid work arrangements established in the post-pandemic environment. The rapid expansion of grab-and-go concepts across major European cities demonstrates strong market acceptance, with Germany emerging as a frontrunner through digital meal solutions combining nutritional information with swift service delivery . Quick-service establishments have evolved by incorporating premium ingredients and professionally crafted menus to distinguish themselves from conventional fast food offerings, establishing a distinct market segment that commands higher transaction values while maintaining operational efficiency. Cloud Kitchen operators have capitalized on this transformation by optimizing their facilities for delivery operations without sacrificing food quality or presentation standards. The emphasis on convenience encompasses reliable pricing structures, quality consistency, and streamlined digital ordering platforms that enhance the overall customer experience.

Surge in Health Consciousness and Demand for Healthy Menu Options

Menu reformulation across European foodservice focuses on health-oriented offerings, as operators implement nutritional analysis systems and use wellness-certified ingredients to meet the demand for functional foods. The European Food Safety Authority's 2024 nutrition labeling requirements have increased transparency, requiring restaurants to display caloric content, allergen information, and nutritional benefits in their menus . The Nordic markets have expanded their protein options to include insect-based ingredients, while Mediterranean operators focus on traditional healthy ingredients such as olive oil, legumes, and whole grains. The cafe segment, particularly in the Netherlands and Denmark, has experienced substantial growth in functional beverages and adaptogenic ingredients, with consumers demonstrating willingness to accept higher prices for products offering health benefits. This market development creates significant business opportunities for foodservice operators who can successfully combine nutritional value with appealing taste profiles in their menu offerings.

Stringent and Evolving Food Safety and Hygiene Regulations

The European Union's increasingly stringent food safety standards and sophisticated enforcement mechanisms have led to higher regulatory compliance costs, particularly affecting smaller operators. The Hazard Analysis and Critical Control Points (HACCP) framework requires extensive documentation and monitoring systems, resulting in annual compliance costs of EUR 15,000-25,000 for independent restaurants. The 2024 digital traceability requirements now mandate electronic systems for ingredient sourcing, temperature monitoring, and staff training documentation, creating operational challenges for traditional establishments using paper-based systems. While cross-border harmonization efforts reduce regulatory complexity for businesses operating across multiple markets, the uniform standards often exceed local requirements and increase operational costs for all participants. These regulatory requirements accelerate market consolidation as smaller operators face difficulties managing compliance investments, while larger chains benefit from economies of scale by implementing standardized systems across multiple locations.

Other drivers and restraints analyzed in the detailed report include:

- Popularity of Sustainable and Locally Sourced Ingredients

- Rise in Plant-Based, Vegan, and Vegetarian Menu Choices

- Allergens, Labeling, and Nutrition Compliance Burdens

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Cloud kitchens are experiencing rapid growth with a 16.62% CAGR through 2031, fundamentally transforming the restaurant industry landscape. These delivery-focused operations have successfully reduced overhead costs by eliminating traditional dining areas while substantially improving kitchen productivity. Full-service restaurants currently maintain the dominant market share at 36.85% in 2025 but continue to face mounting operational challenges from escalating labor costs and real estate expenses. In contrast, cloud kitchen models circumvent these challenges through their streamlined operational structure. Quick-service restaurants maintain their strong market position through established brand presence and standardized operations, while cafes and bars continue to attract customers through irreplaceable in-person social experiences that digital platforms cannot replicate.

Cloud kitchen facilities have revolutionized market entry strategies by enabling operators to launch multiple virtual restaurant brands simultaneously. This approach minimizes market entry risk while allowing continuous refinement of menus based on comprehensive delivery performance data. European regulatory bodies have responded to this evolution by classifying cloud kitchens as a separate operational category, implementing specific licensing and inspection requirements distinct from traditional restaurant regulations. The European Food Safety Authority's 2024 guidelines for delivery-only operations have introduced comprehensive standards for temperature control and packaging. These regulations have created significant advantages for professional cloud kitchen operators while establishing substantial barriers to entry for informal delivery services, ensuring higher quality standards across the industry.

Independent outlets currently dominate the market with a 67.10% share in 2025, while chained outlets demonstrate strong growth potential with a 10.12% CAGR through 2031. The chained outlets' success stems from their ability to implement centralized procurement systems, deliver standardized training programs, and invest in technology that reduces operational costs while maintaining consistent service quality across multiple locations.

Independent operators continue to excel in areas such as menu flexibility, deep local market knowledge, and authentic dining experiences that resonate with customers seeking unique culinary experiences. However, these operators face mounting pressures from increasing compliance requirements, rising ingredient costs, and workforce shortages that impact their operations more severely due to their limited scale. This market dynamic has led independent operators to adopt focused strategies that leverage their strengths in local sourcing, chef-driven menus, and community connections - areas where large chains typically find it difficult to compete effectively.

The Europe Foodservice Market Report Segments the Industry Into Foodservice Type (Cafes & Bars, Cloud Kitchen, Full Service Restaurants, Quick Service Restaurants), Outlet (Chained Outlets, and Independent Outlets), Location (Leisure, Lodging, Retail, Standalone, Travel), Service Type (Dine-In, Takeaway, and Delivery) and Country (France, Germany, Italy, and More). The Market Forecasts are Provided in Terms of Value (USD).

List of Companies Covered in this Report:

- AmRest Holdings SE

- Avolta

- Compass Group PLC

- Coop Gruppe Genossenschaft

- The Coca-Cola Company

- Cremonini SpA

- Domino's Pizza Enterprises Ltd

- Gategroup

- Greggs PLC

- Groupe Bertrand

- Groupe Le Duff

- LSG Group

- McDonald's Corp.

- Mitchells & Butlers PLC

- PizzaExpress Ltd

- JAB Holding Company

- QSR Platform Holding SCA

- Restaurant Brands International Inc.

- Restalia Grupo de Eurorestauracion SL

- Starbucks Corp.

- Yum! Brands Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 KEY INDUSTRY TRENDS

- 4.1 Number of Outlets

- 4.2 Average Order Value

- 4.3 Regulatory Framework

5 MARKET LANDSCAPE

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Increased demand for convenience and ready-to-eat meals

- 5.2.2 Surge in health consciousness and demand for healthy menu options

- 5.2.3 Popularity of sustainable and locally sourced ingredients

- 5.2.4 Rise in plant-based, vegan, and vegetarian menu choices

- 5.2.5 Growing popularity of ethnic and international cuisines

- 5.2.6 Demand for allergen transparency and ingredient traceability

- 5.3 Market Restraints

- 5.3.1 Stringent and evolving food safety and hygiene regulations

- 5.3.2 Allergens, labeling, and nutrition compliance burdens

- 5.3.3 Variability in local food laws, health codes, and licensing

- 5.3.4 Complexity of cross-border regulations within Europe

- 5.4 Regulatory Outlook

- 5.5 Porter's Five Forces

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 6.1 By Foodservice Type

- 6.1.1 Cafe and Bars

- 6.1.1.1 By Cuisine

- 6.1.1.1.1 Bars & Pubs

- 6.1.1.1.2 Cafe

- 6.1.1.1.3 Juice/Smoothie/Desserts Bars

- 6.1.1.1.4 Specialist Coffee and Tea Shops

- 6.1.1.1 By Cuisine

- 6.1.2 Cloud Kitchen

- 6.1.3 Full Service Restaurants

- 6.1.3.1 By Cuisine

- 6.1.3.1.1 Asian

- 6.1.3.1.2 European

- 6.1.3.1.3 Latin American

- 6.1.3.1.4 Middle Eastern

- 6.1.3.1.5 North American

- 6.1.3.1.6 Other FSR Cuisines

- 6.1.3.1 By Cuisine

- 6.1.4 Quick Service Restaurants

- 6.1.4.1 By Cuisine

- 6.1.4.1.1 Bakeries

- 6.1.4.1.2 Burger

- 6.1.4.1.3 Ice Cream

- 6.1.4.1.4 Meat-based Cuisines

- 6.1.4.1.5 Pizza

- 6.1.4.1.6 Other QSR Cuisines

- 6.1.4.1 By Cuisine

- 6.1.1 Cafe and Bars

- 6.2 By Outlet

- 6.2.1 Chained Outlets

- 6.2.2 Independent Outlets

- 6.3 By Locations

- 6.3.1 Leisure

- 6.3.2 Lodging

- 6.3.3 Retail

- 6.3.4 Sandalone

- 6.3.5 Travel

- 6.4 By Service Type

- 6.4.1 Dine-in

- 6.4.2 Takeaway

- 6.4.3 Delivery

- 6.5 By Country

- 6.5.1 Germany

- 6.5.2 United Kingdom

- 6.5.3 Italy

- 6.5.4 France

- 6.5.5 Spain

- 6.5.6 Netherlands

- 6.5.7 Poland

- 6.5.8 Belgium

- 6.5.9 Sweden

- 6.5.10 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration

- 7.2 Strategic Moves

- 7.3 Market Ranking Analysis

- 7.4 Company Profiles (includes Global-level Overview, Market-level Overview, Core Segments, Financials (if available), Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 7.4.1 AmRest Holdings SE

- 7.4.2 Avolta

- 7.4.3 Compass Group PLC

- 7.4.4 Coop Gruppe Genossenschaft

- 7.4.5 The Coca-Cola Company

- 7.4.6 Cremonini SpA

- 7.4.7 Domino's Pizza Enterprises Ltd

- 7.4.8 Gategroup

- 7.4.9 Greggs PLC

- 7.4.10 Groupe Bertrand

- 7.4.11 Groupe Le Duff

- 7.4.12 LSG Group

- 7.4.13 McDonald's Corp.

- 7.4.14 Mitchells & Butlers PLC

- 7.4.15 PizzaExpress Ltd

- 7.4.16 JAB Holding Company

- 7.4.17 QSR Platform Holding SCA

- 7.4.18 Restaurant Brands International Inc.

- 7.4.19 Restalia Grupo de Eurorestauracion SL

- 7.4.20 Starbucks Corp.

- 7.4.21 Yum! Brands Inc.

8 MARKET OPPORTUNITIES AND FUTURE OUTLOOK